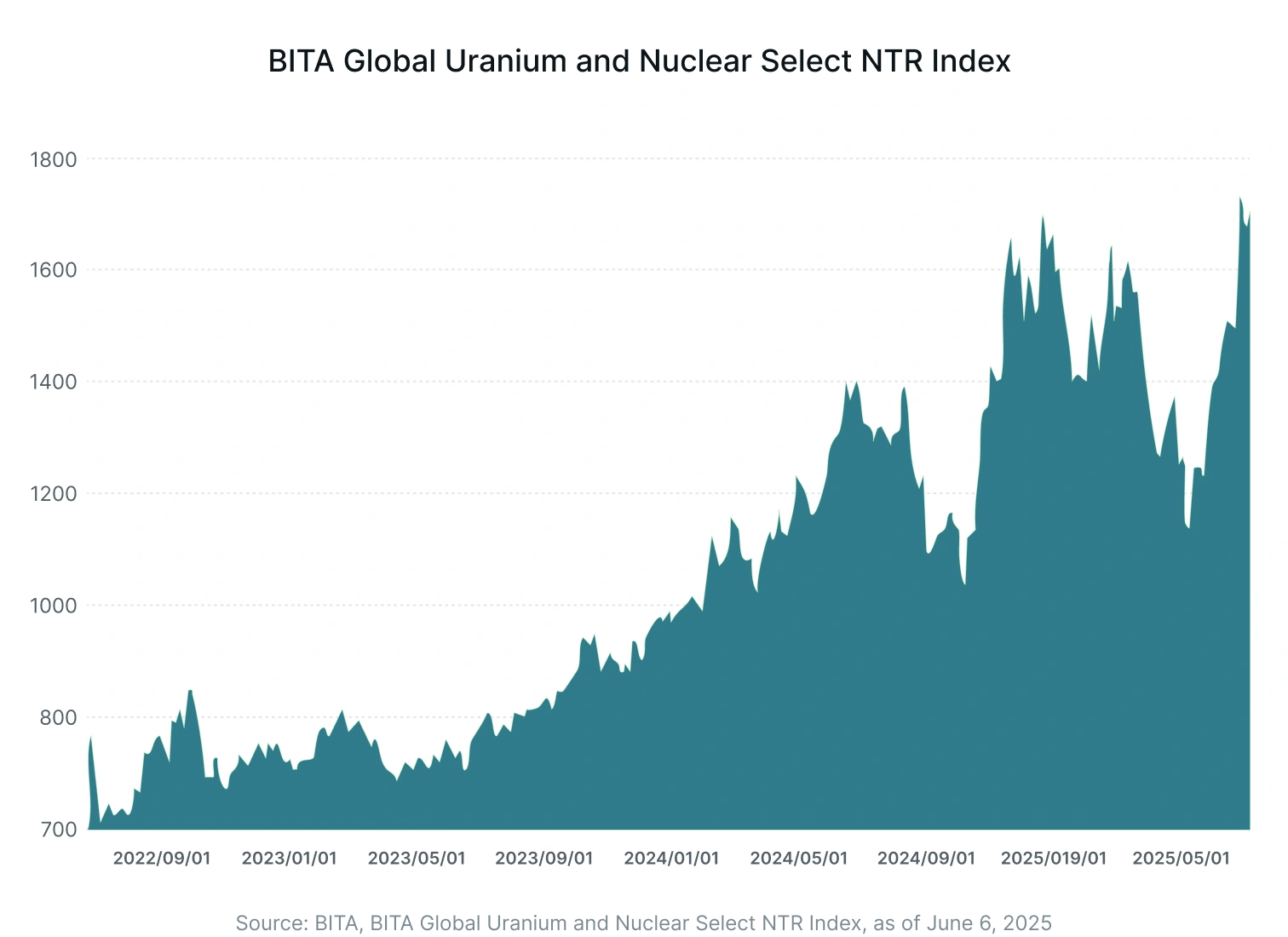

Uranium and nuclear stocks are outperforming the broader market by a wide margin in 2025. This is illustrated by the performance of the BITA Global Uranium and Nuclear Select Index, which as of June 6 was up 21% year to date versus a gain of just 2% for the S&P 500.1 So, what’s behind the momentum in this area of the stock market? Let’s take a look at the key factors that are driving these stocks higher this year.

Kazakhstan Supply Concerns

Uranium and nuclear stocks started 2025 on a positive note, moving up in the first week of January. This rise was mainly down to concerns over uranium supply (uranium is the main fuel source for nuclear energy). Early in January, Canadian uranium producer Cameco – one of the world’s largest producers – advised that output from its Inkai joint venture in Kazakhstan was unexpectedly halted due to a lapse in authorization from the government. This raised concerns about the dependability of Kazakhstan, both as a partner to Cameco and as a global uranium supplier more broadly. Today, the country is the world's largest producer of uranium, providing around 40% of world supply in 2024, according to Research and Markets2. It’s worth noting that production at Inkai resumed in late January. The incident, however, demonstrated the precarity of uranium supply (which is projected to be in shortfall over the next decade).

The IEA’s Nuclear Energy Report

Also in January, nuclear and uranium stocks were boosted by the release of a report on nuclear energy from the International Energy Agency (IEA). This report painted a constructive picture of the nuclear landscape, stating that “the market, technology, and policy foundations are in place for a new era of growth in nuclear energy over the coming decades.”

In its report, the IEA touched on the fact that nuclear power is a clean and reliable energy source, saying that it “brings proven energy security benefits to electricity markets as well as reductions in emissions, complementing renewable energy.” It noted that due to its benefits, governments are increasingly becoming interested in nuclear energy and that today, 63 nuclear reactors are currently under construction, representing more than 70 gigawatts (GW) of capacity – one of the highest levels seen since 1990.3

Zooming in on small modular reactors (SMRs), the IEA said that these can potentially play a major role in creating a new era for nuclear energy, noting that there is a high level of demand for this technology from the private sector. Under today’s policy settings, total SMR capacity is set to reach 40GW by 2050. However, the IEA believes that the potential here is far greater than this. Indeed, in a scenario in which tailored policy support for nuclear and streamlined regulations for SMRs align with robust industry delivery on new projects and designs, it believes capacity could potentially reach 120GW by 2050.

Trump’s Nuclear Executive Orders

In May, uranium and nuclear stocks received another major boost after US President Donald Trump issued four executive orders (EOs) focused on nuclear energy. Trump is looking to re-establish the United States as the “global leader” in nuclear power and in the EOs he set out a number of objectives designed to achieve this.

Specifically, goals of the EOs include:

Quadrupling US nuclear generating capacity by 2050 – Trump is hoping to increase nuclear capacity from approximately 100GW in 2024 to 400GW by 2050.4

Reforming the Nuclear Regulatory Commission (NRC) – The EOs direct the NRC to review and revise its regulations and guidance documents to expedite licensing processes. This includes establishing maximum deadlines for new reactor applications (18 months) and existing reactor renewals (12 months).

Boosting the domestic nuclear industrial base and fuel supply chain – This involves developing a plan to expand domestic uranium processing and enrichment capabilities. It also involves creating a plan for managing spent nuclear fuel, including fuel from Department of Energy (DOE) and Department of Defense (DOD) reactors.

Accelerating deployment of advanced nuclear technologies to enhance national security – Trump wishes to expedite the development and deployment of advanced nuclear technologies by streamlining testing processes and leveraging the DOE's capabilities.

Promoting US nuclear exports and international cooperation – Trump wants to promote US nuclear exports and enhance the global competitiveness of US nuclear firms.

Overall, these EOs signal a strong push from the Trump administration to revitalize the US nuclear power industry. Clearly, Trump believes that nuclear power is critical to American energy independence (and continued dominance in technology). It’s worth noting that since 1978, only two nuclear generators in the US have entered into commercial operation4 and since 2012, over a dozen reactors have been closed5. So, these EOs are a big deal.

Big Tech’s Nuclear Moves

Finally, interest in nuclear energy from Big Tech companies – who have been teaming up with nuclear power companies in order to meet the growing power needs of data centers – has remained a dominant theme in 2025.

In March, a number of tech giants including Amazon, Google, and Meta Platforms signed a pledge to support nuclear energy’s role in creating energy resiliency and “at least” tripling global nuclear capacity by 20505. This took place on the sidelines of the CERAWeek conference in Houston.

More recently, in June, Meta made its first official foray into nuclear power, signing a 20-year agreement to buy energy from Constellation Energy’s Clinton Clean Energy Center in Illinois6. Under this agreement, Meta will buy roughly 1.1GW of energy from Constellation, beginning in June 2027. Note that in December, Meta put out a request for proposals to find nuclear energy developers to partner with, stating that it wanted to add between one and four GW of new nuclear generation in the US. That proposal – which is focused on advanced nuclear energy – remains in progress and is separate from the company’s deal with Constellation Energy.

Constructive Outlook

Overall, there has been a lot of significant activity in the nuclear space in 2025. From US executive orders to major Big Tech energy deals, the industry has seen some exciting developments. These developments suggest that the outlook for the nuclear industry – and its main fuel source uranium – is generally constructive. Today, we are clearly seeing a renewed push for nuclear expansion and innovation.

A Low-Cost ETF for Uranium and Nuclear Stocks

Via the Themes Uranium and Nuclear ETF (URAN), investors can gain exposure to a range of stocks in the uranium and nuclear energy industries. This ETF seeks to track the BITA Global Uranium and Nuclear Select Index, which focuses on companies that derive their revenues from uranium mining, explorations, refining, processing, and royalties, as well as nuclear energy, equipment, technology, and infrastructure.

With a total expense ratio of just 0.35% – more than 50% lower than the category average – URAN offers investors a low-cost route to participate in the potential long-term growth of the uranium and nuclear industries. You can find more information on this ETF, including the holdings and performance figures, here.

Footnotes:

1Google Finance, as of June 6, 2025

2GlobeNewswire, Global Uranium Industry 2025-2030: Forecasts, Key Producers & Nuclear Energy Drivers, as of June 6, 2025

3IEA, The Path to a New Era for Nuclear Energy, published in January 2025

4The White House, ORDERING THE REFORM OF THE NUCLEAR REGULATORY COMMISSION, as of May 23, 2025

5Klgates, President Trump Issues Executive Orders Targeting Nuclear Regulation, as of June 6, 2025

6Meta, Meta and Constellation Partner on Clean Energy Project, as of June 3, 2025