Generative AI has moved rapidly from a specialised research breakthrough to a foundational driver of global technological and economic change. It is reshaping how content is created, software is developed, and decisions are made across industries ranging from manufacturing and healthcare to education and enterprise automation.

This transformation is no longer purely technological; it is economic.

Generative AI is powering a new productivity cycle, expanding computing demand and accelerating digital capability at scale.

As organisations re-architect workflows and platforms to integrate AI, value creation is dispersing across the entire stack - semiconductors, cloud infrastructure, models, applications, and services. In this environment, diversified exposure to the AI value chain has shifted from a tactical idea to a strategic investment opportunity.

The Themes Generative AI ETF (WISE) is built to help capture this opportunity.

By investing in global companies driving or benefiting from generative AI - including hardware enablers, cloud and compute providers, model and software developers, cybersecurity firms, and enterprise platforms, WISE seeks to enable investors to participate in the accelerating commercial adoption and economic impact of this technology wave.

Key Takeaways

Generative AI is scaling beyond experimentation into real-world deployment, driving a new foundation for global technological and economic growth.

Investment is accelerating across infrastructure, enterprise software, and applied AI, creating a multi-layered value opportunity rather than a single-technology bet.

The Themes Generative AI ETF (WISE) aims to provide diversified exposure to companies powering and commercializing generative AI across the global technology stack.

#1 Structural Macroeconomic Growth and Productivity Expansion

Generative AI is increasingly emerging as a major macroeconomic lever, one with the potential to reshape global output and productivity at scale. According to recent estimates, widespread adoption of generative AI could raise global GDP by 7%, adding the rough equivalent of US $7 trillion to the global economy.1

Over a ten-year horizon, this impact translates into an estimated 1.5-percentage-point boost in annual labour-productivity growth.1

This impact stems from generative AI’s ability to automate or augment a large share of knowledge- and communication-intensive tasks - ranging from content creation and code generation to data analysis and customer support.

Additional modelling reinforces the magnitude of this shift. Broader adoption of generative AI across industries could lift global corporate profits by as much as US $4 trillion annually, reflecting a combination of cost efficiencies, improved decision-making, accelerated innovation cycles, and new product generation.2

This profit expansion reflects not only automation, but also enhancements in human performance, shorter development timelines, and the creation of new revenue pools across sectors such as financial services, healthcare, retail, and technology.

As these efficiency and innovation gains unfold across sectors, a cascade effect is likely: companies can reallocate human labor from routine tasks to higher-value, creative, or strategic functions; innovation cycles may accelerate; and overall economic output per worker can rise meaningfully.

The scale of this combined productivity and profit expansion suggests that generative AI is not just an incremental technological upgrade, it represents a potential structural transformation in how value is created across the global economy.

#2 A Global AI Infrastructure Supercycle Underway

A powerful enabler of generative AI’s long-term economic impact is the massive build-out of global computing infrastructure.

Hyperscalers, semiconductor manufacturers, and cloud platforms are deploying record levels of capital to expand the compute foundation required for training advanced models, serving real-time inference, and supporting enterprise-scale workloads.

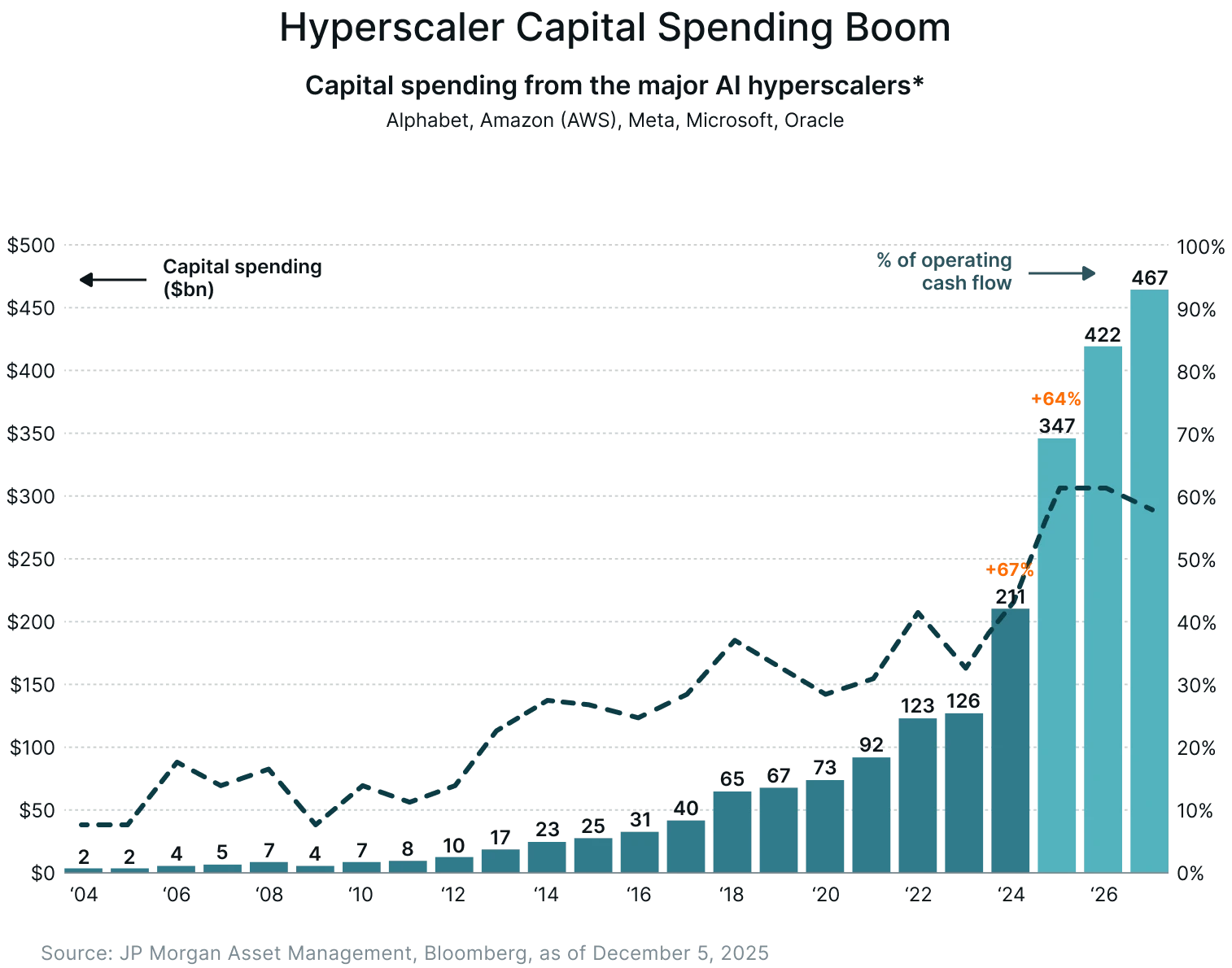

Infrastructure spending across leading technology platforms (Alphabet, Amazon, Meta, Microsoft, Oracle) is projected to exceed US $350 billion by 2025, a rise of more than 60% year over year.3

This surge spans advanced GPUs, high-bandwidth memory, specialized servers, accelerated networking, and the rapid expansion of data-center capacity.

As generative models grow larger and are adopted across more business functions, the availability of compute has become a central determinant of AI’s economic potential - with modelling showing that productivity and profit gains depend heavily on the capacity to scale training and inference infrastructure.2

Capital flows reflect this strategic priority. Major technology companies have raised nearly US $100 billion in new financing specifically for AI and cloud build-outs, with global data-center investment expected to approach US $400 billion this year.4

These investments underscore the competitive need for dense compute clusters, efficient energy and cooling systems, and globally distributed AI infrastructure.

Longer-term projections reveal that this momentum is not a temporary capex cycle but a sustained industrial expansion. Annual AI-infrastructure investment could reach US $3–4 trillion by 2030, cementing compute and data-center development as one of the decade’s defining capital-formation themes.4

Supporting analyses show infrastructure requirements rising exponentially as generative AI is embedded across industries, with demand for compute far outpacing today’s installed base. Importantly, this build-out is being funded by strong operating cash flows, and earnings growth, not valuation expansion has driven most AI-related equity performance to date.5

As a result, the infrastructure layer represents both a near-term earnings catalyst for compute, semiconductor, and cloud providers, and a long-duration backbone that will enable generative AI to scale across the global economy.

#3 Rapid Enterprise Adoption and Improving ROI Signals

Enterprise adoption of generative AI is advancing at remarkable speed, signalling a transition from exploratory pilots to meaningful operational integration.

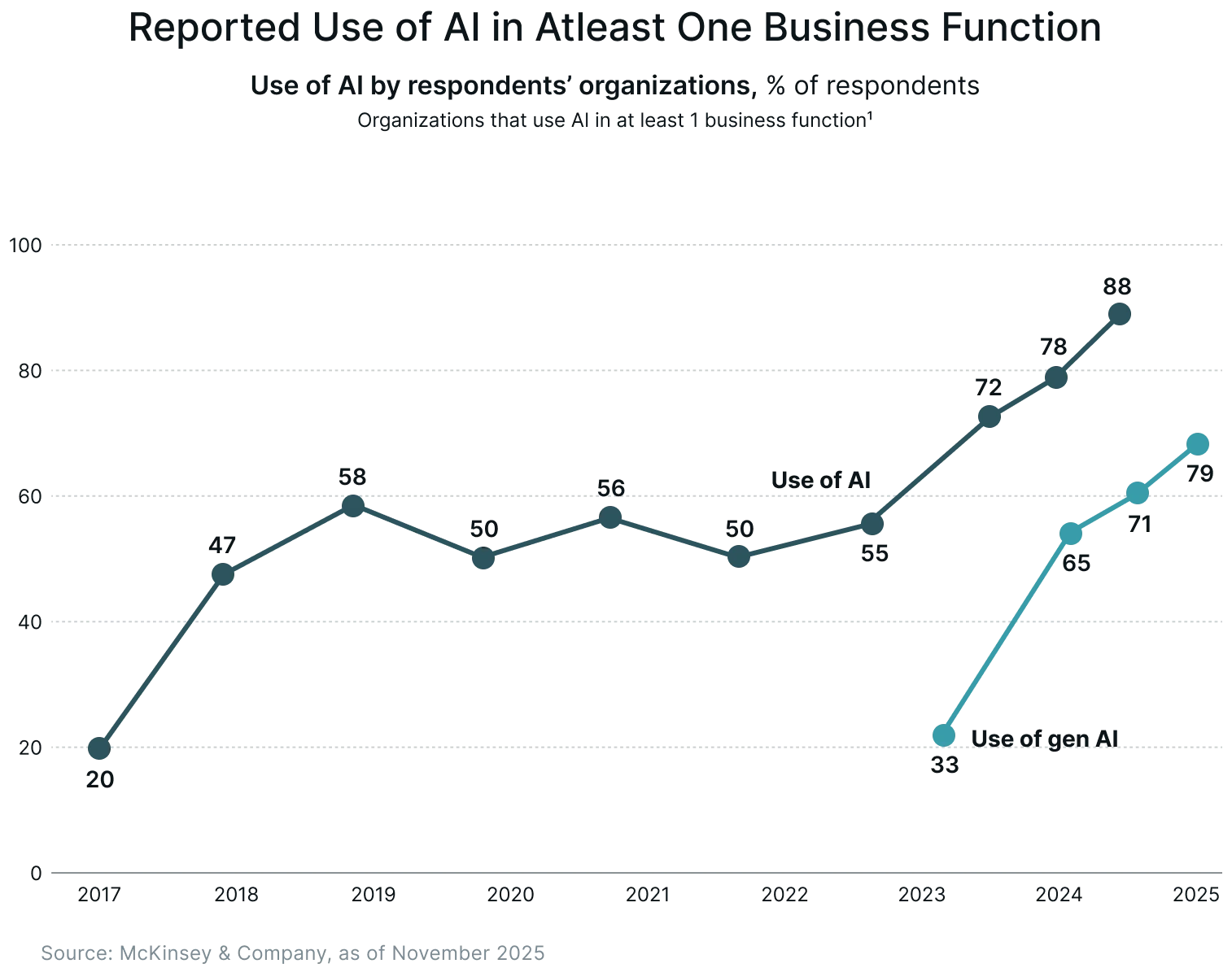

Recent global surveys show that nearly 88% organisations now use AI in at least one business function, 69% report use in two or more functions, and 50% report AI use across three or more functions, highlighting increasingly enterprise-wide integration.6

Adoption is no longer confined to isolated use cases: almost half of all enterprises now apply AI across multiple functions, demonstrating a clear move toward organisation-wide integration.

This acceleration is underpinned by measurable productivity gains. Software development teams report 20–50% reductions in coding time through AI-assisted tools, while customer-operations groups achieve faster resolution rates and improved service efficiency through AI-enabled support systems.1

In marketing and sales, generative AI is contributing to higher lead conversion, improved personalisation, and faster content production, supporting both revenue uplift and margin expansion.

Financial outcomes are beginning to materialise. Companies that have progressed further in their AI journeys are beginning to see measurable financial impact.

McKinsey’s 2025 survey shows that while only 39% of organizations report any EBIT contribution from AI, a small group of “AI high performers”, representing about 6% of respondents, attribute more than 5% of their EBIT to AI-driven efficiencies, workflow redesign, and innovation initiatives.6

For investors, this combination of rapid adoption, early ROI validation, and widening performance differentials signals a durable opportunity. Providers of compute, enterprise-grade AI platforms, cybersecurity, data-integration tools, and domain-specific AI applications are positioned to capture rising budgets.

#4 Broad Value Capture Across the AI Stack

Generative AI is no longer confined to a single segment of the technology landscape. Its economic impact is spreading across the entire technology stack, from semiconductors and cloud infrastructure to enterprise software and domain-specific applications, creating a diversified and multi-layered investment universe.

Forecasts across leading institutions highlight the scale of this expansion –

Global AI semiconductor revenue is expected to surpass US $1 trillion by 2030, driven by GPUs, accelerators, and next-generation AI chips7.

Cloud providers may generate about US $2 trillion in cumulative AI-related cloud revenue by 2032, led by demand for scalable training and inference infrastructure8.

The AI data-centre market could exceed US $1 trillion by 20309;

The emerging “digital labour” category could grow into a US $12 trillion opportunity10;

Together, these estimates underscore how value is accumulating across diverse components of the ecosystem.

The value chain spans several layers. At the foundation are semiconductors and hardware, supporting accelerated compute and memory needs. Cloud and data-centre platforms provide the distributed environments required for model training and inference. Above these sit model and platform developers, including providers of foundation models and vertical AI engines.

The software and application layer incorporates AI-enhanced tools across cybersecurity, CRM, analytics, productivity, and design. Finally, services and system-integration providers capture value by helping organisations deploy, govern, and scale AI responsibly.

Because value is emerging simultaneously at each of these layers, investors are not limited to a narrow cohort of AI-native firms. Exposure can be built through AI-focused ETFs, infrastructure strategies, semiconductor and cloud allocations, and targeted holdings in platform and application leaders.

As adoption spreads across financial services, healthcare, retail, manufacturing, logistics, and education, the economic impact is expected to diffuse across public markets, shifting AI from a niche thematic allocation to a mainstream pillar of portfolio construction.

#5 Earnings Momentum Backed by Real AI-Driven Demand

A notable feature of the current generative-AI cycle is that a meaningful share of market performance is being supported by real revenue and profit growth.

Companies across the AI value chain (semiconductors, cloud platforms, and enterprise software) are reporting measurable financial contributions from AI-related demand, grounding the theme in operating fundamentals.

Semiconductor leaders illustrate this dynamic most clearly. In Q3FY26, NVIDIA reported US $57 billion in quarterly revenue, up 62% year-on-year, with data-center revenue rising 66% YoY to US $51.2 billion, growth driven almost entirely by demand for AI training and inference systems.11

Cloud platforms are also capturing tangible upside. In the quarter ended September 2025, Microsoft reported 18% year-on-year revenue growth to US $77.7 billion, with management highlighting that Azure’s acceleration was powered by AI workloads and demand for model-development services.12

Enterprise-software companies are reporting similar traction. In December 2025, Salesforce raised its fiscal-year revenue and profit guidance, citing stronger-than-expected enterprise uptake of its AI-enhanced CRM, automation, and analytics tools.13

Collectively, these examples demonstrate that AI-driven value creation is broad, not concentrated - spanning hardware (NVIDIA), cloud platforms (Microsoft), enterprise applications (Salesforce), and the surrounding services ecosystem.

This breadth of tangible financial impact also reinforces generative AI as a durable, earnings-supported investment theme with momentum that extends well beyond early-cycle speculation.

How to Play It

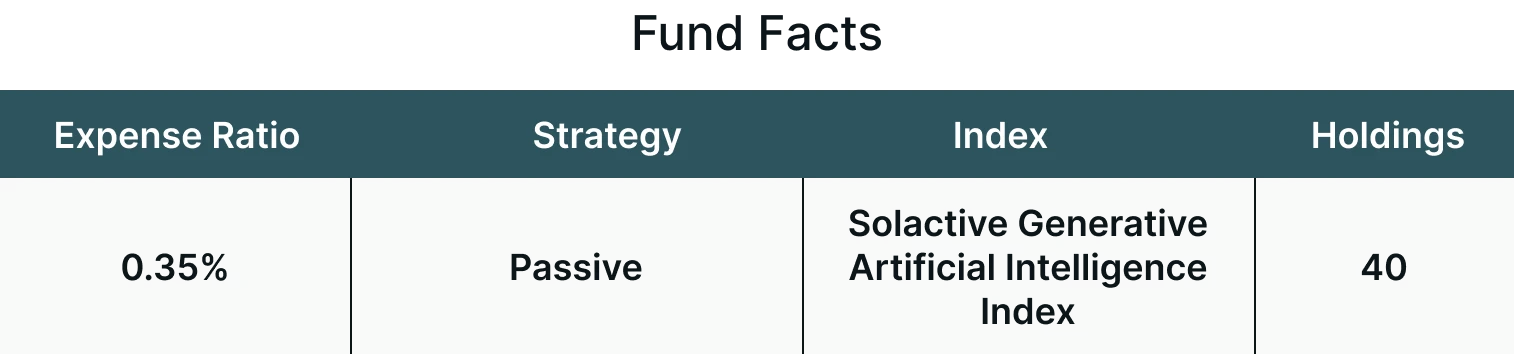

The Themes Generative Artificial Intelligence ETF (WISE) seeks to track the Solactive Generative Artificial Intelligence Index (SOLGAIN), which identifies 40 companies that derive their revenues from either:

Artificial Intelligence

Data Analytics & Big Data

Natural Language Processing

Artificial Intelligence-Driven Services

WISE seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the SOLGAIN Index.

Conclusion

Generative AI is shifting rapidly from experimentation to scaled execution, powered by expanding infrastructure, accelerating enterprise deployment, and a deepening pipeline of real-world applications. The technology is no longer defined by isolated breakthroughs, but by the emergence of a connected ecosystem.

For investors and operators, this transition signals the early stages of a long-term structural cycle. As the economic impact becomes more visible and adoption extends across sectors, those positioned across the global AI value chain stand to benefit from a transformation that is still in its formative years.

For more information about the fund, including fees/expenses, holdings, standardized performance, risks and more, please visit https://themesetfs.com/etfs/wise.

Footnotes:

1Goldman Sachs, Generative AI could raise global GDP by 7%, as of April 5, 2023

2McKinsey Global Institute, AI could increase corporate profits by $4.4 trillion a year, according to new research, as of July 7, 2023

3J.P Morgan Asset Management, Artificial Intelligence, as of December 5, 2025

4Reuters, Tech companies tap debt markets to fund AI and cloud expansion, of November 24, 2025

5The Tribune, No bubble in AI, current funding by cash flows rather than excessive borrowing: JP Morgan, as of November 25, 2025

6QuantumBlack AI by McKinsey, The state of AI in 2025, as of November 2025

7Forbes, AI To Drive $1 Trillion In Global Chip Sales By 2030, as of July 26, 2024

8Goldman Sachs, Cloud revenues poised to reach US$ 2 trillion by 2030 amid AI rollout, as of September 4, 2024

9Reuters, AMD expects profit to triple by 2030, data center chip market to grow to $1 trillion, as of November 12, 2025

10Reuters, Major analyst and enterprise forecasts on the AI market, as of November 13, 2025

11NVIDIA, NVIDIA Announces Financial Results for Third Quarter Fiscal 2026, as of November 19, 2025

12Microsoft, Earnings Release FY26 Q1, as of October 29, 2025

13Reuters, Salesforce raises annual forecasts as AI software adoption picks up steam, as of December 4, 2025

*Specific investments described herein do not represent all investment decisions made by Themes ETFs. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.