Not long ago, gold was largely seen as a safe-haven asset investors turned to during bouts of volatility. Today, it is emerging as a structural cornerstone of global portfolios, supported by record central bank buying, surging institutional inflows, and its proven ability to withstand inflation and currency shocks, in our opinion.

Driving this transformation is the extraordinary scale of macroeconomic and geopolitical uncertainty in recent years. War in Europe, intensifying trade frictions, volatile currencies across emerging markets, and stubborn inflation have all reinforced gold’s relevance.

Investors are also looking beyond bullion itself, with growing interest in gold miners, whose earnings power expands significantly when prices rise.1 In our view, the Themes Gold Miners ETF (AUMI) provides a targeted approach to this opportunity, offering investors exposure to companies best positioned to benefit from gold’s ongoing re-rating.

Key Takeaways

Gold is evolving from a crisis hedge to a structural portfolio asset.

Central banks, institutions, and retail investors are driving resilient demand.

The Themes Gold Miners ETF (AUMI) offers focused exposure to miners set to capitalize on sustained price momentum.

#1 Exceptional Price Momentum and Liquidity

Gold has been on a remarkable run, hitting fresh record highs in late September and early October 2025 as investors positioned for U.S. Federal Reserve rate cuts and reacted to ongoing geopolitical shocks.

On October 1, 2025, spot gold traded in the US$3,880–3,895 per troy ounce range, with intraday quotes crossing US$3,890/oz.2 This marks a dramatic multi-fold surge compared to the US$1,100–1,400/oz range seen in 2015–2016.3 Sustained upward momentum not only has reflected gold’s role as a crisis hedge but has also attracted further liquidity as new investors enter the market.

That liquidity is visible across instruments. COMEX data shows open interest in hundreds of thousands of contracts, with daily futures volumes regularly matching those levels.4 The depth of this market ensures smooth execution, even for large institutional trades, reinforcing gold’s status as one of the most liquid commodities globally.

The accessibility extends beyond futures. SPDR Gold Shares (GLD), the world’s largest gold-backed ETF, reported US$124.5 billion in assets under management (AUM) as of end-September 2025, with shares outstanding in the hundreds of millions.5 Such scale makes it easy for both institutional and retail investors to gain exposure via equity exchanges without the costs of holding physical bullion.

Taken together, this combination of record price momentum and deep liquidity across markets makes gold uniquely attractive today, in our opinion. Moreover, with the metal trading near US$3,900/oz, investors have one of the most liquid and scalable entry points into gold in decades.

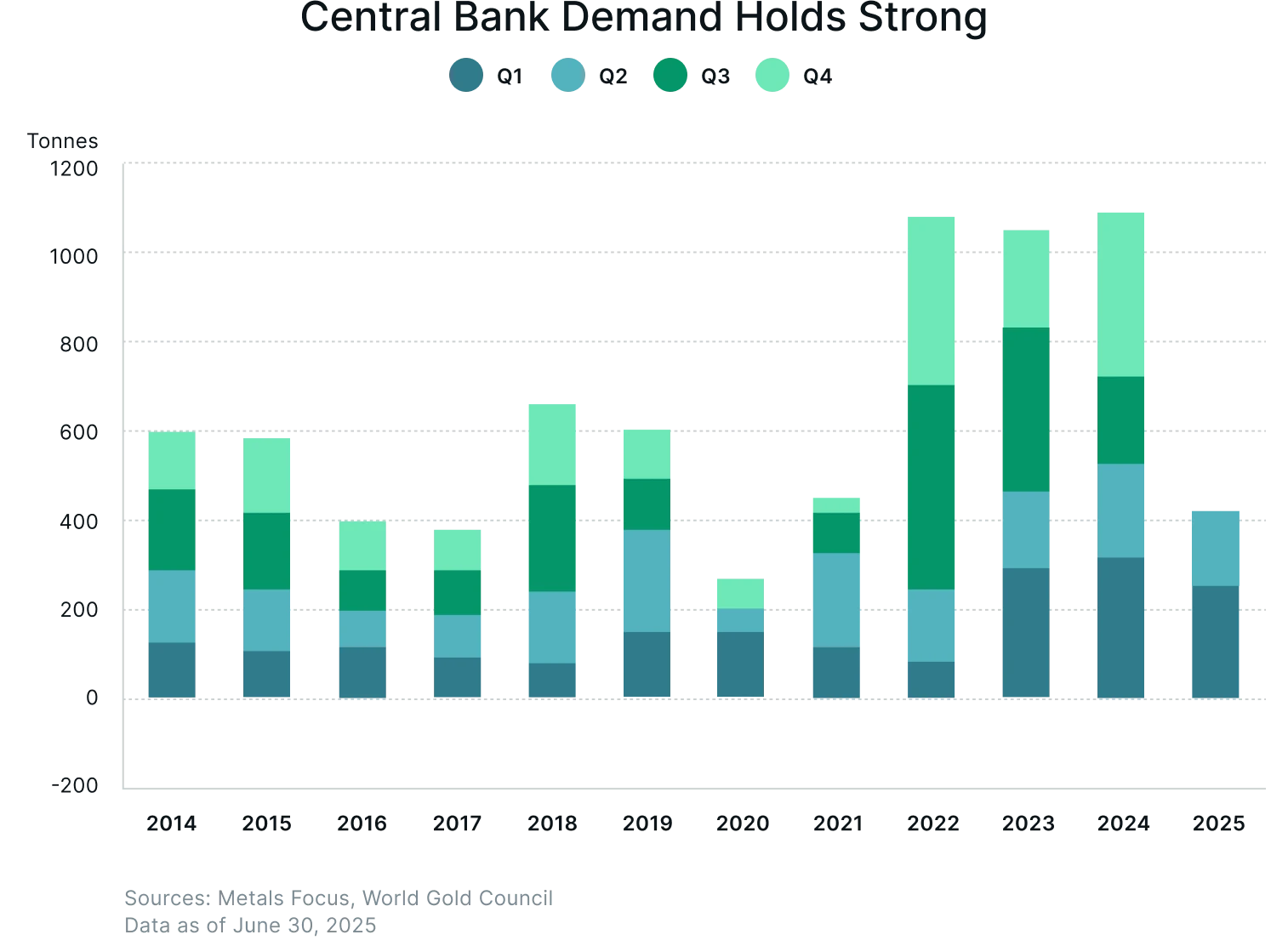

#2 Global Central Banks Continue to Drive Demand

Central banks remain one of the strongest and most reliable pillars of gold demand today. After record-setting purchases in 2022–2024, buying has continued at scale in 2025, with full-year purchases forecast to reach around 900 tonnes.6 This signals a structural shift in reserve management, where gold is increasingly viewed as a strategic, long-term asset rather than a tactical hedge.

According to the World Gold Council (WGC), total gold demand in Q2 2025 rose 3% year-on-year to 1,249 tonnes, with the value of demand jumping 45% thanks to higher prices.7 Central banks were a key driver, adding 166 tonnes to global official gold reserves during the quarter.8

Although this was slower than the record pace of 2022 and 2023, net purchases still reflect a healthy, broad-based trend.

This matters for investors because central bank purchases are structural and less price-sensitive than retail flows. Unlike private buyers who may retreat during price spikes, official sector buying tends to be steady, often based on diversification targets or quota programs. That persistence not only reduces the amount of gold available for private investment but also provides a base layer of long-term demand that can stabilize prices.

The 2025 Central Bank Gold Reserves Survey further reinforces this trend: the share of reserve managers actively managing their gold holdings rose from 37% in 2024 to 44% in 2025, and a majority of respondents indicated plans to maintain or increase gold allocations.9 Even in months when official purchases slowed, for instance, in July 2025, net buying still totaled over 10 tonnes across several jurisdictions. Central banks remained net buyers on a yearly basis.10

Together, this steady, strategic buying underscores confidence in gold’s role within global reserve portfolios at a time of persistent macro risks, currency diversification efforts, and shifting geopolitical alignments.

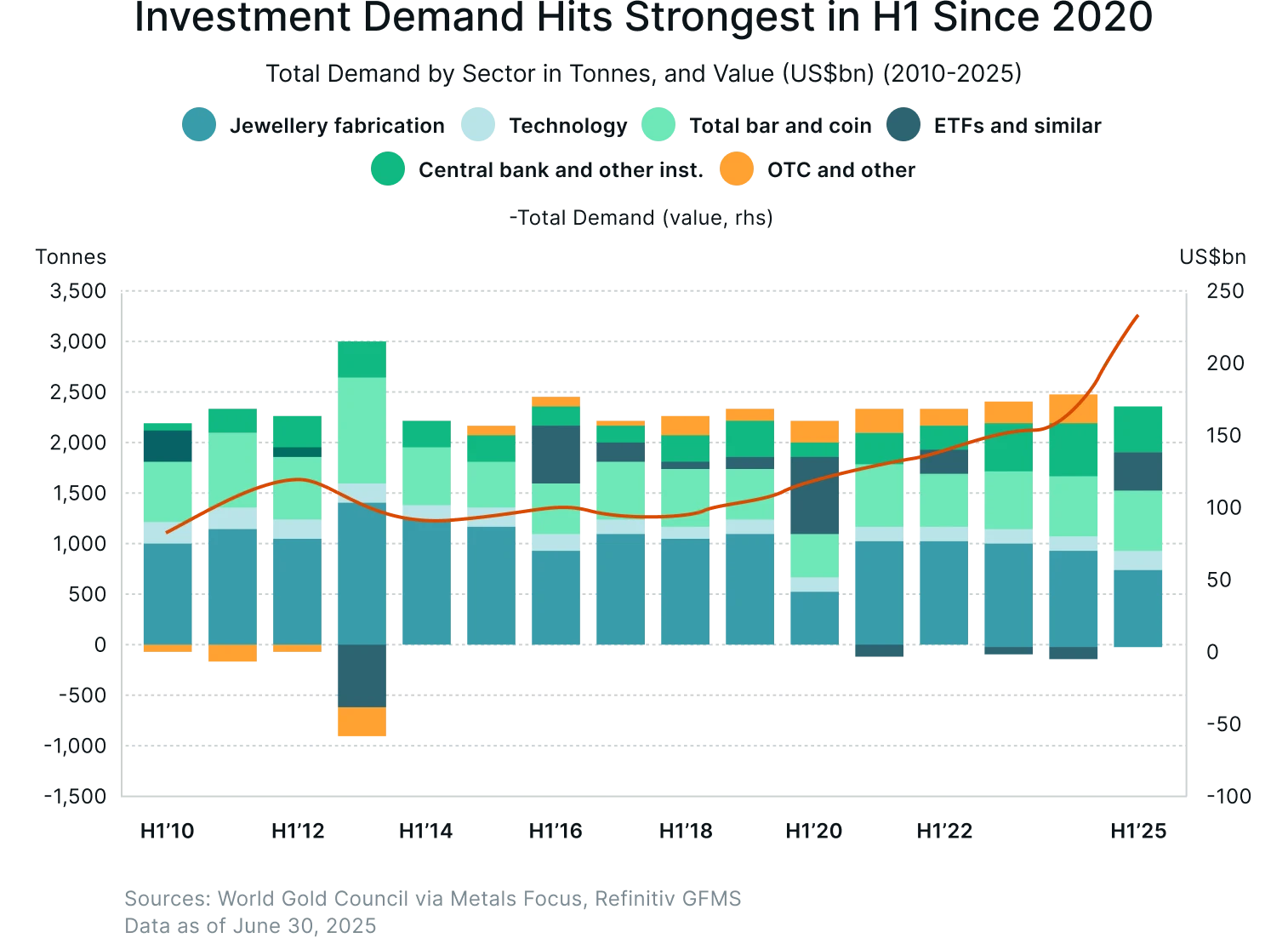

#3 Institutional and Retail Investment Flows Are Surging

Investment demand for gold has accelerated sharply in 2025, with flows from both institutional and retail investors reaching record levels.

A second consecutive quarter of large ETF inflows signaled that institutions are allocating capital at scale. With positive demand in all regions, global holdings increased by 397 tonnes over H1 – the strongest semi-annual performance since the record-breaking 734 tonnes in H1 2020.11

Net ETF holdings rose meaningfully, reversing the outflows of 2021–2022 and reinforcing gold’s role as a possible portfolio hedge in a climate of easing interest rate expectations and ongoing geopolitical risks.11

At the same time, retail investment demand remained robust. Bar and coin purchases, often a barometer of household and high-net-worth sentiment, stayed elevated, particularly in Asia and the Middle East, where cultural affinity and inflation protection remain strong drivers.11 This parallel rise in retail and institutional flows creates a broad-based demand structure that may be less vulnerable to single-segment pullbacks.

For private investors, the implication appears straightforward: institutional capital is moving into gold in quantities that matter, and ETFs can provide one of the most efficient ways to participate.

Unlike physical bullion, ETFs allow investors to gain exposure through traditional equity markets, with less need to worry about storage, security, or insurance costs.

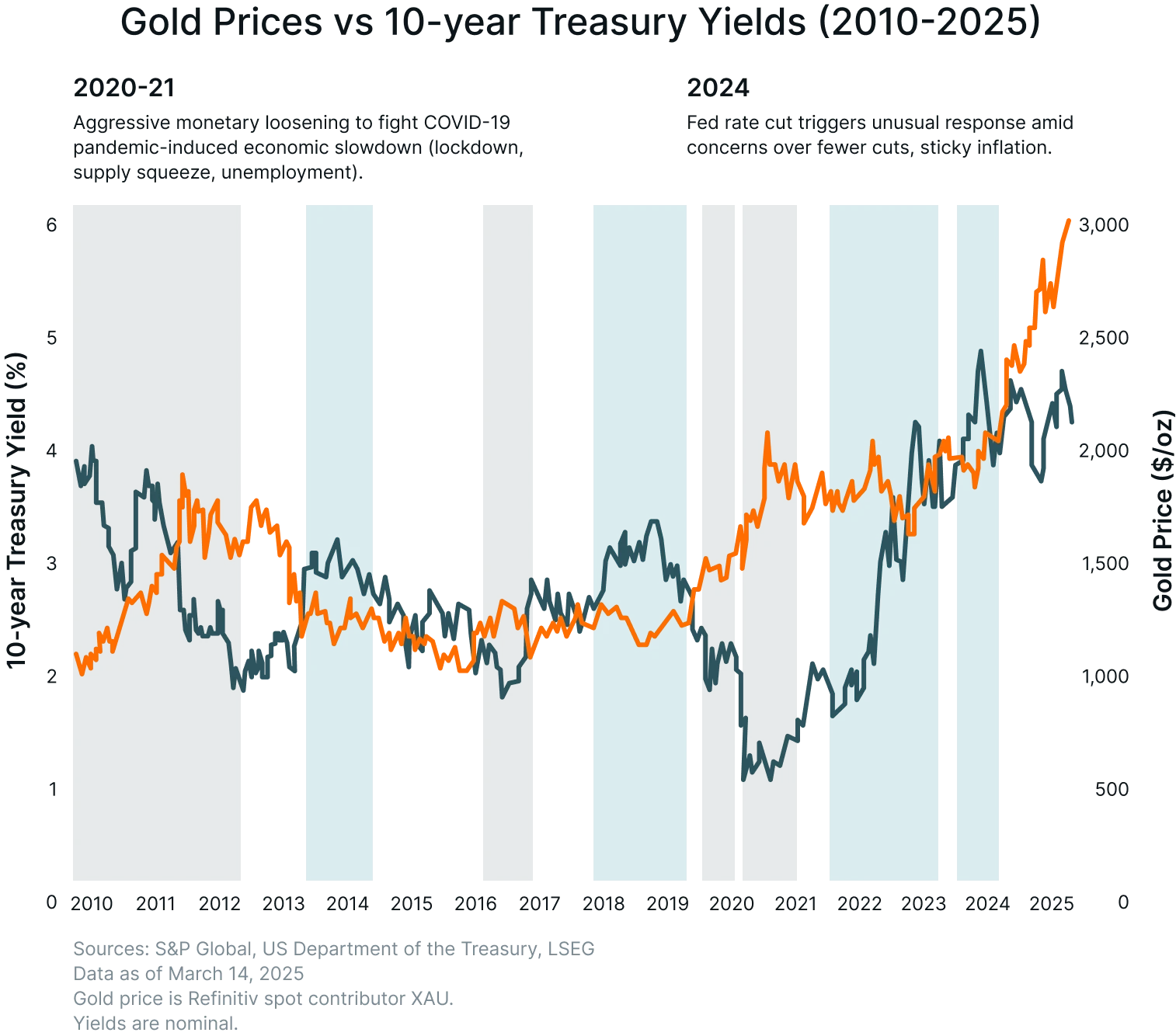

#4 Inflation and Currency Volatility Bolster Gold’s Appeal

Rising inflation and volatile currencies have made gold an increasingly attractive option for investors seeking to protect their wealth. Gold has tended to perform well when inflation is high and real yields on government bonds are low or negative. Since gold does not pay interest, it becomes more appealing when cash or bonds offer little or no real return.

In the U.S., the 10-year TIPS yield is a widely tracked measure of real returns. Data from the St. Louis Fed (FRED) shows that when this yield falls toward zero or negative territory, gold typically rallies (FRED, 2025).12 For example, if the nominal 10-year Treasury yield drops from 4.5% to 3.5% while inflation expectations remain at 2.5%, the real yield compresses from 2.0% to 1.0%, lowering the opportunity cost of holding gold and making it more appealing.

Inflation remains a live concern across many economies. U.S. CPI data from the Bureau of Labor Statistics and FRED show that annual price growth continues above pre-pandemic norms (FRED CPIAUCSL, 2025; BLS, 2025).13

Currency volatility in several regions, including emerging markets such as Turkey, Argentina, and India, has further strengthened gold’s role as a store of value. In these countries, local currencies have experienced sharp swings, prompting investors to allocate a portion of their portfolios to gold as potential protection against devaluation and inflation.

#5 Geopolitical and Macroeconomic Uncertainty Reinforce Gold’s Safe-Haven Status

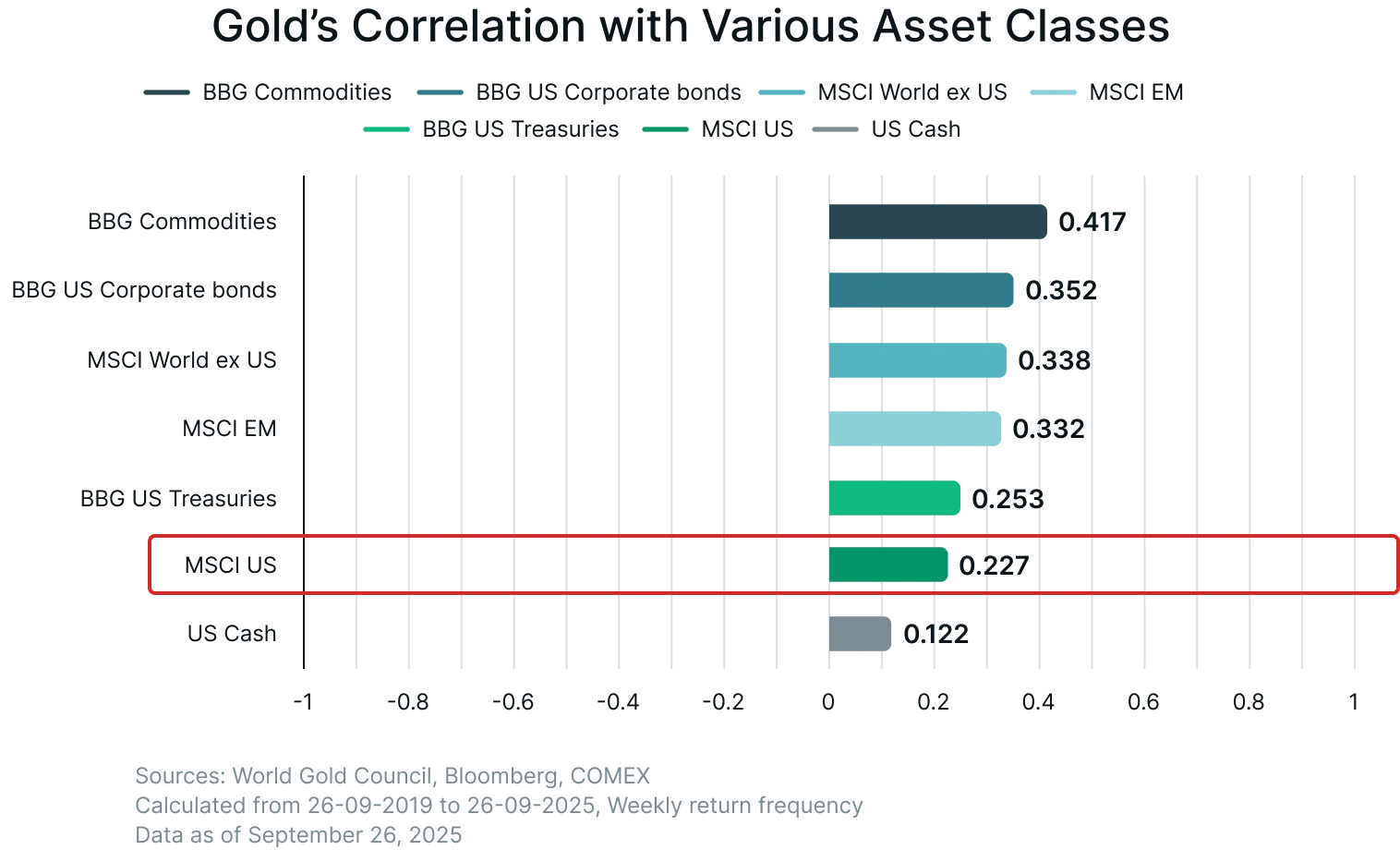

In an era marked by escalating geopolitical tensions and unpredictable macroeconomic conditions, gold has demonstrated its reputation as an established safe-haven asset. Its negative correlation with equities during periods of market stress and historical outperformance in crises make a modest allocation (commonly 2–10%) toward the precious metal a prudent insurance policy, in our opinion.

The World Gold Council’s correlation analyses demonstrate that gold's relationship with major equity indices varies over time, becoming notably negative during market stress. This characteristic can enhance its effectiveness as a crisis hedge. In recent quarters, as geopolitical risks heightened and markets anticipated policy easing, gold decoupled from equities, providing essential portfolio ballast.14

Quantitative studies further underscore gold's role in enhancing portfolio resilience. Backtests have indicated that incorporating a modest allocation to gold can significantly improve risk-adjusted returns. For instance, adding a 5% allocation to a typical 60/40 equity/bond portfolio often reduces tail risk (peak drawdown) and can modestly increase Sharpe ratios, especially during decades that encompass high inflation periods and recent geopolitical crises.15

Historically, during major crises such as the early 2020 COVID shock and the 2022–2025 geopolitical tensions, gold has often outperformed, or mitigated losses compared to equities and some nominal bonds. This underscores its practical role in portfolio stress scenarios.16

In summary, amid the prevailing geopolitical and macroeconomic uncertainties, gold continues to serve as a strategic asset, offering diversification and potential protection against systemic risks.

How to Play It

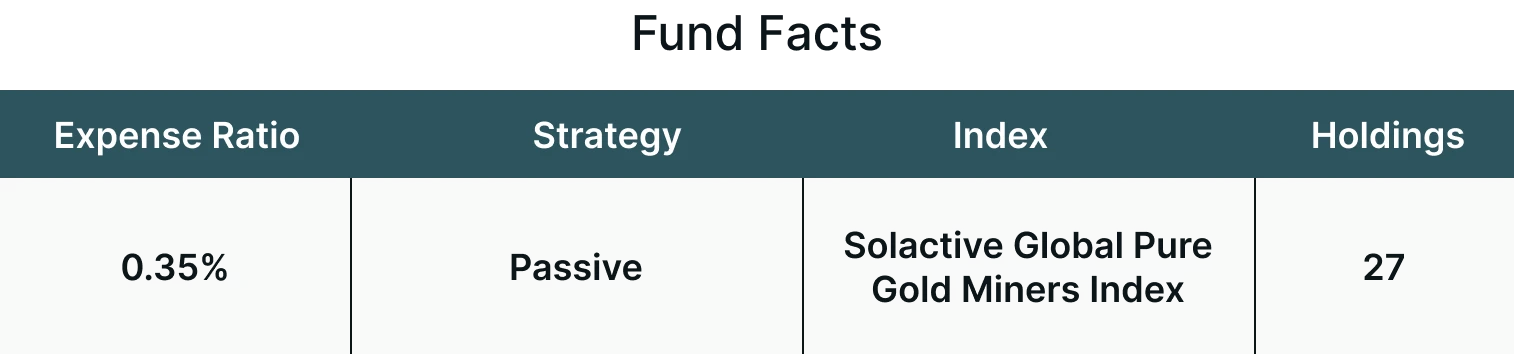

The Themes Gold Miners ETF (AUMI) seeks to track the Solactive Global Pure Gold Miners Index (SOLGLPGM), which identifies the largest 30 companies by market capitalization that derive their revenues from gold mining.

AUMI seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the SOLGLPGM Index.*

Conclusion

Gold is no longer just a traditional safe haven. It is evolving into a strategic asset class shaped by structural central bank demand, deep market liquidity, and broad-based investor participation.

In our view, gold is the “utility” of uncertain markets: it reliably stores value when inflation erodes bonds, currencies swing, or geopolitics destabilize portfolios.

Looking ahead, as real yields remain pressured and global risks intensify, investors who secure exposure to gold, whether through ETFs, futures, or physical allocation, stand to benefit meaningfully from its resilience and diversification power.

For more information about the fund, including fees/expenses, holdings, standardized performance, risks and more, please visit https://themesetfs.com/etfs/aumi.

Footnotes:

1VanEck, Miners Find Their Mojo as Gold Consolidates, as of September 10, 2025

2Reuters, Gold rallies to record high on US government shutdown and Fed rate cut bets, as of October 1, 2025

3World Gold Council (2016), Historical Gold Prices 2015–2016, as of October 2, 2025

4CME Group (2025), COMEX Gold Futures and Options Market Data, as of October 3, 2025

5State Street Global Advisors (2025), SPDR Gold Shares (GLD), as of September 30, 2025

6Reuters, Central banks on track for 4th year of massive gold purchases, Metals Focus says, as of June 5, 2025

7World Gold Council, Gold Demand Trends Q2 2025, as of July 31, 2025

8World Gold Council, Gold Demand Trends Q2 2025: Central Banks, as of July 31, 2025

9World Gold Council, Central Bank Gold Reserves Survey 2025, as of June 17, 2025

10World Gold Council, Central bank gold buying slows in July but remains firm, as of September 3, 2025

11World Gold Council, Gold Demand Trends Q2 2025: Investment Demand, as of July 31, 2025

12Federal Reserve Bank of St. Louis (FRED), 10-Year TIPS Yield (DFII10), as of September 30, 2025

13Federal Reserve Bank of St. Louis (FRED), Consumer Price Index (CPIAUCSL), as of September 11, 2025

14World Gold Council, Gold Correlation to Stock, as of October 1, 2025

15World Gold Council, Gold Portfolio Visualizer & Backtest, as of October 2, 2025

16World Gold Council, The Portfolio Continuum: Rethinking Gold in Alternatives Investing, as of July 24, 2025

*Specific investments described herein do not represent all investment decisions made by Themes ETFs. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.