October 9, 2025

6 Stocks at the Heart of the Generative AI Revolution

The emergence of generative AI - the technology behind tools like ChatGPT, Gemini, and Grok - is one of the most exciting tech developments since the arrival of the internet. Already reshaping industries, it is transforming everything from how people obtain information to how creators produce content.

For investors, the growth of the industry is creating many opportunities as the companies providing the core infrastructure, powerful foundational models, and consumer-facing applications for generative AI are experiencing strong demand for their solutions. Here’s a look at six stocks at the heart of the revolution.

Nvidia

It’s hard to talk about generative AI and not mention Nvidia. Because this company has almost single-handedly powered the revolution to date.

Generative AI models, especially Large Language Models (LLMs) like those powering ChatGPT, require massive parallel processing power for both training and inference (execution). This is where Nvidia is playing a major role. It designs high-powered Graphics Processing Units (GPUs) that are capable of handling thousands of operations simultaneously. These GPUs are very well suited to the complex computations at the heart of generative AI.

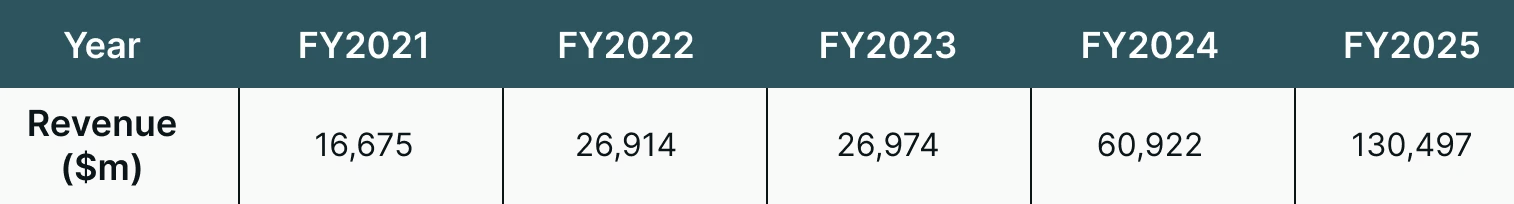

Today, Nvidia’s GPUs are used by almost all of the big players in the generative AI space including ChatGPT owner OpenAI, Microsoft, Google, and Meta Platforms. In recent years, these companies have purchased tens of thousands of chips from the company to build and run their models. As a result of the sky-high demand for its GPUs, Nvidia’s sales have skyrocketed. Last fiscal year (ended January 31, 2025), revenue came in at $130.5 billion1, up from $27.0 billion three years earlier.

Looking ahead, Nvidia - which today has a 80% to 90% market share2 for AI chips - looks well placed to continue dominating the generative AI compute landscape, especially after the news that the company will invest $100 billion3 in OpenAI (OpenAI will spend the money on Nvidia GPUs). However, investors should note that other chip companies are now having success with AI GPUs and are starting to capture market share.

AMD

One such company is Advanced Micro Devices or “AMD”. It’s a chip designer that operates in several areas including high-performance computing.

In recent years, AMD has been working hard to compete in the AI space, directly challenging Nvidia’s dominance with its “Instinct” series of GPUs. And this hard work is now paying off.

In May, for example, CEO Dr. Lisa Su told investors that several hyperscalers have expanded their use of Instinct accelerators to cover an increasing range of generative AI use cases. She also said that a major AI model developer is now using Instinct GPUs for inference.

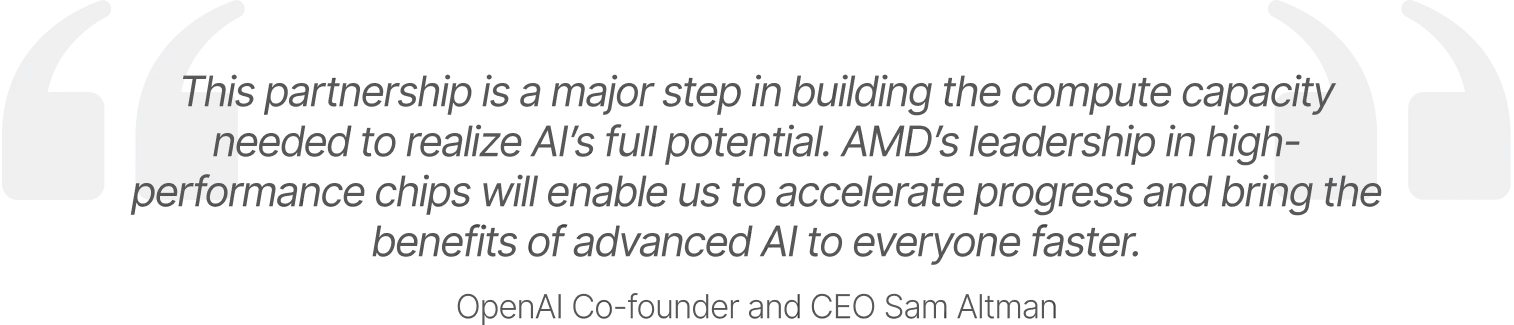

More recently, in October, the company signed a major deal4 with OpenAI. This will see OpenAI deploy six gigawatts of AMD GPUs in the years ahead as the AI powerhouse expands and it is expected to generate “tens of billions” in revenue for AMD.

On the back of this deal with OpenAI, many Wall Street analysts raised their price targets for AMD stock. The general consensus within the analyst community is that the deal represents a major vote of confidence in AMD's AI chips and software.

Broadcom

Another chip designer that is currently having success in the generative AI space - and potentially poses a threat to Nvidia - is Broadcom. It makes custom chips (which it calls “XPUs”) for hyperscalers such as Alphabet and Meta Platforms.

In September, Broadcom announced that it had landed a fourth customer for its XPUs and that this customer had committed to $10 billion worth of chips. The company has not disclosed who this customer is, but it is believed to be OpenAI.

As a result of this new customer, and increasing volumes from its other XPU customers, the company expects AI revenue to grow significantly in the future. This quarter (Q4 FY2025), it expects AI revenue of $6.2 billion5, up from $5.4 billion in the previous quarter, while next fiscal year, it expects AI revenue to grow by more than 60%.

Looking further out, Broadcom CEO Hock Tan has said that he believes that in the future, XPU share at the group’s hyperscaler customers could be bigger than GPU share. In other words, demand for the custom chips Broadcom designs could eventually outstrip the demand for general-purpose GPUs designed by the likes of Nvidia and AMD.

Alphabet

Turning to the hyperscalers, one company that is very active in the generative AI space is Google owner Alphabet. It has its own generative AI app, Gemini. While this app was launched after ChatGPT, it now has hundreds of millions of monthly active users. And in September, it overtook ChatGPT to become the most downloaded app in Apple’s App Store6.

Recently, Google has been integrating Gemini technology into its consumer and enterprise products to enhance functionality. For example, on the consumer side, Google has launched AI Overviews and AI Mode, both of which can provide direct, conversational AI-generated summaries and answers to complex queries. Meanwhile, on the enterprise side, there is Gemini for Google Workspace, which introduces powerful AI features (e.g. drafting emails, proposals) that can help businesses increase productivity. This is increasing the value and stickiness of the subscription service.

On top of all this, generative AI has become a major growth engine for Alphabet’s cloud computing division. Thanks to its powerful compute resources - which can handle complex AI workloads - Google Cloud is now being used by a range of well-funded generative AI startups including Anthropic, Midjourney, and Osmo. Note that in June, OpenAI announced that it is now using Google's cloud infrastructure for compute resources7. Previously, it was relying on Microsoft’s Azure to meet its massive demand for computing capacity.

Microsoft

Speaking of Microsoft, it’s another hyperscaler that is benefiting from the growth of generative AI in several ways. Like Alphabet, it offers both consumer-facing AI applications and behind-the-scenes AI computing services.

Microsoft is a strategic partner to OpenAI and as a result has been able to roll out ChatGPT technology across its services. One specific example of this is Microsoft 365 Copilot. An AI-powered assistant that is integrated across Microsoft 365 apps such as Word, Excel, PowerPoint, Outlook, and Teams, this can draft emails, summarize meetings, and generate content, potentially driving measurable productivity gains and return on investment (ROI) for businesses. Given that Copilot is an add-on subscription ($30 per user, per month), the service could potentially lead to significant revenue growth for Microsoft in the years ahead if it sees mainstream adoption.

Microsoft's partnership with OpenAI is also a major driver for its Azure cloud platform. While no longer the exclusive cloud provider for all of OpenAI’s workloads, the growth of OpenAI is still leading to high demand for Azure’s services, propelling revenues in this segment of the business higher.

One other factor worth highlighting here is that Microsoft is a major investor in OpenAI, having invested more than $13 billion in the unlisted company8. Given that OpenAI is now valued at $500 billion9, this investment could pay off in a big way down the line if OpenAI decides to go public via an IPO.

Snowflake

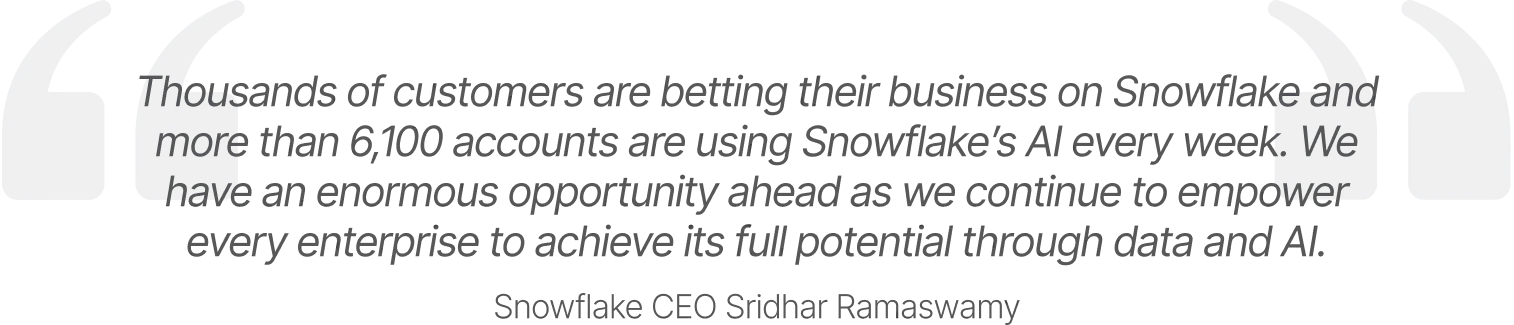

While ChatGPT and Gemini are the most recognizable faces of generative AI, a growing number of companies are busy building and deploying their own AI apps. And one company that is playing a key role here is Snowflake. It’s a tech company that provides the essential tools needed for businesses to build, deploy, and scale AI applications using their own data.

Snowflake's flagship AI service is called Snowflake Cortex. This is a fully managed suite of artificial intelligence and Machine Learning (ML) services built directly into the Snowflake AI Data Cloud platform. Using this service, customers can run LLMs and ML models directly on their data without having to move it out of the platform. The fact that Snowflake's architecture allows customers to run AI models and fine-tune LLMs on their private, governed data without moving it out of the secure platform boundary is a key selling point for regulated security-conscious enterprises.

With companies of all shapes and sizes scrambling to experiment with generative AI, Snowflake is seeing high demand for its services today. This is reflected in its recent Q2 earnings figures. For the quarter, product revenue growth came in at $1.09 billion, up 32% year on year10. This represented a sharp acceleration in growth from the previous quarter, when growth was 26%, showing that AI is having a notable impact on performance.

Footnotes:

1LSEG, as of October 9, 2025

2IOT Analytics, The leading generative AI companies, as of March 4, 2025

3NVIDIA, OpenAI and NVIDIA Announce Strategic Partnership to Deploy 10 Gigawatts of NVIDIA Systems, as of September 22, 2025

4OpenAI, AMD and OpenAI announce strategic partnership to deploy 6 gigawatts of AMD GPUs, as of October 6, 2025

5Broadcom, Broadcom Inc. Announces Third Quarter Fiscal Year 2025 Financial Results and Quarterly Dividend, as of September 4, 2025

6TechCrunch, Gemini tops the App Store thanks to new AI image model, Nano Banana, as of September 16, 2025

7CNBC, OpenAI says it will use Google’s cloud for ChatGPT, as of July 16, 2025

8CNBC, The rise of OpenAI and Microsoft’s $13 billion bet on the AI startup, as of August 10, 2025

9Yahoo Finance, OpenAI now worth $500 billion, possibly making it the world's most valuable startup, as of October 2, 2025

10Snowflake, Snowflake Reports Financial Results for the Second Quarter of Fiscal 2026, as of August 27, 2025