September 15, 2025

AI Stocks: 5 Standout Performers From Recent Earnings

While there are many companies offering artificial intelligence solutions today, the gap between the AI leaders and the rest of the pack is starting to widen. This was illustrated during the most recent earnings season, with some companies reporting accelerating revenue growth and sharply higher profitability on the back of their AI products and services and others seeing lackluster results.

Here, we are going to highlight five AI stocks that were standout performers during the most recent earnings season. With the market increasingly rewarding businesses that can demonstrate not just AI investment, but tangible revenue and profitability stemming from their AI solutions, these companies can no longer be ignored when it comes to artificial intelligence.

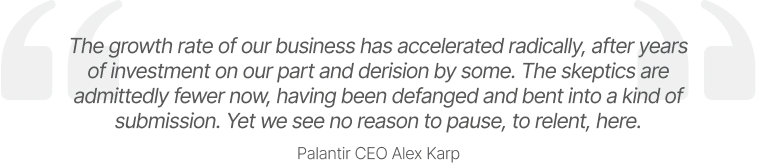

Palantir

There are few companies that are benefiting from the AI boom more than software company Palantir. Thanks to the power of its Artificial Intelligence Platform (AIP)—which allows organizations to build, deploy, and manage AI applications directly on top of their own data—its revenue is soaring. Today, Palantir is working with a range of government organizations to build AI-powered solutions for everything from national defense and intelligence to public health and social services. It’s also working with many large-scale corporations including the likes of BP, American Airlines, and Novartis.

For the second quarter of 2025, Palantir’s revenue came in at $1.0 billion, up 48% year on year. This was significantly above the consensus estimate of $940 million. Growth was driven by a very strong performance in the US, where revenue was up 68% year on year to $733 million. Breaking this US revenue figure down, commercial revenue was up 93% year over year to $306 million while government revenue was 53% higher at $426 million. On the back of this strong performance, the company raised both its Q3 and full-year guidance. For Q3, it now expects year-on-year growth of 50% while for 2025, it anticipates year-on-year growth of 45%.

Since Palantir Q2’s earnings, multiple Wall Street firms have raised1 their price targets for the stock. The highest price target currently belongs to Wedbush’s Dan Ives, who believes the AI stock can hit $200.

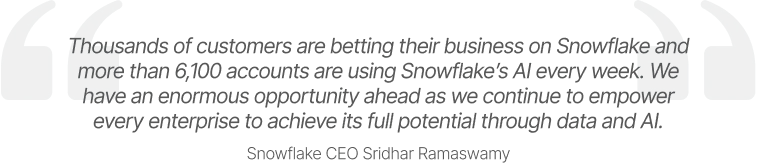

Snowflake

A crucial first step for any business looking to deploy AI is to properly structure its data. This is where Snowflake comes in. It offers a unified platform for enterprise data known as the AI Data Cloud. Using this platform, organizations can unite their siloed data, easily discover and securely share governed data, execute diverse analytic workloads, and securely create and deploy LLMs and AI models.

For the quarter ended 31 July, Snowflake’s product revenue came in at $1.1 billion, up 32% year on year. This was an acceleration of growth relative to the previous quarter, where top-line growth was 26%. Net revenue retention rate for the quarter was 125%, indicating that existing customers are spending more money with the company. Given the acceleration in growth, the company increased its full-year product revenue growth guidance from 25% to 27%.

As a result of the acceleration in top-line growth and the increase to guidance, Snowflake stock received a large number of price target increases2 after its earnings. Currently, the average price target is $262, however, many firms have targets of $280 or higher.

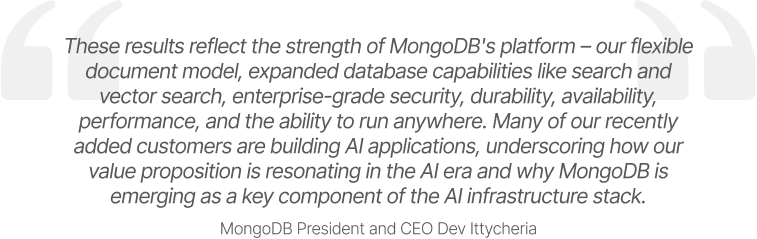

MongoDB

Another data specialist that is benefiting as companies move to adopt AI is MongoDB. It offers a powerful database called Atlas that simplifies the development of AI applications. Unlike traditional relational databases that use rigid tables, rows, and columns, Atlas stores data in flexible, JSON-like documents where specific information can be accessed using a feature called vector search. This design makes it well-suited to diverse, unstructured, and semi-structured data, which is common in modern web and mobile applications.

For the second quarter of its fiscal 2026, MongoDB posted revenue of $591.4 million, an increase of 24% year-over-year. This was an acceleration of growth relative to Q1, when its top line grew by 22%. Atlas revenue was up 29% year on year while subscription revenue was 23% higher. Non-GAAP income from operations was $86.8 million compared to $52.5 million in the prior-year period.

In its earnings report, MongoDB said that during the quarter, it unveiled a range of product innovations and AI partner ecosystem expansions that make it easier for customers to build accurate, reliable AI applications at scale. It also noted that it had added 5,000 new customers in the first seven months of the year—the most ever over this timeframe. Thanks to this momentum, the company raised guidance on the top and bottom line for the full year. It now expects revenue of $2.34 billion to $2.36 billion for fiscal 2026 versus $2.01 billion for fiscal 2025.

After the earnings report was released, more than 20 Wall Street firms increased3 their price targets for MongoDB stock. Currently, several brokers have price targets of $350 or higher.

Broadcom

While Nvidia has dominated the AI chip market in recent years thanks to its high-powered GPUs, investors are now shifting their focus to Broadcom. It designs custom AI chips (XPUs) for hyperscalers, and it is having a lot of success at present. On its most recent earnings call, the company advised that it had signed a fourth customer for these chips and that this company had placed orders worth $10 billion. The chip designer did not name this customer; however, many analysts believe that it is OpenAI.

For the quarter ended July 31, Broadcom’s revenue amounted to $15.95 billion, up 22% year on year. In terms of AI chip revenue, this came in at $5.2 billion, up 63% year on year. Non-GAAP net income for the quarter was $8.4 billion while non-GAAP diluted earnings per share (EPS) was $1.69 versus $1.66 expected. This represented growth of 36% year on year.

For the current quarter, Broadcom expects total revenue of $17.4 billion, an increase of 24% from the prior-year period. AI semiconductor revenue is expected to climb to $6.2 billion, an increase of 19% quarter on quarter. Looking further out, AI revenue is expected to grow by 60% or more next fiscal year. Given this high level of projected growth, Wall Street analysts have been scrambling to increase4 their price targets, with many going to $400.

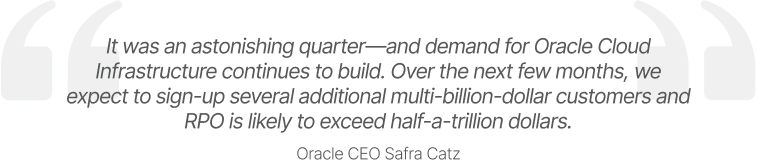

Oracle

Alongside large cloud providers such as Amazon and Microsoft, Oracle has been a major beneficiary of the demand for accelerated computing infrastructure in recent years thanks to its cloud infrastructure business, Oracle Cloud Infrastructure (OCI). In this part of the business, revenue has soared. Offering a dedicated, high-speed environment powered by Nvidia GPUs, Oracle has managed to position itself as a go-to partner for some of the most innovative companies in the AI space. Note that OCI offers “MultiCloud” functionality, meaning that companies can run their Oracle databases directly within the data centers of rival cloud providers such as Amazon Web Services (AWS) and Google Cloud.

While Oracle’s revenue and earnings growth (12% and 6% respectively) for the first quarter of its fiscal 2026 may not have set the world on fire, its Cloud Infrastructure guidance did. Because this was far better than expected. For the current fiscal year, Oracle now sees $18 billion in Cloud Infrastructure revenue, 77% higher than the figure in fiscal 2025. Looking further out, it expects revenue of $32 billion, $73 billion, $114 billion, and $144 billion from this segment over the subsequent four years.

What really jumped out in the Q1 earnings report was remaining performance obligations (RPO). This is a measure of contracted revenue that has not yet been recognized. It soared to $455 billion, up 359% from a year earlier. According to the company, it was driven by four multi-billion-dollar contracts from three different customers.

It’s worth noting that in its earnings report, Chairman and CTO Larry Ellison told investors that next month, the company will introduce a new Cloud Infrastructure service called the Oracle AI Database. This will enable customers to use the LLM of their choice (e.g. ChatGPT, Gemini, Grok, etc.) directly on top of the Oracle Database. Ellison also said that he expects MultiCloud revenue to grow substantially every quarter for several years as the group delivers dozens of data centers to its three hyperscaler partners, Amazon, Google, and Microsoft. In Q1, MultiCloud database revenue grew by 1,529%.

As a result of Oracle’s strong guidance, Wall Street analysts have increased5 their price targets for the stock significantly. Several firms have gone to $400, indicating that they see further share price upside ahead.

Footnotes:

1Investing.com, Palantir Technologies Inc Consensus Estimates, as of September 10, 2025.

2Investing.com, Snowflake Inc Consensus Estimates, as of September 10, 2025.

3Investing.com, Mongodb Consensus Estimates, as of September 10, 2025.

4Investing.com, Avago Technologies Consensus Estimates, as of September 10, 2025.

5Investing.com, Oracle Corp Consensus Estimates, as of September 10, 2025.