Gold’s Breakout to Fresh Record Highs Amid Persistent Geopolitical Tensions

Global demand for gold has surged since the outbreak of the Russia-Ukraine conflict, with prices rising more than 133% from its September 2022 levels. Gold has shown remarkable resilience this year, rising 44% year-to-date and outperforming global equity markets.

Gold’s rally has been fuelled by a combination of supportive factors, including persistent geopolitical tensions, inflation concerns, expectations of the Fed resuming an easing cycle, a softer U.S. dollar, and central bank demand. Elevated global debt levels, weaker U.S. growth prospects, and tariff-driven inflation risks have further driven investors toward gold; while growing worries over U.S. fiscal discipline and the Federal Reserve’s institutional independence have intensified the search for stability, strengthening the metal’s appeal during times of uncertainty.

Gold Surges as Dollar Weakens and Rate Cut Bets Mount

Gold surged to an all-time high of $3,790 per ounce on Tuesday and is on track for its strongest annual performance since 1979. The latest rally follows dovish signals from the U.S. Federal Reserve, with the market widely expecting three interest rates cuts this year.1

Additionally, the U.S. dollar slumped to a ten-week low, amplifying bullion’s allure. Non-yielding assets such as gold typically outperform in a low-rate environment, as they become more attractive relative to government bonds.

Gold Gains on U.S. Policy Uncertainty and Eroding Fed Independence

Uncertainty surrounding U.S. President Donald Trump’s trade tariffs has also been a driver of gold. Additionally, Trump’s direct conflict with the Federal Reserve have shaken confidence in U.S. policymaking, further undermining the dollar’s status as the world’s reserve currency.2

Trump’s political pressure on the central bank could erode institutional credibility and may accelerate foreign diversification away from dollar-denominated assets, boosting the strategic case for gold.

Inflation, Stagflation Fears, and Fed Easing Expectations

Despite headline inflation stabilizing, underlying concerns about stagflation are fuelling demand for bullion. Gold is increasingly seen as a hedge against stagflation, a scenario where inflation persists while growth and labour markets deteriorate.

Recent weak payrolls data and the highest unemployment rate since 20213 have locked in expectations of the Fed delivering three interest rate cuts this year, pushing gold prices higher. Futures imply more than 100 basis points of easing under Powell’s watch before his term ends in May 2026.

Technical Analysis

After a strong rally in early 2025, gold entered a consolidation phase from April, forming an ascending triangle - a continuation pattern typically resolved to the upside. The resistance of $3,499 was broken in early September, confirming the bullish pattern and opening the way for a measured move toward the $3,800-$3,900 zone based on the triangle’s height projection.

While a short-term pull back is possible as the Relative Strength Index (RSI) is in strongly overbought territory, momentum remains firmly anchored within the 40-80% bull market band, reinforcing the bullish outlook over the long-term. Given the positive fundamental and technical backdrop, we see levels to $4,500 achievable in 2026.

Why Gold Miners ETFs Are Now Outperforming Gold and What’s Next in 2026

In 2024, gold miners ETFs lagged behind the performance of gold itself despite a favourable environment for the metal. The main reason was that mining companies faced elevated costs across the board, from energy and fuel to labour and equipment, which eroded the profitability benefits of higher gold prices. While gold was seen as a pure safe-haven asset, miners were treated as equities, leaving them vulnerable to pressure from high real interest rates and broad equity market underperformance relative to gold.

The story has changed in 2025. With oil prices dropping year-to-date and other input costs stabilizing, miners are enjoying improved margins as gold prices kept rising. Years of balance sheet repair and disciplined capital spending are paying off, with many companies now able to generate improved free cash flow and return capital to shareholders through dividends and buybacks. This combination of leverage to the gold price and the appeal of equity income has attracted flows into gold miners ETFs, leading them to outperform bullion.4

Looking ahead to 2026, the outlook for gold miners will hinge on the macroeconomic backdrop. If the Federal Reserve follows through with its projected rate cuts and the U.S. dollar weakens further, gold should remain well supported, setting the stage for miners to extend their outperformance. Inflation is likely to stay elevated, not least because tariffs will be passed on to consumers, and a combination of sticky prices and looser monetary policy could push real interest rates into negative territory, a scenario historically favourable for gold. In such an environment, miners stand to benefit disproportionately, as revenues rise with gold while operating costs remain relatively stable, driving earnings growth.

Investors Pour Billions into Gold and Miners ETFs Amid Bullion’s Price Rally

Investor appetite for gold shows no sign of cooling as prices surge to record highs. Global gold ETFs extended their momentum with a third consecutive month of inflows in August, driven primarily by North American and European funds. Physically backed products attracted US$5.5bn during the month, lifting year-to-date inflows to US$47bn, the second-strongest on record, trailing only 2020’s peak.5

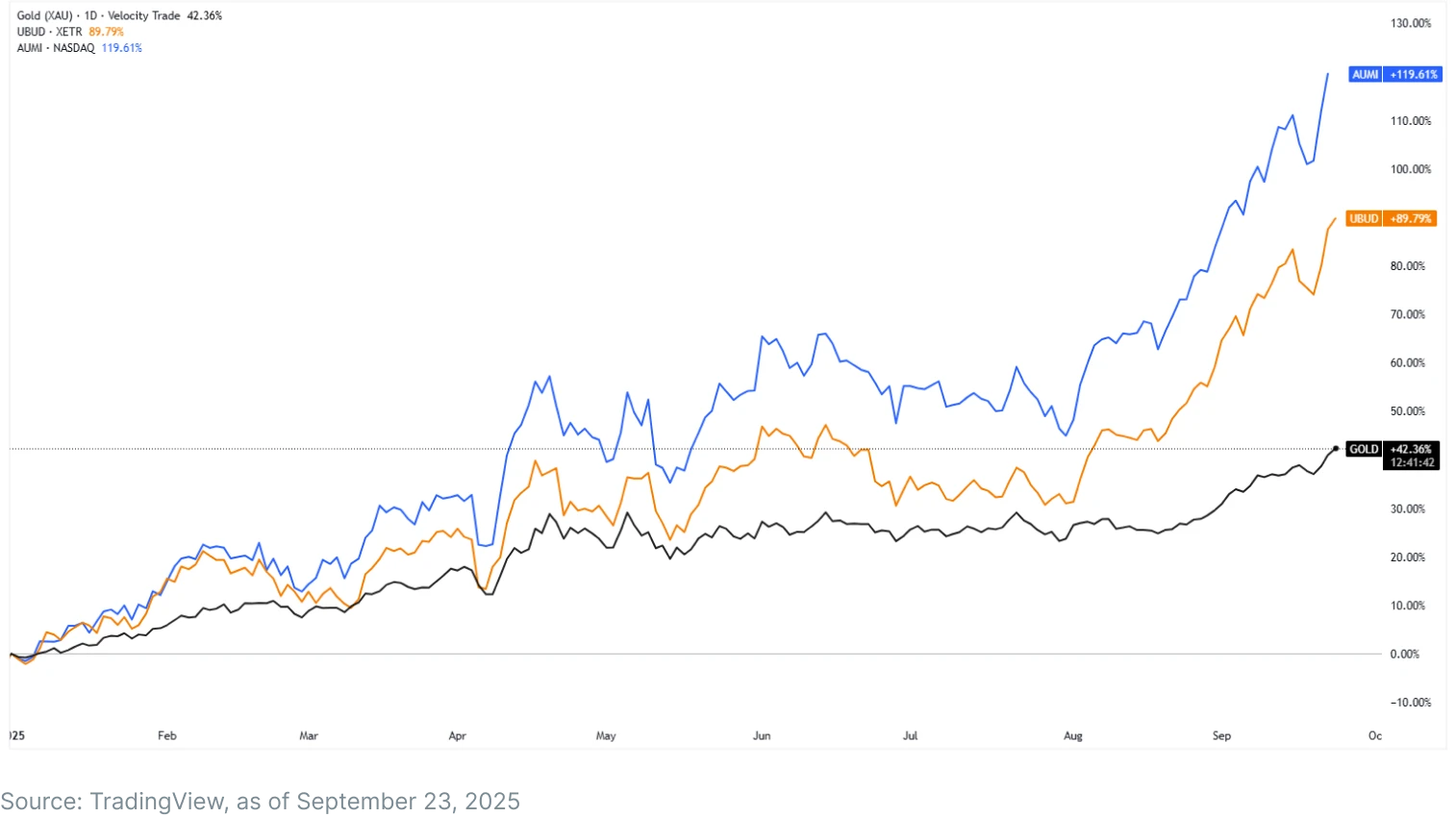

The Solactive Global Pure Gold Miners Index, which tracks the price movements in shares of companies active in the gold mining industry has surged more than 89% year-to-date, while the Themes Gold Miners ETF, which seeks to track the Solactive Global Pure Gold Miners Index (before fees and expenses) has risen more than 119%, both far outpacing gold’s 44% gain and the S&P 500’s 13% advance.

Footnotes:

1Federal Reserve, September 17, 2025: FOMC Projections materials, accessible version

2Harvard Kennedy School, The End of the Federal Reserve as We Know It?, as of September 26, 2024

3Trading Economics, United States Unemployment Rate, as of September 23, 2025

4Discovery Alert, Record-Breaking Profits for Gold Miners in Q2 2025, as of August 16, 2025

5World Gold Council, Gold ETF Flows: August 2025, as of September 5, 2025