September 24, 2025

Inside China’s Ambitions of a $38 Billion Generative AI Industry

In a bid to position itself as a global leader in AI technologies, China has made significant strides in AI infrastructure over the past few years. Driven by both government initiatives and private investment, over 500 new data center projects1 were announced everywhere from Inner Mongolia to Guangdong in 2023 and 2024. Of these, at least 150 of the newly built data centers were finished and running by the end of 2024. By 2035, China aims to add AI as a new growth engine2 that would add 11 trillion yuan into its economy.

A key element of this push is buildout of Generative AI capabilities.

Expanding Generative AI Across Industries and Enterprises

We believe that Generative AI is positioned to deliver significant benefits in content writing, chatbot-based support, web search, code generation and testing, image editing, text to voice processing and video editing – among others.

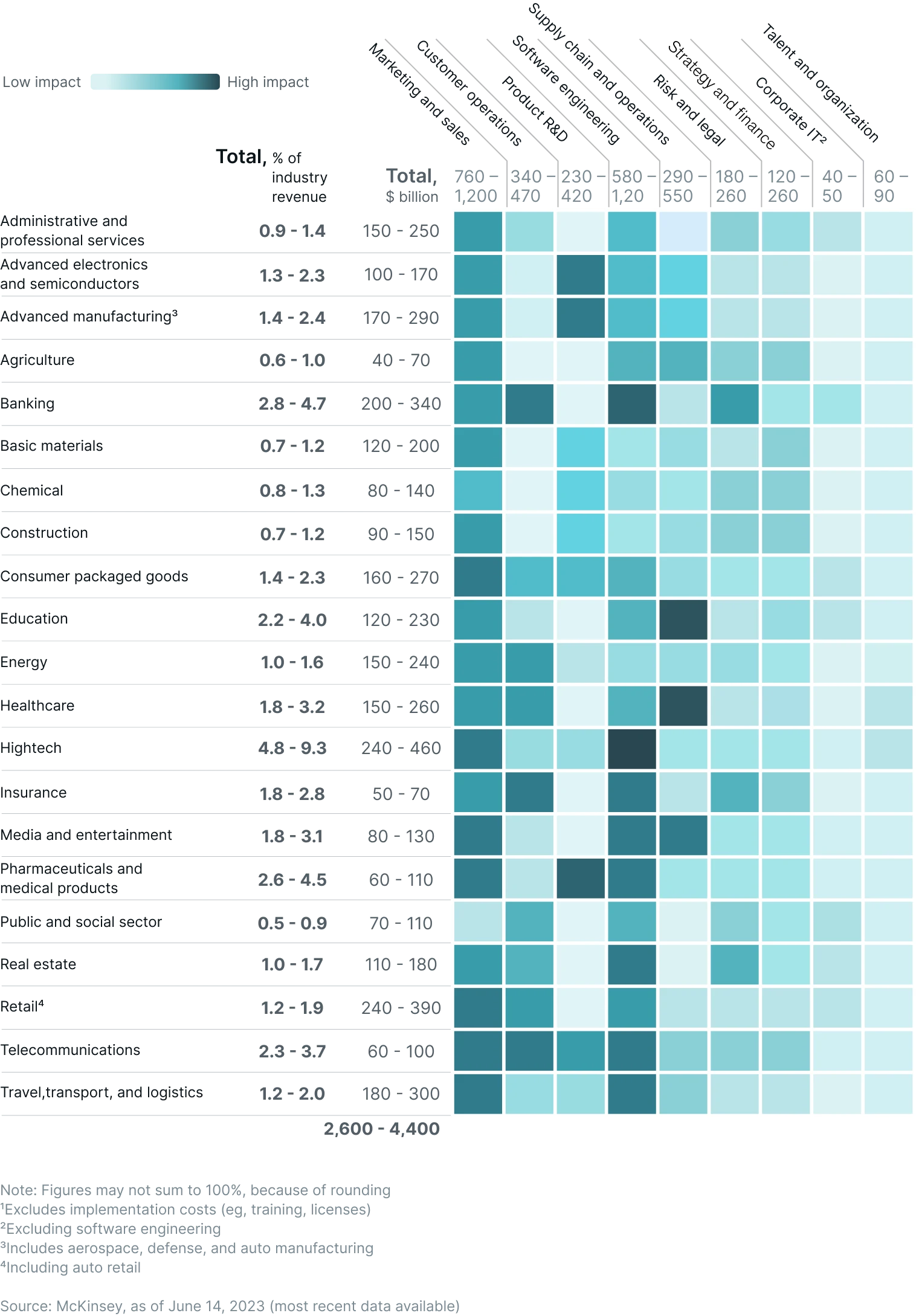

Overall, it is estimated3 that generative AI will have a substantial impact in sectors as diverse as banking and high tech to agriculture and construction.

Generative AI Use Cases Will Have Different Impacts on Business Functions Across Industries.

Generative AI Productivity Impact by Business Functions1

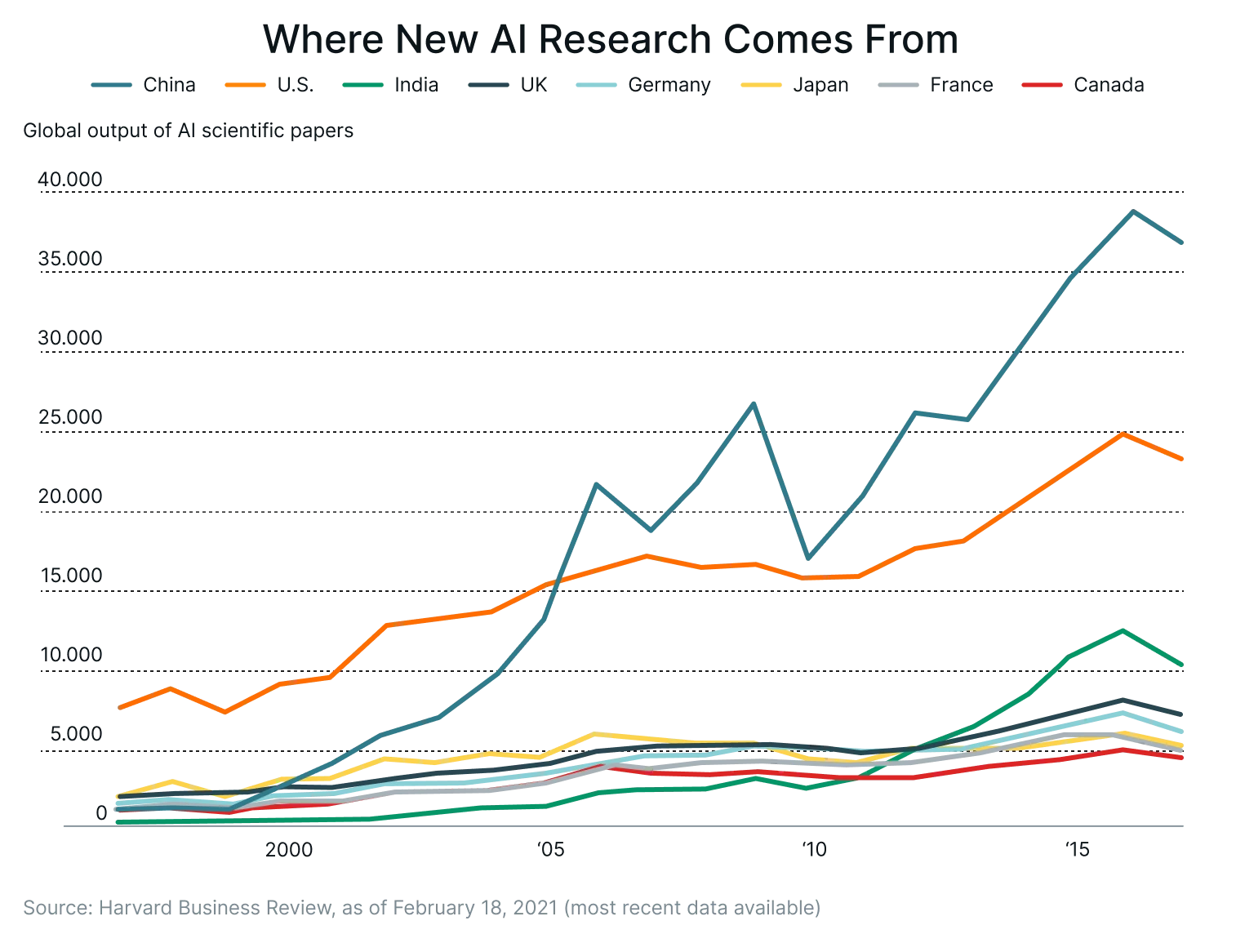

China has seen a rapid increase in AI-related talent: as of 2024, there were over 2 million AI professionals working in China, and this number is expected to reach 4 million by 2030. China's universities and research institutes continue to be at the forefront of AI research and estimated4 to be leading in the publishing of AI-centric scientific papers for some time.

Numerous Chinese companies have been working on pursuing either deeper generative AI integration into their existing products and services or as standalone buildouts. Baidu – already a purported leader in providing cloud-based AI services and infrastructure to various industries – also works on producing AI-centric “Kunlun” chips and has launched a series of large language models (LLMs) such as Ernie 4.0, which rivals OpenAI’s GPT series in both English and Chinese language capabilities.

Kuaishou, one of China’s leading short-video platforms, leverages AI for video content recommendations, content moderation, and live-streaming optimization and is experimenting with generative AI models for video generation and virtual influencers in the short-video space.

Kingsoft Cloud Holdings, a key player in the cloud services market in China via an “AI-as-a-service” offering for industries like e-commerce, gaming, and healthcare, is exploring applications of generative AI in enterprise automation, in areas such as document processing and data-driven content generation.

Beijing Fourth Paradigm Technology, which focuses on AI model development and enterprise AI solutions to help companies integrate AI into their operations, is working on AI for predictive analytics to fuel the operations of decision-making models.

Arcsoft Corp, whose computer vision technology forms the backbone of many AI infrastructure projects focused on imaging and video processing, is venturing into generative AI for image enhancement, deepfake detection, and creating synthetic media.

The Road to a $50 Billion Generative AI Economy

China’s generative AI market is expected to grow from a little under $6 billion in 2025 to over $38 billion by 20315. This growth is driven by industrial applications in sectors like media, finance, education, and manufacturing. By 2030, generative AI is being touted to be deeply integrated into all levels of business, providing automation for everything from content generation to customer service and product design.

In 2025 so far, China’s market breadth has been shrinking due to concerns over sustainable growth in the face of soft consumption sentiment and economic headwinds twenty years in the making. However, while China’s long-term bet on AI aims to position it as a global hub for generative technologies, Chinese enterprises in the fray currently are – at least – well-positioned to benefit from the reshaping of the domestic digital economy. This has been helping prop up valuations of select tech stocks in China and reshaping their forward-looking outlook.

Footnotes:

1“China built hundreds of AI data centers to catch the AI boom. Now many stand unused.”, MIT Technology Review, as of March 26, 2025

2“China bets on AI to pump trillions into economy amid national computing push”, South China Morning Post, as of August 25, 2025

3“The economic potential of generative AI: The next productivity frontier”, McKinsey, as of June 14, 2023

4“Is China Emerging as the Global Leader in AI?”, Harvard Business Review, as of February 18, 2021

5“Generative AI – China”, Statista Market Insights, as of March 2025