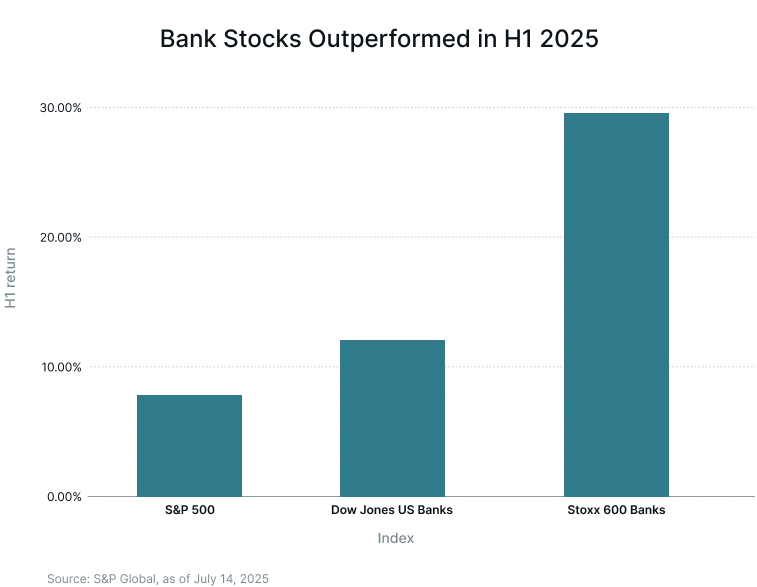

Forget the idea that bank stocks’ best days are in the past. This year, these stocks are truly shining, outpacing the broader market by a wide margin. In the US, the Dow Jones US Banks index delivered a return of 13% for the first half of 20251 – more than double the S&P 500's return. European banks performed even better, with the Stoxx 600 Banks index returning 29% for the period – its strongest H1 performance since 19972.

As for what’s driving this remarkable outperformance, it’s a combination of factors. From macroeconomic shifts to regulatory tailwinds, there are a range of forces at play that are creating a bullish environment for bank stocks. Here’s a look at the key factors fueling their gains in 2025.

Anticipation of Rate Cuts

Without a doubt, expectations of lower interest rates have been a key driver of the banking sector gains seen this year. Lower rates are expected to stimulate loan demand, leading to increased activity across mortgages, business loans, and consumer credit.

At its June meeting, the Federal Reserve held interest rates steady at 4.25-4.50%. However, the Fed’s “dot plot” showed that the central bank plans to make two rate cuts before the end of the year3. Multiple rate cuts could have a positive impact on mortgage demand as lower interest rates would make homeownership more accessible. Lower rates could also lead to an increase in refinancing activity.

In Europe, the European Central Bank (ECB) has already made a number of rate cuts to support the economy, reducing rates eight times over the last year4. As a result, the deposit rate now stands at just 2.00%. Given this interest rate backdrop, lending across Europe is expected to increase this year. One recent survey from global real estate advisor CBRE showed that nearly 80% of lenders plan to increase origination efforts in 2025, with refinancing identified as the primary driver of demand5.

Deregulation Under the Trump Administration

Another key driver of the banking sector outperformance this year has been anticipation of US deregulation under the Trump administration. Looking ahead, investors expect changes to regulation related to capital and leverage requirements that was introduced in the wake of the 2008 financial crisis. A specific example here is the Enhanced Supplementary Leverage Ratio (eSLR), which targets the largest, most systemically important US banks and is designed to bolster the financial stability of firms by ensuring they maintain a sufficient capital cushion. Any changes to these regulations could free up capital for loans and potentially lead to higher levels of profitability for the banks.

Stress Test Results

While some investors are concerned that banking deregulation is a risk, the Federal Reserve’s annual stress test in June showed that institutions in the US are well-positioned to weather economic turbulence. In this year’s stress test, all 22 banks tested remained above their minimum common equity tier 1 (CET1) capital requirements during the hypothetical “severe recession” scenario6. These results – which led to gains for the sector – indicate that US banks are built on solid foundations. And it suggests that they have the capital and risk management capabilities to operate safely even with potentially fewer explicit regulatory constraints.

Increased IPO Activity

IPO activity is also helping to create a bullish backdrop for the banks in 2025. In recent months, the IPO market has started to heat up with successful listings from a range of companies including CoreWeave, Circle Internet Group, Chime, and eToro.

The strong post-IPO performance from these stocks (Circle’s share price is up more than 500% from its IPO price) is likely to boost confidence among companies preparing to go public. And it could lead to a rush of new listings. Looking ahead, there are some big names waiting to IPO. Companies that could potentially IPO this year include buy-now-pay-later giant Klarna, ticketing specialist StubHub, crypto exchange Gemini, AI chipmaker Cerebras, and travel software company Navan.

If the IPO market was to remain buoyant, it would most likely benefit a range of banks including Goldman Sachs, JP Morgan Chase, and Morgan Stanley, all of which are very active in the IPO space. Note that Renaissance Capital expects between 155 and 195 IPO issuances in 2025 versus 150 deals in 20247.

Favorable Equity Market Conditions

Broader conditions in the financial markets are another positive for the sector. Today, a lot of banks, including the likes of Morgan Stanley, JP Morgan, and UBS, have significant wealth management operations. Here, a large portion of revenue comes from management fees based on assets under management (AUM). With equity markets near their all-time highs, banks are benefiting. Zooming in on JP Morgan, its wealth and asset management arm reported $5.731 billion in net revenue for the first quarter of 2025, a 12% increase year on year. Net income for the segment rose 23% year on year to $1.583 billion8.

The market volatility we’ve seen recently is also potentially a positive for the banks. Many of the big banks have their own trading divisions and can therefore benefit from volatility. Meanwhile, volatility tends to lead to increased client activity as investors reposition their portfolios.

Sector Rotation and International Diversification

Bank stocks have also benefited from sector rotation in 2025. This year, the “Magnificent 7” trade has not delivered the kind of gains that investors have come to expect from it. As a result, investors have been seeking out other areas of the market with potential. With their lower valuations, healthy dividend yields, and share buybacks, bank stocks have seen inflows.

It’s worth noting that many institutional investors have moved capital away from the US in 2025 given the volatile political backdrop. This has benefited the European equity market. In Europe, banks make up around 12% of the Stoxx Europe 600 index9 (the third-largest sector weighting). So, flows to Europe have given the banking sector a boost.

Operational Efficiency and M&A Activity Across Europe

Yet capital flows to Europe are not the only thing boosting European bank stocks. Today, many of these stocks are benefiting from increased operational efficiency and/or M&A activity. This year, Société Générale shares have almost doubled thanks to a turnaround plan launched by CEO Slawomir Krupa. This plan involves exiting non-core businesses, boosting the balance sheet, and lifting profitability targets. And it appears to be working. For Q1, group net income was €1.6 billion, up 136% year on year10. Another strong performer in Europe has been Commerzbank. Its share price has more than doubled since UniCredit took a stake in September 2024, raising the possibility of a merger.

Note that according to Oliver Wyman, a record $27 billion worth of European banking deals have been announced since the start of 2025 – almost double the volume for the same period in 202411. Today, European banks are increasingly using M&A to acquire capabilities such as wealth management and payments, as well as to improve the quality of their earnings and improve shareholder returns.

A Sentiment Shift

In summary, the narrative around bank stocks has dramatically shifted in 2025. This year, a range of factors, including anticipated rate cuts, the push for deregulation in the US, and a revitalized IPO market, has boosted sentiment towards these stocks and propelled them to impressive heights. Of course, bank stocks are cyclical so there’s no guarantee that the upward trend will continue. Yet with valuations still looking reasonable, and dividends and buybacks rising, they could be worth a look in the second half of 2025.

Footnotes:

1S&P Global, Dow Jones U.S. Banks Index, as of July 11, 2025

2Yahoo Finance!, European Banks’ First-Half Stock Gains Are Biggest This Century, as of July 1, 2025

3CNBC, Fed holds key rate steady, still sees two more cuts this year, as of June 18, 2025

4Reuters, ECB cuts rates for eighth time amid trade war risk, as of June 5, 2025

5CBRE, European Lending Activity Expected to Rise, According to New CBRE Survey, as of June 12, 2025

6Yahoo Finance!, U.S. bank stocks rise after Fed stress test results, as of June 30, 2025

7DealRoom, Upcoming IPOs in 2025 and Recent IPOs Reviewed, as of May 14, 2025

8JP Morgan Chase, First Quarter 2025 Results, as of April 2025

9STOXX, Index Description, as of July 14, 2025

10Societe Generale, Results at 31 March 2025, as of April 30, 2025

11OliverWyman, European Banking M&A Surges In 2025, as of July 14, 2025