July 8, 2025

The Cash Flow Differentiator: Strategic Flexibility & More Resilience

Why Cash Flow is Important

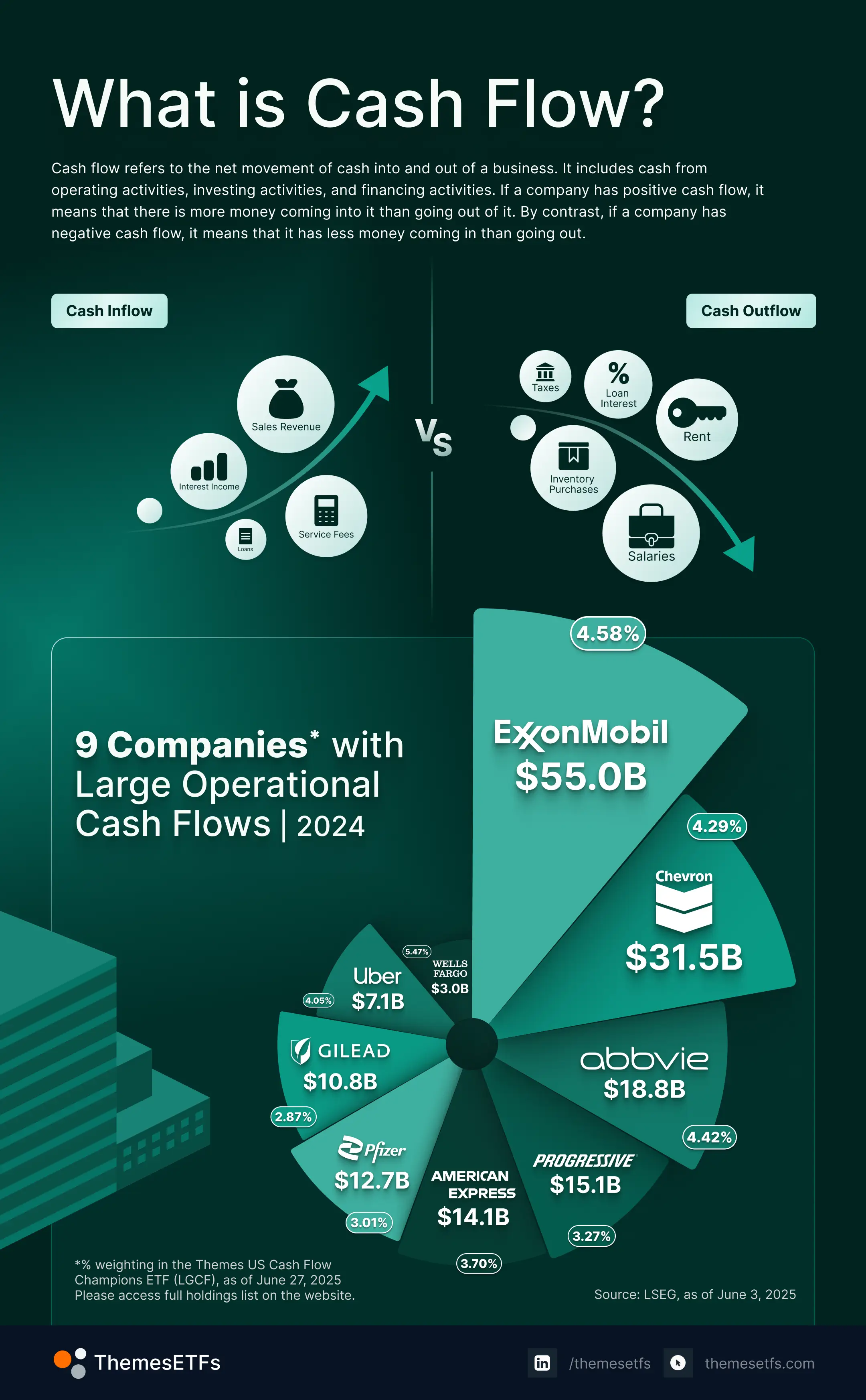

Cash flow is the lifeblood of any business. So, it’s an important metric to focus on when investing in stocks, especially when there is a high level of economic uncertainty. If a company consistently has substantial positive cash flows, it’s likely to have the ability to invest for long-term growth, pay off its debts, and weather economic downturns. However, if a company has negative cash flow, it may struggle to meet its financial obligations and end up getting into financial difficulty.

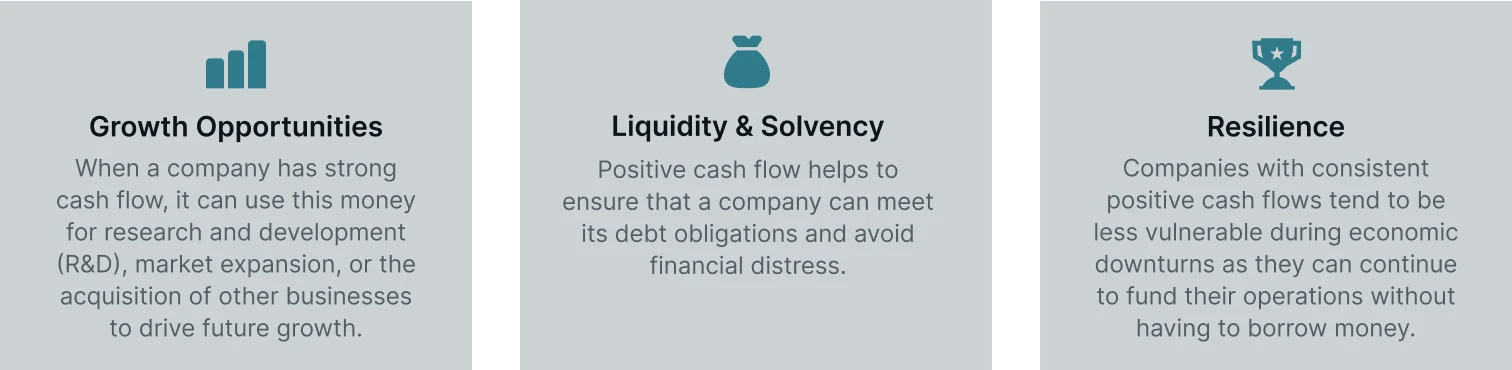

The Benefits of Positive Cash Flow

Why Cash Flow is Crucial in an Economic Downturn

Economic downturns can be problematic for businesses as they can lead to both lower sales and delayed payments from customers. In this kind of environment, strong cash flows are crucial. Not only can cash flow help to ensure that a company has enough liquidity to cover immediate operational expenses such as rent, utilities, and payroll, but it can help enable a firm to meet its debt obligations and avoid liquidity crises that can lead to insolvency. A lack of cash flow is one of the main reasons that a lot of businesses fail during recessions.

Cash flow isn’t just a defensive attribute in an economic downturn though; it can also fuel offensive moves. When the economy is weak, opportunities for strategic investments can sometimes arise. For example, acquisition targets can become available at more compelling valuations. Companies with strong cash flows can be better positioned to capitalize on these kinds of opportunities.

The Three Types of Cash Flow

Cash flow is typically calculated using a cash flow statement, which is a report designed to show how a company’s activities have affected its cash and cash equivalents. Net cash flow for the period is calculated by adding up all the cash inflows from operating, investing, and financing activities, and then subtracting all the cash outflows from these same activities.

How is Cash Flow Measured?

In the investment world, cash flow is often measured on a per share basis. This provides investors with a cash flow yield. A high cash flow yield signals that a company generates a lot of cash relative to its market cap. Meanwhile, a low cash flow yield signals that a company does not generate much cash relative to its market cap.

The Benefits of Investing in Companies With High Cash Flow Yields

Investing in stocks with high cash flow yields can offer several potential advantages. These include:

The Potential for Capital Appreciation: When a stock has a high cash flow yield, it means that the company is generating a significant amount of cash relative to its market cap. This often implies that the market is underappreciating the company's cash-generating ability.

The Potential for More Portfolio Stability: Businesses that are able to consistently generate positive cash flows tend to be more resilient than those that are not able to. As a result, they can offer a degree of stability for investors when there are concerns in relation to the economic outlook. Note that in the first half of 2025, when stocks were extremely volatile due to tariff uncertainty, the Themes US Cash Flow Champions ETF experienced significantly less volatility than the broader market. Its max drawdown between February and April 2025 was 18% versus 21% for the S&P 500* and 26% for the Nasdaq 100**.1

The Potential for Capital Returns: Healthy cash flow allows companies to return capital to shareholders. Returns can come via dividends or share buybacks or a combination of both.

More Dividend Security: Dividends are typically paid out of a company's cash balance therefore strong and stable cash flows are a prerequisite if a company wants to consistently pay dividends to its investors. If a company has reliable cash flows, it can signal that dividend payments are more likely to be secure.

More Transparency: A company’s earnings can be influenced by a range of non-cash items including depreciation, amortization, and deferred revenue recognition – all of which can potentially mask underlying financial issues. Cash flow cannot be manipulated like this, however, so it can offer a more reliable gauge of a company's financial strength and operational efficiency.

The Themes US Cash Flow Champions ETF

Those looking for exposure to businesses with high cash flow yields may wish to check out the Themes US Cash Flow Champions ETF (LGCF). This seeks to track the Solactive US Cash Flow Champions Index (SOLUCFCT), which identifies the top 75 large/mid-cap companies with the highest three years of positive cash flow yield.

With an expense ratio of just 0.29%, this ETF aims to offer a cost-effective way to invest in a range of high-quality companies with substantial cash flows. It could potentially be a valuable portfolio addition for those seeking both participation in bull markets and resilience during market downturns.

Footnotes:

*The Standard and Poor's 500, or S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States.

**The Nasdaq-100 is a stock market index made up of equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index.

You cannot directly invest in an index.

1Themes research with data from WSJ & Yahoo Finance, as of June 3, 2025