July 18, 2025

Boeing and Raytheon: Positive Growth Expected from Military Spending in U.S., Middle East

Long-running tensions between Iran and Israel came to a head on the 12th of June 2025 after the latter attacked dozens of Iranian nuclear facilities, military bases and infrastructure installations and key military commanders as well as air defence systems and missile infrastructure. Over the course of the next twelve days, Iran launched hundreds of ballistic missiles1 and around a thousand drones at Israeli targets while Israel launched hundreds of airstrikes in return. U.S. forces in the region also contributed to the defence of Israel via warships at sea and missile batteries on land, finally culminating in a series of airstrikes by U.S. bombers on Iran’s nuclear facilities on the 22nd. On the 24th, a ceasefire was agreed upon by all sides.

Seemingly, this was on the nick of time. In addition to the substantial human costs were financial: missile defence alone was estimated to have cost Israel around $200 million per day2, with Boeing-developed Arrow missiles costing around $3-4 million per interception and David’s Sling – jointly developed by Israel’s Rafale and U.S.-based Raytheon – costing around $700,000 per month. In addition, each fighter jet launched in the battle cost around $10,000 per hour in fuel costs, with munitions deployed costing more. Near the end of this 12-day war, Israel’s arsenal was reported to be running low3 on interceptor missiles while the U.S. is estimated4 to have incurred around $800 million in costs after expending 15-20% of its global interceptor missile stockpile in the defence of Israel.

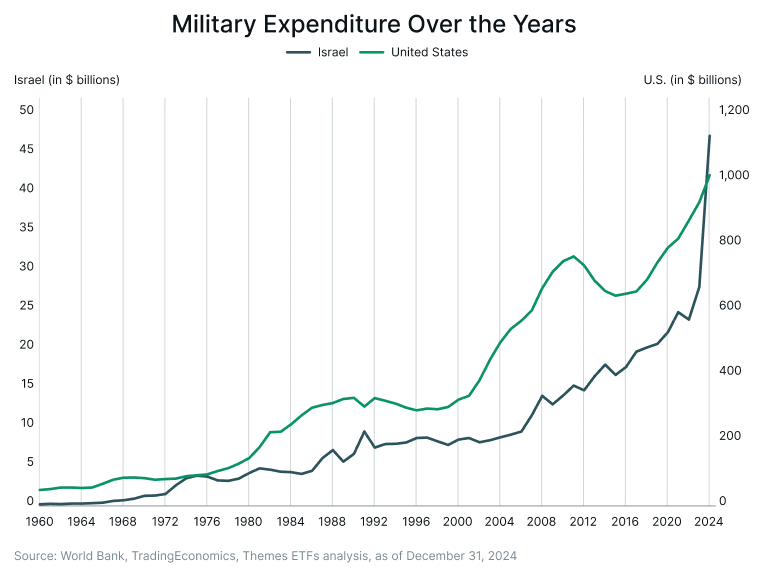

As seen in recent times throughout the region, the cessation of a shooting match doesn’t necessarily imply that the root causes of the conflict have been addressed. Like many other nations in the region, the U.S. and Israel have consistently been matched in military expenditure growth trends – with high spending highly likely in the immediate future.

Military Spending Trends

With the historically deep involvement of the U.S. in the Middle East, U.S. and Israeli military spending have been roughly correlated for over fifty years now.

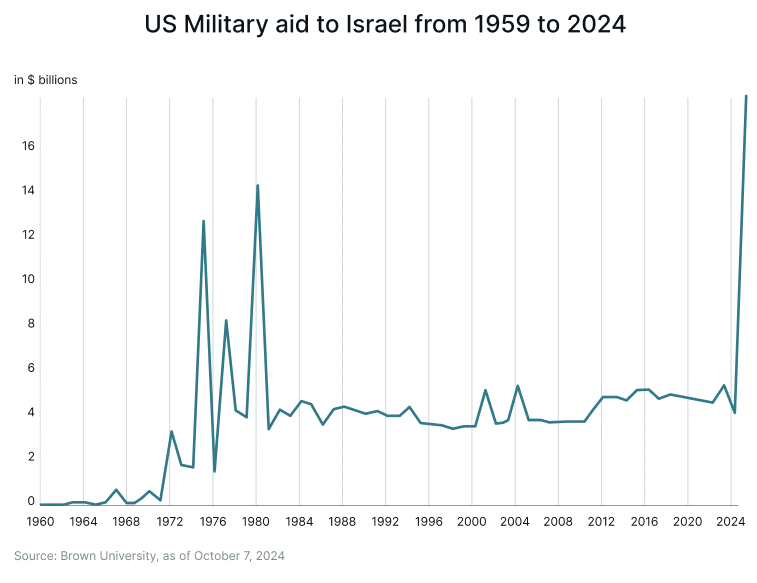

There is, however, a difference in scale: Israel’s military spending for 2024 was $24 billion while the U.S.’ was over $997 billion. To essentially maintain a parity in military effectiveness, the U.S. government has been supplementing Israel’s military budget with military aid for over half a century. Between 1959 and 2024, the Watson Institute for International & Public Affairs at Brown University estimated5 that total U.S. military aid to Israel accounted for $251.2 billion when adjusted for inflation to 2024 dollars.

This is only part of a larger aid – both military and non-military – historically provided to Israel which started with military loans in 1958 and went up to military grants in 1974, which is also when repayments of military loans made to Israel were waived. In April 2025, the U.S. Department of State stated6 that Israel is the largest recipient of military assistance under the U.S. Foreign Military Financing (FMF) programme. Since 2009, Israel has received $3.9 billion in funding every year for missile defence as part of an agreement set to end by 2028 – of which 25% is allowed to be spent on Israeli-origin systems. This is set to decrease to zero by 2028, i.e. all future aid and grants under FMF are to be spent on U.S.-origin and -made systems.

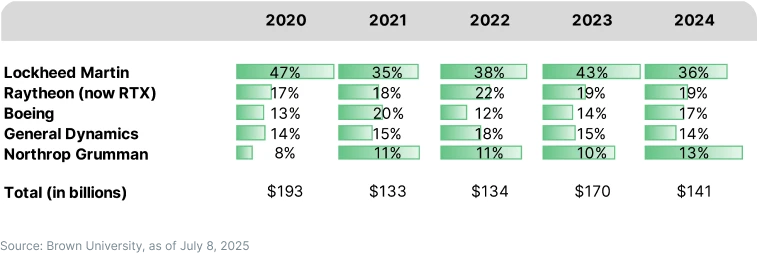

In a roundabout way, this adds to the bonanza for U.S. weapons manufacturers. From 2020 to 2024, it is estimated7 that private firms received $2.4 trillion in contracts from the Pentagon, of which $771 billion in Pentagon contracts went to just five firms: Lockheed Martin, RTX (formerly Raytheon), Boeing, General Dynamics, and Northrop Grumman. Among the five, Boeing averages at around 15% of all contracts by value while Raytheon averages at around 19%

Lockheed Martin’s high-priced jets tip the scale in contract value in its favour by averaging around 40%.

Raytheon’s Stake in the Middle East

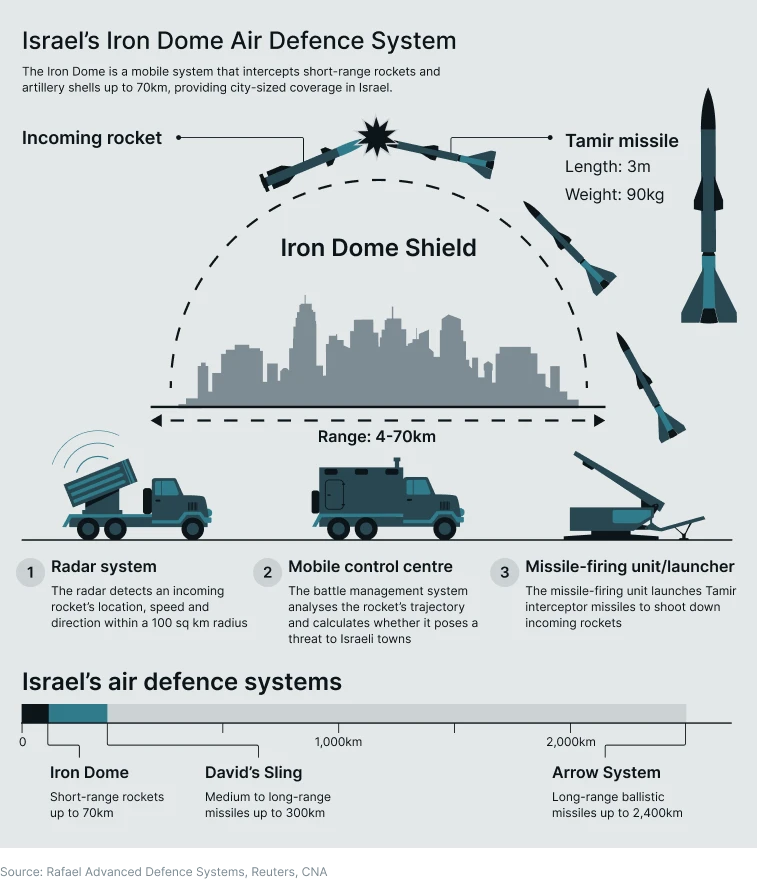

Outside of consulting engagements with various U.S. allies in the region, Raytheon looms large within Israel’s Iron Dome, an air defence system developed by Israel’s Rafael Advanced Defense Systems and Israel Aerospace Industries that is designed to intercept and destroy short-range rockets and artillery shells fired from distances of 4 to 70 kilometres away.

Central to the Iron Dome’s response is the “Tamir” missile, the majority of whose components are procured8 through the Raytheon supply chain in the United States. The system’s high success rate – a 90% success rate in intercepting more than 1,500 incoming targets since being fielded in 2011 – has resulted in the Tamir being inducted into the U.S. military as the Raytheon SkyHunter.

Another part of Israel’s missile defense is David’s Sling designed to intercept aerial munitions at ranges from 40 to 300 kilometers. Jointly developed by Rafael and Raytheon9, the latter produces the firing units and is partnered in the production of the Stunner missiles it uses. The U.S. variant of the Stunner producer by Raytheon – SkyCeptor – is currently pitched to the U.S. as well as other U.S.-allied nations. In the aftermath of the war between Iran and Israel, it can be expected that interest in the system from other countries will be piqued.

Late in April 2025, the United Arab Emirates (UAE) signed an agreement with Raytheon to co-produce the Coyote10, a small rail-launched missile designed to knock out drones. This announcement came around three years after Abu Dhabi came under missile and drone attacks11 from Yemen’s Houthi group in retaliation for the UAE’s involvement in the ongoing civil war in Yemen.

Raytheon also produced the Patriot missile batteries that David’s Sling was expected to replace and which also played a hand in the defence of Israel’s airspace in June. Patriot systems have seen extensive service in the region since the Gulf War of 1991 onwards and are also presently inducted in Saudi and Emirati defences – with both countries seeing extensive usage of Patriot systems to defend from Houthi attacks in recent times.

Boeing’s Stake in the Middle East

With roughly half of its revenue originating from military sales, Boeing essentially stands to benefit from U.S. military pacts and agreements. It’s F-15 fighter jets are in service in the militaries of Israel, Qatar and Saudi Arabia. Despite its vintage, it continues to be a highly-favoured system in the region: late in 2024, Israel’s defence ministry signed a $5.2 billion deal12 to acquire 25 upgraded F-15s.

Some of the munitions flown on Israeli military aircraft also originate from Boeing: in 2021, under a $735 million direct sale agreement13, Boeing supplied Israeli forces with conversion kits that turn unguided munitions into guided weapons – deliveries of which were accelerated as Israeli military operations escalated in 2023.

Since 2000, Israel has operated the Arrow missile family that was jointly developed with Boeing. With the capability to strike at targets at long ranges and altitudes, this system was heavily utilized during the 12-day war between Iran and Israel. Whilst it was historically only operated by Israel, the U.S. government in 2023 cleared a $3.5 billion deal14 that delivers Arrow-3 missile systems to Germany. Given that it’s a jointly-developed system, Boeing is expected to be a recipient of a portion of this amount; however, given the reported state of Israel’s missile inventory, deliveries might be delayed.

Earlier in May 2025, the U.S. and Saudi Arabia signed a $142 billion Defense Sales Agreement15, which includes air force advancement and missile capabilities. While details of how this breaks down is as yet unreleased, it can be assumed that Boeing will be a net beneficiary here as well.

“One Big Beautiful Bill” and Beyond

The recently-passed “One Big Beautiful Bill Act” included $150 billion16 in additional defence spending, which included $25 billion to initiate deployment of the “Golden Dome” – the U.S. version of Israel’s battle-tested Iron Dome system – which is expected to cost at least $175 billion to complete. Given the success of Arrow and Stunner, both Boeing and Raytheon stand to potentially gain a number of contracts within the overall project. With low inventories in missile stocks and the fluid situation in the Middle East, Raytheon can be expected to witness a surge in orders as the U.S. and its allies in the region either replenish or acquire stocks.

Also included in the “One Big Beautiful Bill Act” was an allocation of $16 billion for the development of drones, AI and low-cost weapons. Boeing has at least two drone projects that are on the cusp of full integration. The first is the MQ-28 Ghost Bat – jointly developed with Australia – which acts as a “wingman” combat drone that is paired with fighter jets, that has evinced strong interest17 from the U.S. Navy. The second is the MQ-25 Stingray – an aerial refueling drone – which the U.S. Navy is in the 4th year of integrating two squadrons18 of. With this allocation, the adoption of Boeing’s drones might be accelerated. Other areas where Boeing could be expected to pick up some high-value contracts would be from the $25 billion allocation for munitions and $9 billion for air superiority aircraft development. Also added was $1 billion specifically for Boeing to continue development of the X-37 robotic spaceplane. Furthermore, on the 30th of June, the U.S. government has approved the sale of $510 million in bomb kits19 to Israel, in which the principal contractor is Boeing.

Around half of Boeing’s revenue typically comes from its military endeavours but the other half comes from commercial products, which have been fraught with problems for almost twenty years now. Its leading product – the 737 Max – has been fraught with product problems, leading to multiple airliners crashing around the world and the loss of life of several hundreds of passengers. In 2021, 2024 and 2025, the U.S. Justice Department had repeatedly charged the company with fraud, conspiracy to defraud, and misleading regulators and stopped short of criminal prosecution in exchanges of billions of dollars in settlements20. A criminal conviction would have caused the company to lose its status as a federal contractor – thereby meaning either the loss of its military business or it being hiving off into a separate entity.

While Raytheon is a predominantly military products and services company, it too has exposure to commercial business since its merger with the aerospace divisions of United Technologies in 2020. In 2023, Raytheon stated that over 600-700 of its Pratt & Whitney engines used in Airbus airliners would have to be pulled aside for inspections over the next three years due to manufacturing flaws21, leading to a ripple effect extending from component manufacturers like Japan's Kawasaki Heavy Industries to airline carriers like Germany's Lufthansa that have bought Airbus aircraft. Its military business also encountered problems in 2024 when the U.S. Justice Department brought charges on the company for bribing Qatari officials to secure defense contracts and attempting to defraud the U.S. government by inflating costs of the Patriot missile system as well as other products and services22. In exchange for dropping criminal charges, the company settled the cases with a payout of over $1 billion.

Due to the vast volume of controversies that have dogged both companies over the decades, there is no objective means by which either company could be considered as model engineering enterprises. However, while the rest of the U.S. equity universe might be subject to uncertainty over inflation, tariffs throttling trade between the U.S. and its biggest trading partner – the European Union – and other economic headwinds, we believe that both Boeing and Raytheon are likely to continue to make inroads in expanding its military-facing revenue globally on account of geopolitical concerns.

With Raytheon (or RTX) expected to announce its earnings on the 22nd of July and Boeing doing the same on the 29th of July, we expect that many investors who aren’t currently holding these stocks in their portfolio to take note of the potential for revenue upticks from military spending as a positive relative to other companies likely to be affected by tariffs or consumption drawdowns and consider them for inclusion.

Footnotes:

1“How Israel used Iran’s massive attacks to enhance its top ballistic missile shield”, Business Insider, as of June 26, 2025

2“Israel’s War on Iran Is Costing Hundreds of Millions of Dollars a Day”, Wall Street Journal, as of June 19, 2025

3“Israel Running Low on Arrow Interceptor Missiles Used to Defend Against Iranian Attacks, WSJ Reports”, Haaretz, as of June 18, 2025

4“US Missile Defenses Heavily Depleted in Shielding Israel: report”, Newsweek, as of June 27, 2025

5“United States Spending on Israel’s Military Operations and Related U.S. Operations in the Region, October 7, 2023 – September 30, 2024”, Brown University, as of October 7, 2024

6“U.S. Security Cooperation with Israel”, U.S. Department of State Fact Sheet, as of April 25, 2025

7“Profits of War: Top Beneficiaries of Pentagon Spending, 2020 – 2024”, Brown University, as of July 8, 2025

8“What We Do: Iron Dome System and SkyHunter Missile”, Raytheon

9“What We Do: David's Sling System and SkyCeptor Missile”, Raytheon

10“Raytheon, Tawazun sign term sheet to bring Coyote counter-UAS production to UAE”, Breaking Defense, as of April 23, 2025

11“Drone and missile attacks on the UAE shows its strengths more than vulnerabilities, security analysts say”, CNBC, as of February 23, 2025

12“Defense Ministry signs $5.2 billion deal to buy 25 advanced F-15IA fighter jets”, Times of Israel, as of November 7, 2024

13“Boeing Accelerates Delivery of Up to 1,800 GPS-Guidance Bomb Kits to Israel”, Bloomberg News, as of October 19, 2023

14“Israel says Arrow-3 missile-killer sale to Germany approved by U.S.”, Reuters, as of August 17, 2023

15“Fact Sheet: President Donald J. Trump Secures Historic $600 Billion Investment Commitment in Saudi Arabia”, U.S. White House, as of May 13, 2025

16“Congress passes Trump’s reconciliation megabill with $150B for defense”, Breaking Defense, as of July 3, 2025

17“MQ-28 Ghost Bat Is Of “Strong Interest” To The U.S. Navy”, The War Zone, as of April 15, 2025

18“Navy Establishing Two MQ-25 Squadrons For Detachments, Plans To Refuel Test E-2”, Defense Daily, as of August 2, 2021

19“Israel – Munitions Guidance Kits and Munitions Support”, U.S. Defense Security Cooperation Agency, as of June 30, 2025

20“A look at Boeing’s recent troubles after Air India crash”, AP News, as of June 13, 2025

21“RTX jet engine problem ripples across global aerospace industry”, Reuters, as of September 13, 2023

22“RTX subsidiary Raytheon to pay more than $950 million to settle foreign bribery, export control fraud probes”, CNBC, as of October 16, 2024