Demand For Copper is Projected to Rise

Over the next few decades, copper demand is expected to increase significantly as a result of several factors. These include:

The global energy transition – Copper is essential for clean energy technologies such as wind turbines, solar panels, and electric vehicles (EVs).

Technological advancements – The metal is used in computers, laptops, smartphones, data centers, and other areas of technology, so increased digitalization and connectivity is likely to increase demand.

Growth in developing countries – Developing countries such as China and India will increasingly strive to achieve the same high standard of living as developed countries, likely leading to a greater need for copper.

Global economic growth – As the global economy continues to grow in the decades ahead, and demand for electrical wiring and construction materials rises, demand for copper should grow too.

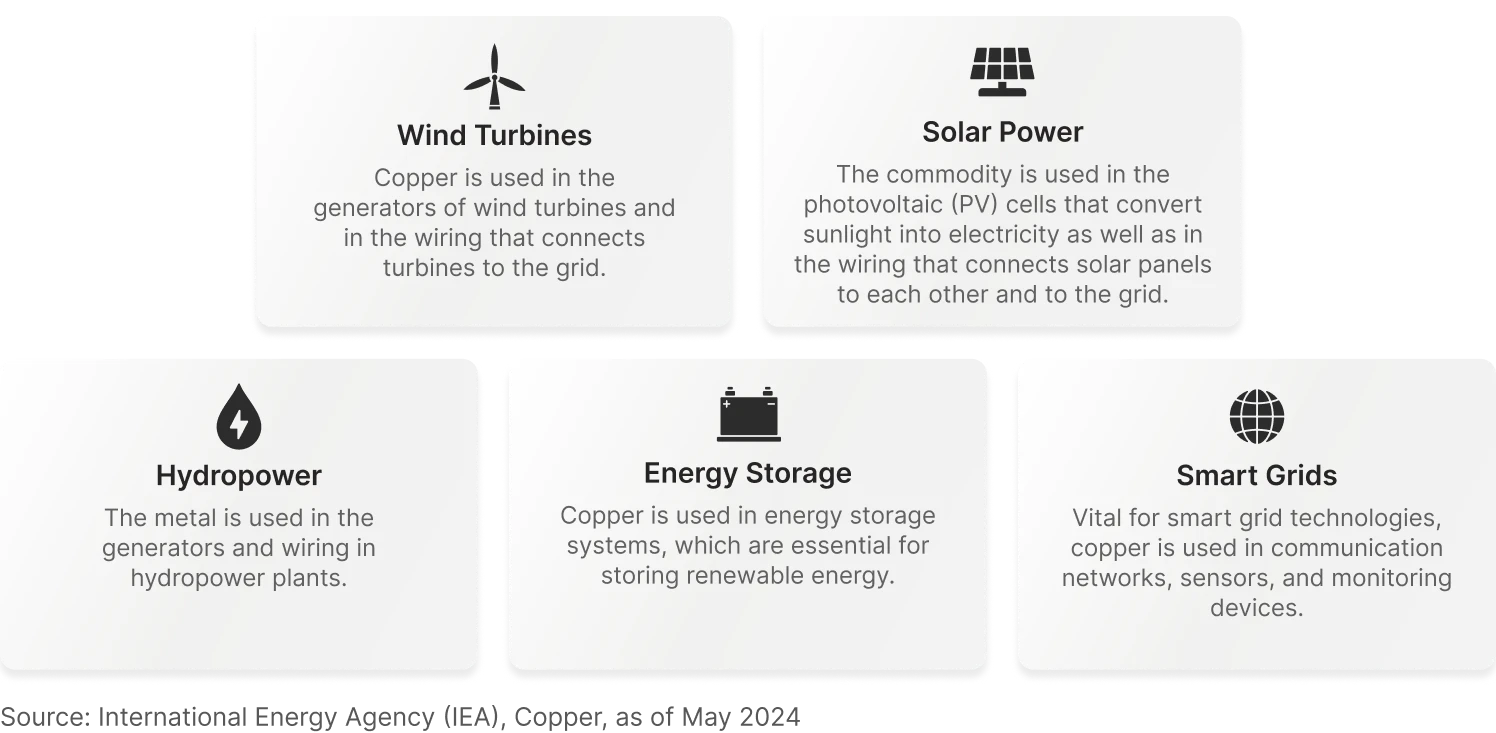

Copper’s Role in Renewable Energy

Copper is likely going to play a major role in the transition to clean energy. Thanks to its strong conductivity, copper can transmit electricity with minimal loss. So, it can help maximize the efficiency of renewable energy systems. It is also a durable and corrosion-resistant commodity. Therefore, it is well suited to the harsh environments that renewable energy systems are often exposed to. Additionally, copper is 100% recyclable, which means that it can be reused over and over again. This is important for creating a sustainable energy system.

How Copper is Used in the Renewable Energy Ecosystem

As countries and businesses invest more in renewable energy technologies, demand for copper is likely to rise. According to the International Energy Agency (IEA), the transition to renewable energy is projected to drive an additional 10,000 kt of global copper demand between 2023 and 2040, spurring higher demand for copper mine production to bridge the supply gap.

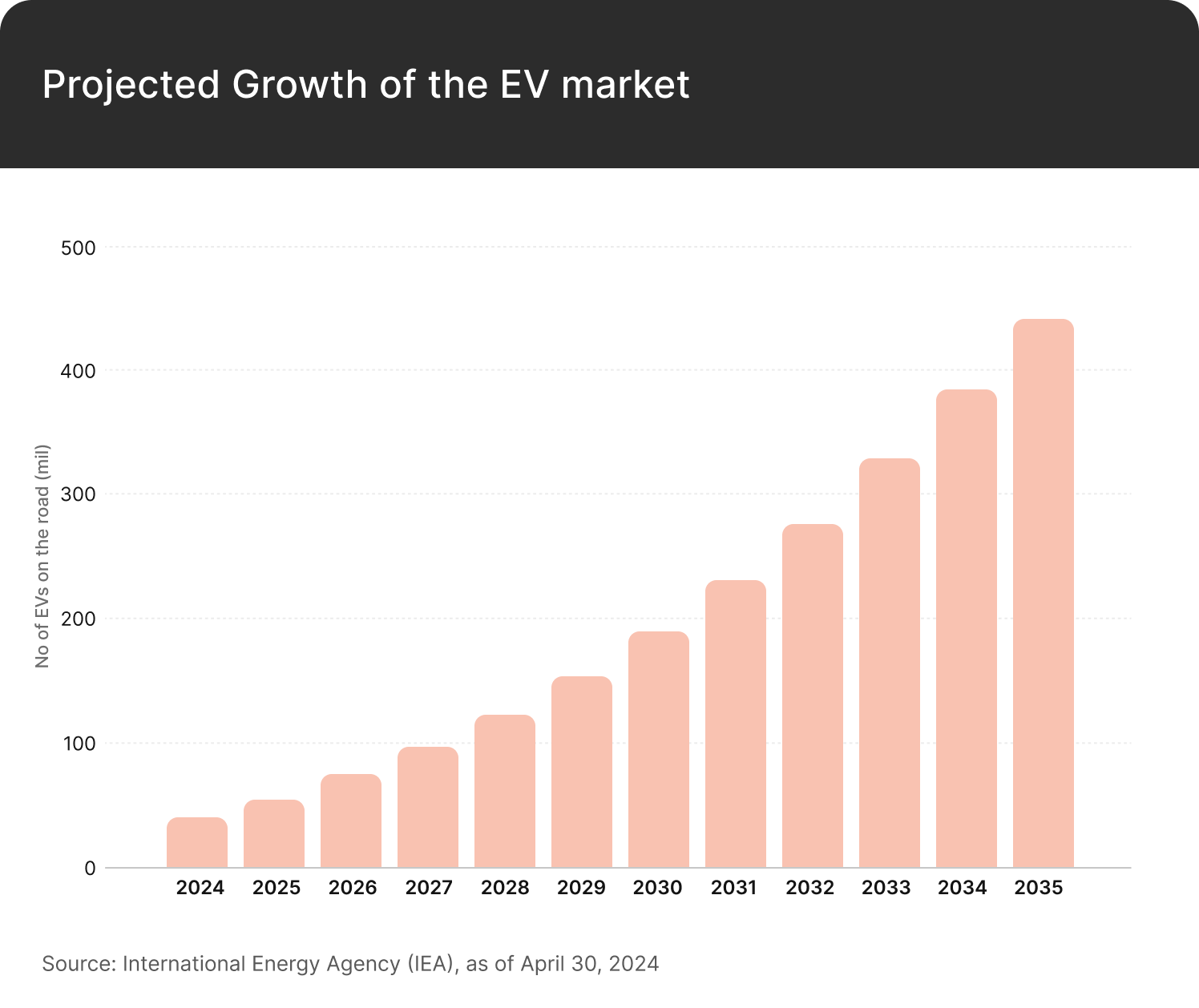

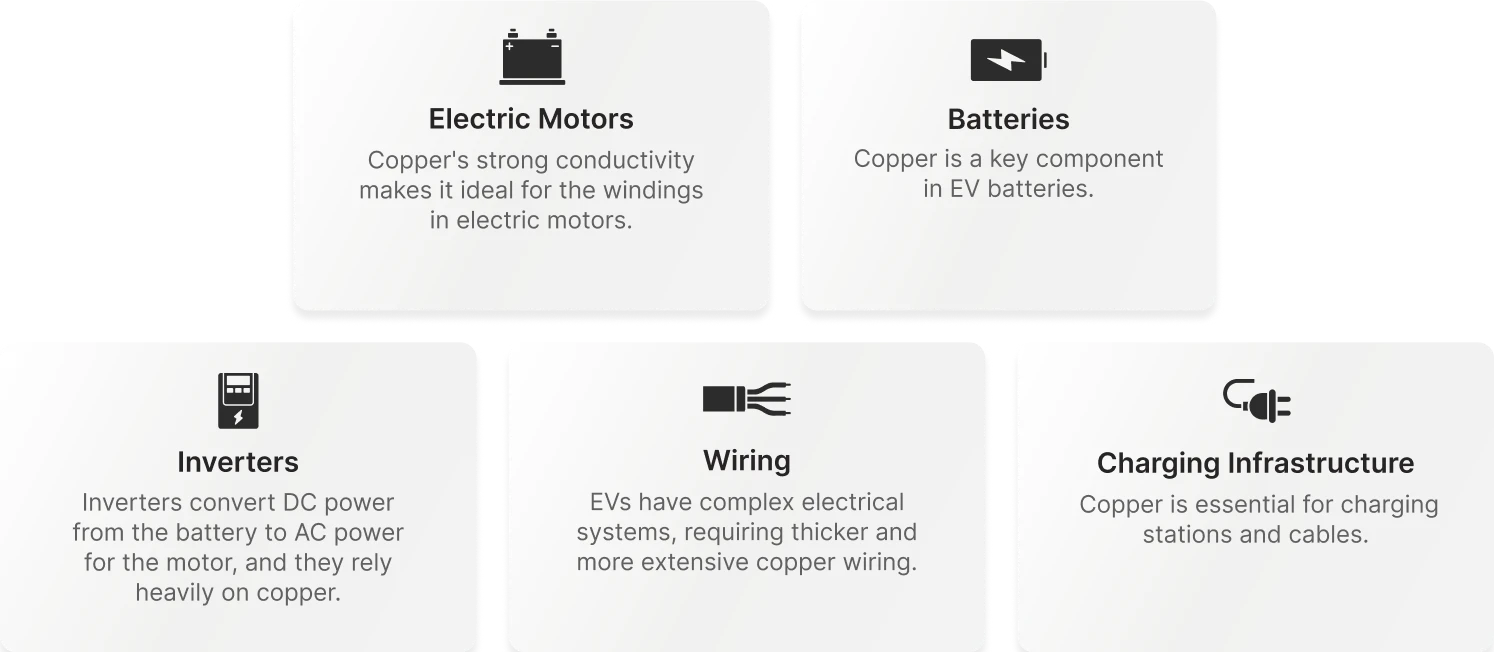

Copper’s Role in the Electric Vehicle Boom

Copper is also going to be crucial for the EV revolution. Whereas a traditional car uses around 20-25 kg of copper, an EV uses about 80-85 kg1. As more people switch to electric vehicles in the years ahead, demand for copper is likely to increase substantially. According to the International Energy Forum (IEF), many new copper mines will be needed to meet demand from EVs.

How Copper is Used in EVs

Copper’s Role in the Tech Revolution

In the years ahead, the rise of artificial intelligence (AI) is likely to lead to a significant increase in the number of data centers across the world. This is likely to increase the demand for copper. Packed with computers, servers, and cabling, data centers require substantial amounts of copper for their construction and operation. These facilities are also energy-intensive meaning that copper will be required for the generation and delivery of power. According to BHP2, the amount of copper used in data centers globally is set to grow six-fold by 2050. So, this area of technology could be a major demand driver. 5G networks could also be a material demand driver for the metal. Compared to 4G networks, 5G networks require a much higher density of base stations. And every base station requires copper for wiring, grounding, and components. Additionally, IoT and robotics devices running on 5G networks are likely to require significant levels of copper.

Who are the Biggest Consumers of Copper?

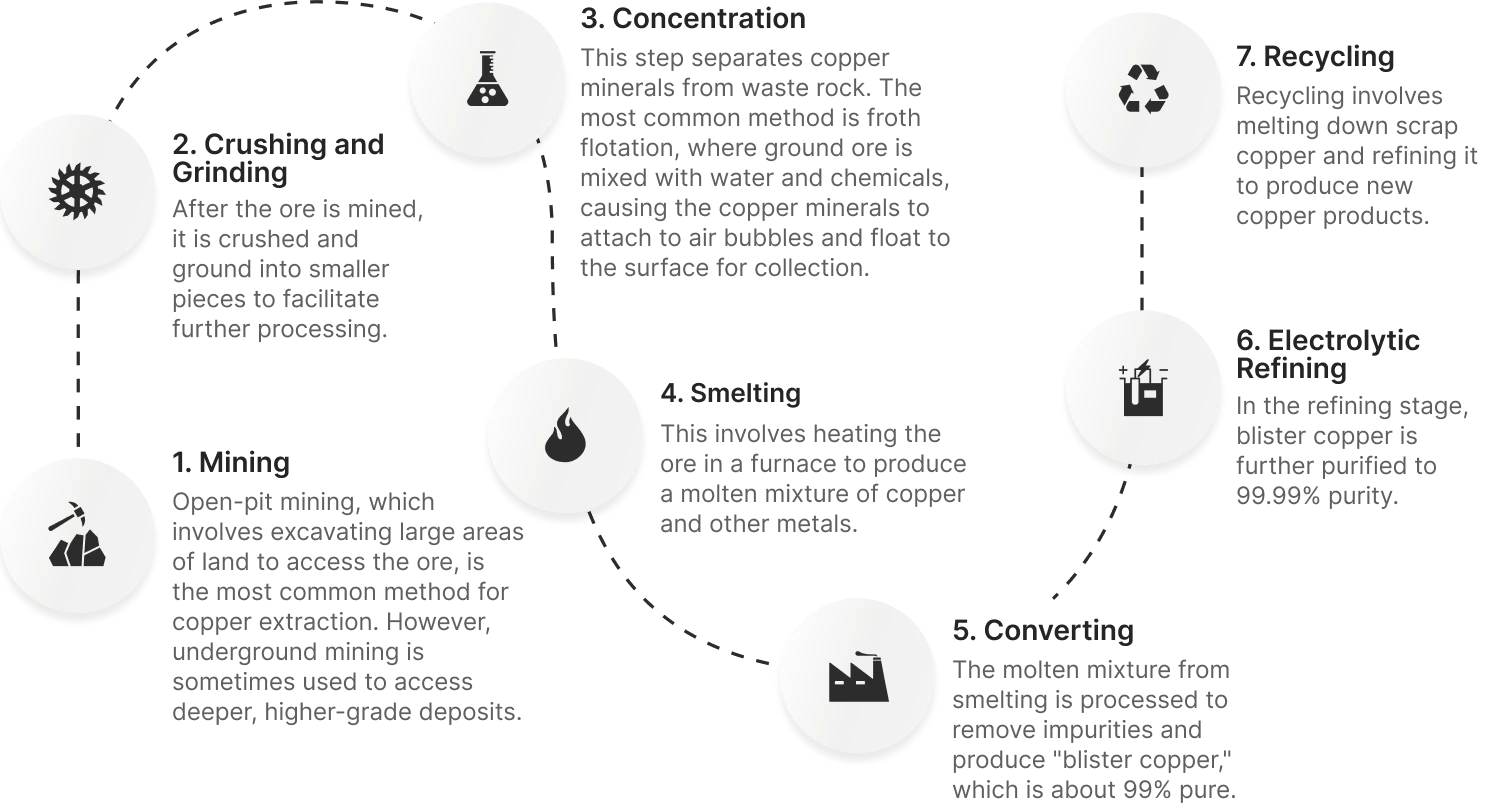

How is Copper Produced?

Copper production is a multi-stage process that involves extracting copper from ore and refining it into a pure metal. Here’s a breakdown of the main steps:

Potential Advantages of Investing in Copper Miners

Investing in copper miners offers several potential advantages over investing directly in copper. These include:

Operational Leverage – Copper miners can increase their profitability by expanding production and/or improving operational efficiency. For investors, this can potentially lead to returns that exceed the simple price appreciation of copper.

Company Growth – Miners can grow by making strategic acquisitions, developing new mines, and discovering new deposits. This growth potential is not present when investing directly in commodities.

Exploration Upside – If a miner discovers a new large-scale copper deposit, its valuation has the potential to increase significantly.

Dividend Payments – Many copper mining companies pay dividends, which may boost overall returns for investors.

Ease of Investing – Investing in mining stocks is typically easier than investing directly in copper and dealing with the complexities of storing and insuring a physical commodity or trading futures contracts.

The Themes Copper Miners ETF

Investors seeking portfolio exposure to copper miners may wish to take a look at the Themes Copper Miners ETF (COPA) This seeks to track the BITA Global Copper Mining Select Index (BGCMSI), which identifies companies that derive their revenues from copper mining, exploration, refining, and royalties.

Footnotes:

1Metelec, The power of copper in electric vehicles, as of February 16, 2024

2BHP Insights: how copper will shape our future, as of September 30, 2024