Considering small caps? If so, say hello to my little friend, SMCF.

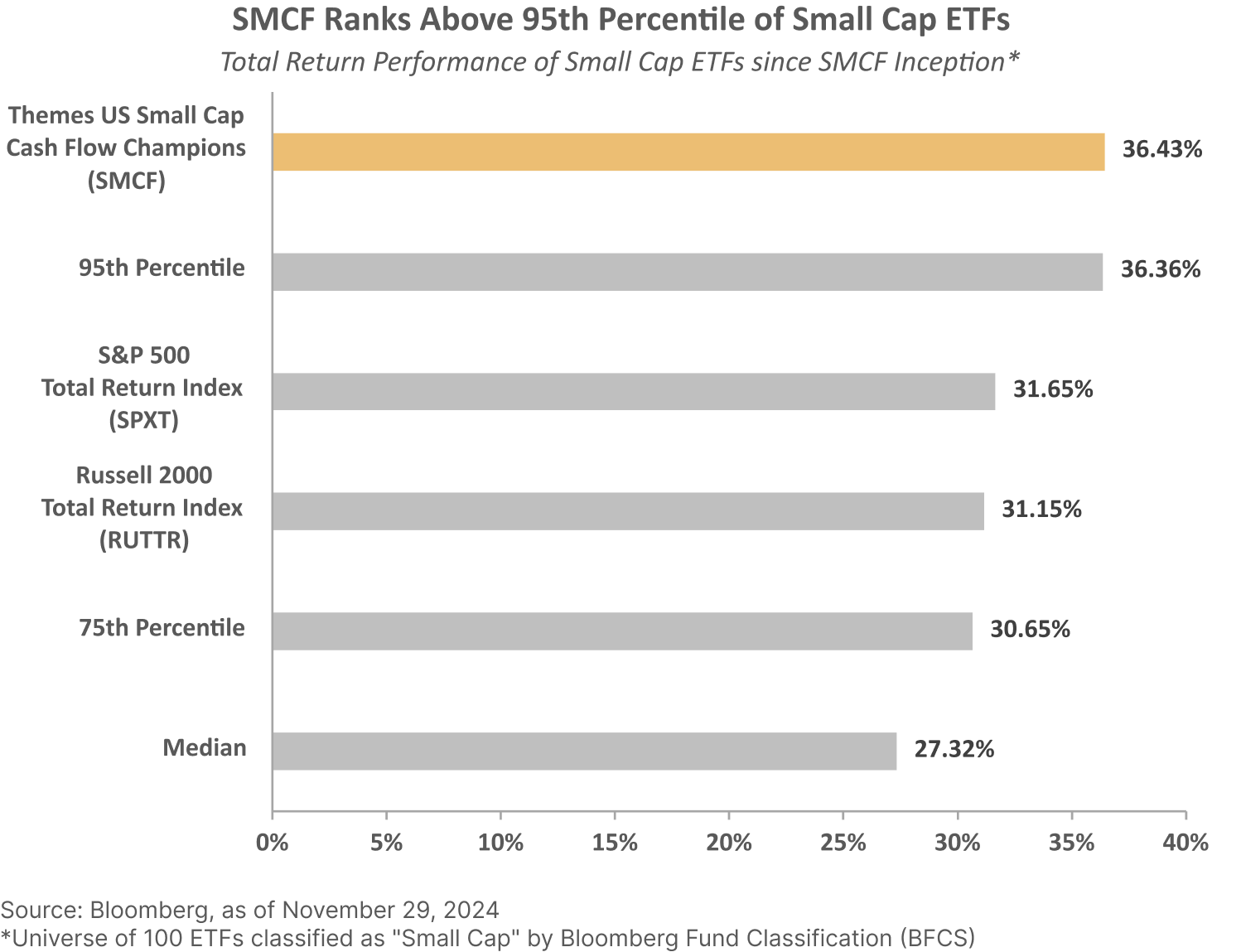

Since inception, the Themes US Small Cap Cash Flow Champions ETF (SMCF) has delivered a +36.43% return, outperforming both the S&P 500 (+31.65%) and the Russell 2000 (+31.15%), placing it above the 95th percentile of all 100 ETFs classified as “small cap” by Bloomberg Fund Classification (BFCS).1

What Makes SMCF Different?

Top 75 small cap companies with the highest 3 years of positive cash flow yield.

Unlike other cash flow strategies, it also includes exposure to Financials.

Expense ratio is over 30% lower than the average charged by small cap ETFs.

Put these factors together, SMCF has delivered one of the best total returns amongst small cap ETFs since its inception.1 In a market environment where quality matters, SMCF may be a small cap solution worth considering.

1Source: Bloomberg as of 29 November 2024. Universe of 100 ETFs classified as “Small Cap” by Bloomberg Fund Classification (BFCS). The inception date of SMCF is 13 December 2023. All ETF performance is shown on an ETF price total return basis, net of all fees. Index performance is shown on a post-inception, total return basis (i.e., with gross income reinvested, where applicable). Cumulative return is the aggregate amount that an investment has gained or lost over time. Annualized return is the average return gained or lost by an investment each year over a given time period.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. High short- term performance, when observed, is unusual and investors should not expect such performance to be repeated. Investors cannot invest directly in an index. Indices may change over time. Indices are not an investment and, therefore, have no investment performance history. Index performance does not include risks, fees, or other costs. Past index performance is no indication of future results for the index or for any investment.

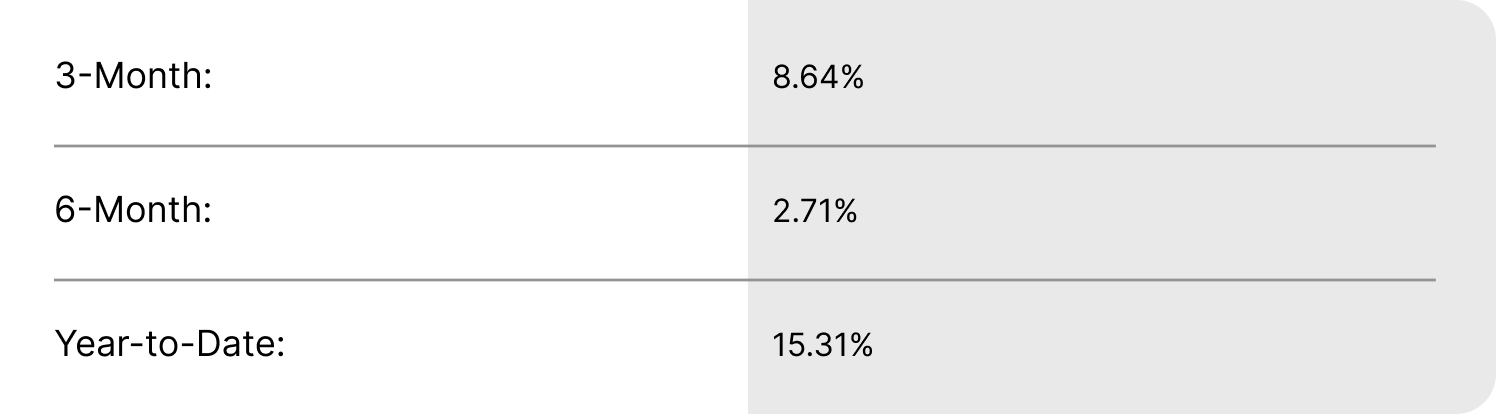

Standardized Performance of SMCF as of 30 September 2024: