Silver is back in focus, and not just as the quieter cousin of gold.

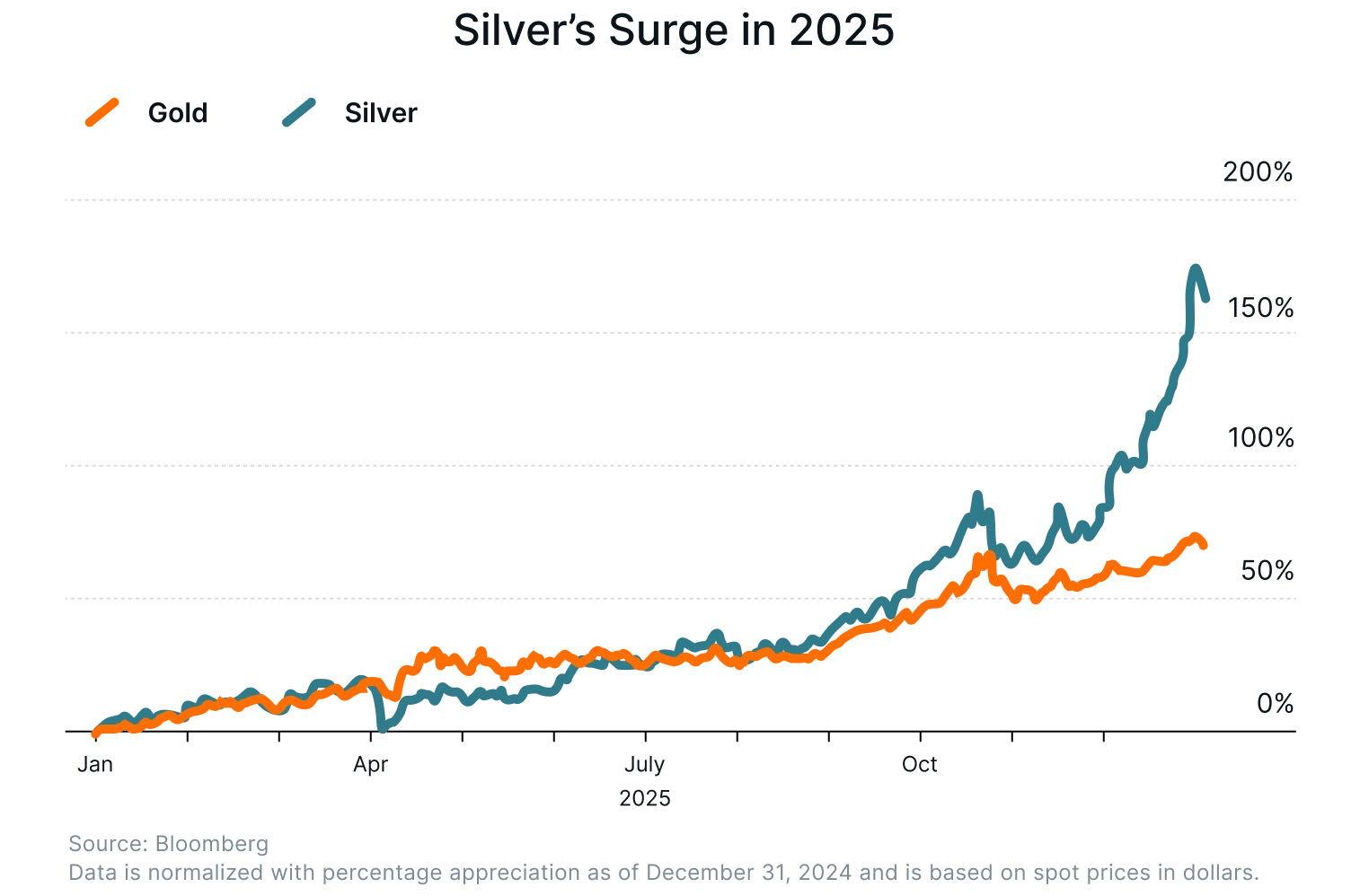

In 2025, the metal surged 150%, beating gold’s 68% gain in a remarkable year for precious metals as investors responded to inflation risks, shifting interest-rate expectations, and rising geopolitical uncertainty.1

In 2026, that momentum has carried forward, with silver remaining firmly in the spotlight as structural demand, tight supply conditions, and sustained investor interest continue to support its long-term investment case.

But silver’s appeal today goes beyond macro fear. It is being pulled higher by forces that are reshaping the global economy - from technological expansion to the worldwide push towards clean energy.

These trends are not short-term cycles but long-running shifts that are changing how energy is produced, how technology is built, and how resources are consumed. As a result, silver is increasingly viewed not only as a defensive asset, but as a way to participate in the next phase of global economic transformation.

The Themes Silver Miners ETF (AGMI) is built to capture this opportunity.

By providing diversified exposure to companies engaged in silver mining and production, AGMI allows investors to participate in the long-term structural trends shaping the silver market through a single, liquid investment vehicle.

Key Takeaways

Silver has evolved into a hybrid asset, driven by both industrial growth and macro-financial forces, making it relevant in expansionary and defensive market environments.

Structural demand from energy transition, technology, and electrification is rising faster than supply, creating persistent market deficits and higher price sensitivity.

Silver-focused ETFs offer a simple way to access this opportunity by combining physical scarcity, industrial growth, and investor demand into a single investment theme.

#1 Silver Is More Than Just a Precious Metal - It’s Dual-Purpose

Silver’s investment profile is shaped by its dual role as both a precious metal and a critical industrial input.

Global silver demand typically totals around 1.1–1.2 billion ounces per year, and roughly 50% of this comes from industrial uses.2 This is structurally different from gold, where less than 10% of demand is industrial, with the majority going into jewellery and investment.3

In its industrial role, silver is widely used in electronics, solar panels, automotive systems, medical devices, and advanced manufacturing, tying a large share of its demand directly to global growth, infrastructure spending, and technological investment.

As these sectors expand, silver increasingly behaves like a growth-linked metal, strengthening during periods of rising manufacturing activity and capital expenditure.

At the same time, silver continues to display characteristics of a monetary and defensive asset.

Academic research shows that silver prices often move in the same direction as gold and are highly correlated with a one-year rolling correlation coefficient ranging from 0.68 to 0.95.4 This reflects investor demand for tangible assets when confidence in currencies or financial markets weakens.

Because silver’s market is smaller and less liquid than gold’s, it tends to be more volatile. Historical data show that silver is typically 2-3 times as volatile as gold, meaning it can deliver larger gains in favourable conditions but also sharper drawdowns.5

For investors, this creates a distinctive profile. Silver cannot be viewed purely as a safe-haven hedge like gold, nor purely as a cyclical commodity like copper. It sits between the two, responding to both macro-financial forces and real-economy demand, which gives it a unique diversification role within a broader portfolio.

#2 Industrial Demand Is Rising Alongside Structural Megatrends

Silver’s industrial relevance has expanded sharply over the past decade, driven by structural shifts in energy, transport, and digital infrastructure rather than short-term economic cycles. Its role is becoming increasingly central to three major transitions shaping the global economy: decarbonisation, electrification, and digitalisation.

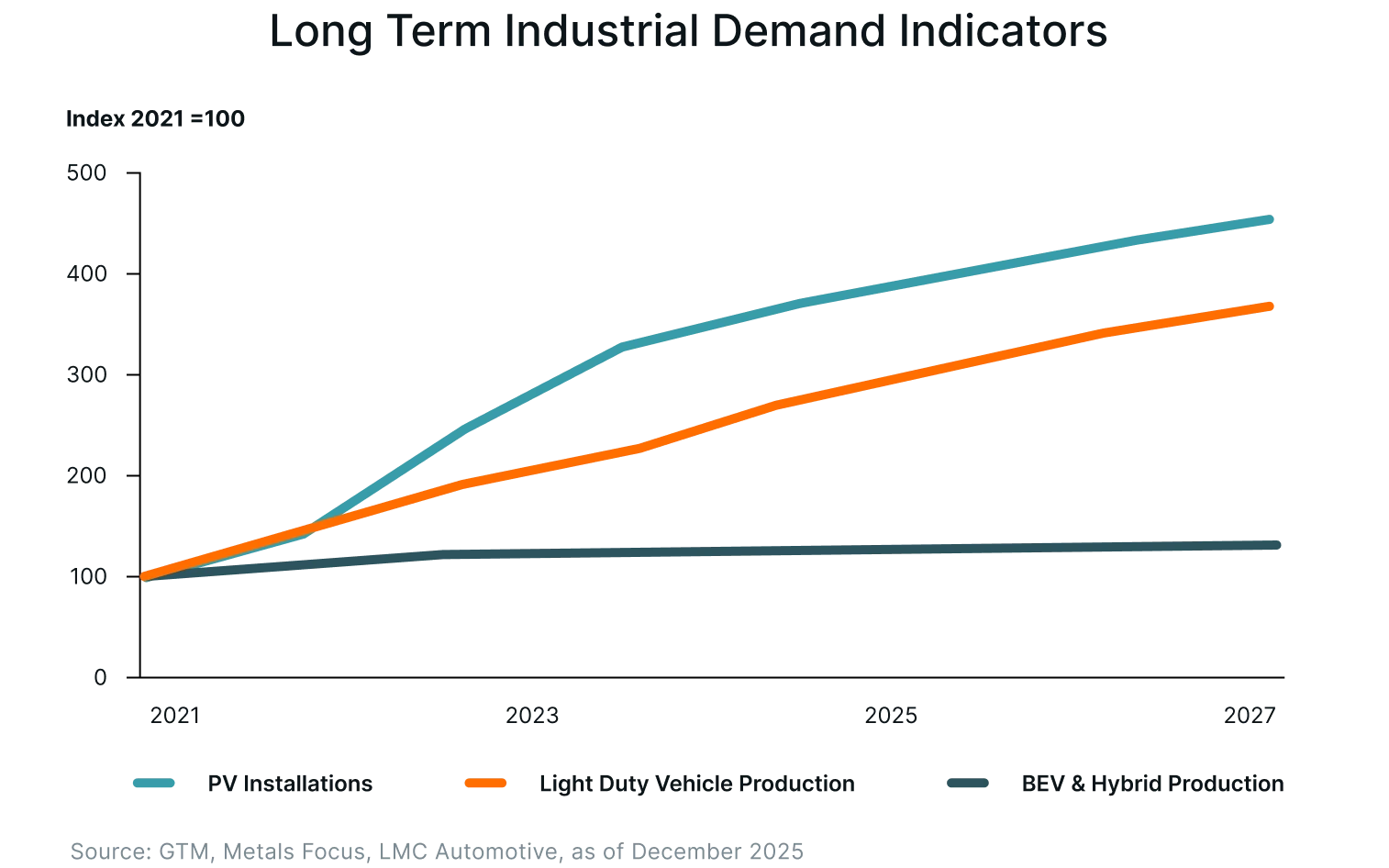

In renewable energy, solar power has been a key driver.

Global photovoltaic capacity has grown more than tenfold over the last decade, led by China, Europe, and the United States. Over the same period, silver demand from solar applications has risen roughly threefold. Today, photovoltaics account for close to 30% of total industrial silver demand, up from around 11% in 2014.6 Even though manufacturers have reduced the amount of silver used per solar cell, rapid growth in installations and the shift toward next-generation cell technologies, which require more silver, have kept overall demand high.

Electrification of transport is another major force. Battery electric vehicles use significantly more silver than internal combustion engine vehicles because of their heavier reliance on electronics, power management systems, and charging infrastructure.

Electric vehicles typically contain 67–79% more silver per vehicle, and global EV production is expected to grow at double-digit rates over the rest of the decade, making EVs a dominant source of future automotive silver demand.6

Digitalisation is the third pillar. Data-centre capacity has expanded more than fifty-fold since 2000, driven by cloud computing and artificial intelligence.6 These systems rely heavily on silver in semiconductors, connectors, cooling systems, and power infrastructure.

Together, these trends show that silver demand is increasingly anchored in long-duration megatrends, making its industrial role both broader and structurally embedded in the future economy.

#3 Silver Offers Investment Benefits Similar to Precious Metals

Like gold, silver exhibits safe-haven characteristics.

During periods of high inflation, currency depreciation, financial crises, or geopolitical stress, investors tend to seek assets that are not directly tied to government-issued money. In such environments, silver often moves in the same direction as gold, benefiting from demand for tangible, scarce assets.

Historical market data show that when real interest rates fall or inflation expectations rise, silver prices frequently strengthen alongside gold, reflecting similar macro drivers.7

Another important feature is diversification.

Silver’s correlation with equities and bonds has historically been low or even negative at certain times, particularly during market stress. This means that when traditional assets struggle, silver can sometimes hold its value or even rise, helping to reduce overall portfolio volatility.

Studies of multi-asset portfolios show that small allocations to precious metals, including silver, can improve risk-adjusted returns during turbulent periods.8

Affordability is a further advantage, especially for retail investors. On a per-ounce basis, silver is far cheaper than gold, making it easier for smaller investors to build meaningful exposure.

While gold may require large capital outlays for even a few ounces, silver allows gradual accumulation with relatively modest sums. This accessibility makes silver a practical entry point for investors seeking exposure to precious metals without committing significant capital upfront.

#4 Financial Products Have Made Silver More Accessible

The rise of modern financial products has fundamentally changed how investors participate in the silver market.

Historically, investing in silver meant buying physical bars or coins, arranging secure storage, paying insurance costs, and dealing with liquidity constraints when selling. The development of exchange-traded funds has removed many of these frictions.

Silver ETFs allow investors to gain exposure to silver prices through a simple stock-market transaction, without the operational burdens of physical ownership. These funds typically hold physical silver in secure vaults or track silver prices closely, offering daily liquidity, transparent pricing, and regulatory oversight similar to equities.

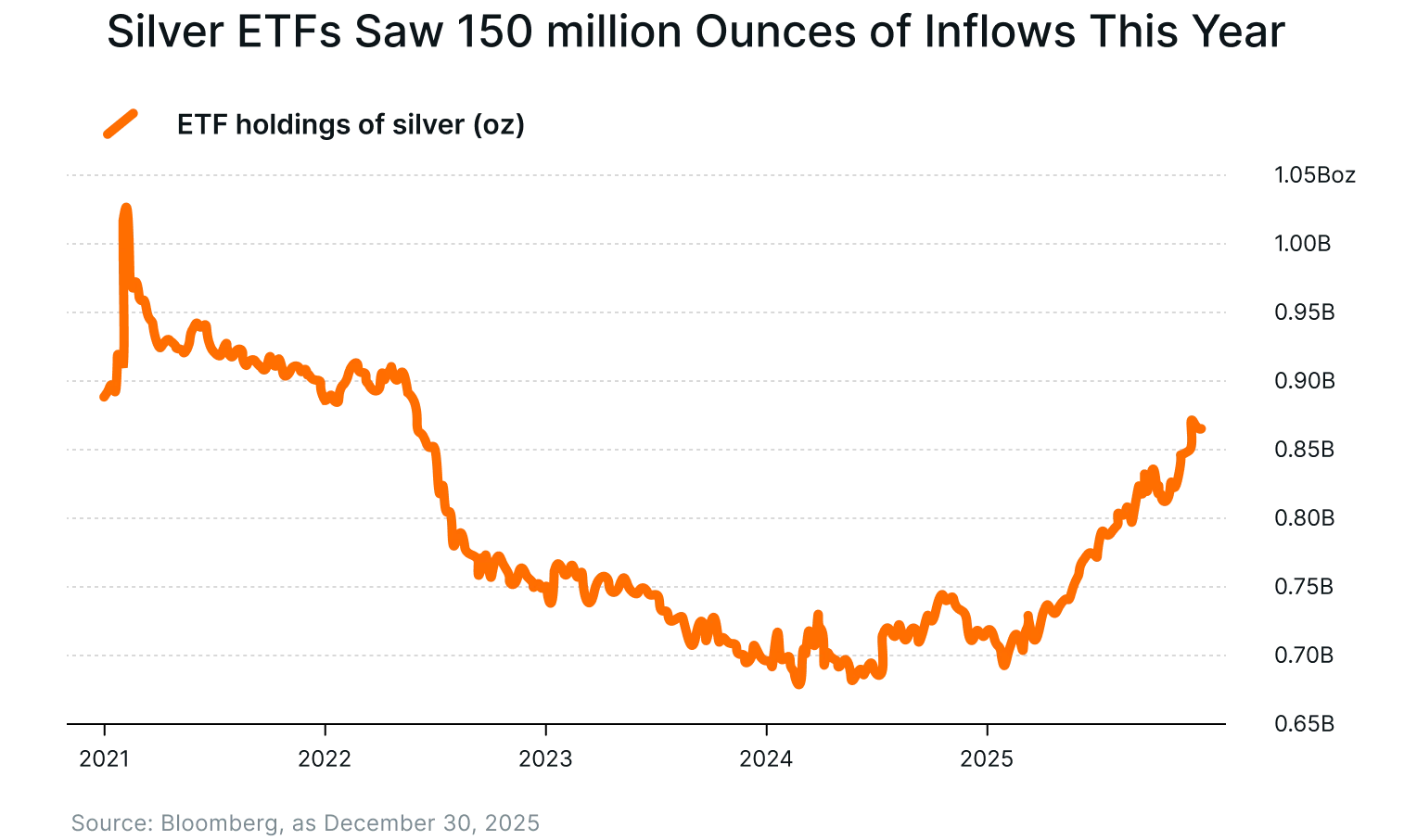

In 2025, silver ETFs recorded some of their strongest annual inflows in years, coinciding with silver prices reaching multi-year and record highs. Holdings in physical-backed silver exchange-traded funds have surged this year, rising by more than 150 million ounces.9

While total holdings remain below the peak reached during the Reddit-driven retail investment surge in 2021, the inflows have been large enough to materially affect market dynamics.

According to Bloomberg calculations, ETF holdings have increased in every month but one this year, and these inflows have helped erode available supplies in an already tight physical market.

This ease of participation is especially important for retail investors. Instead of navigating futures contracts, margin requirements, or the logistics of physical bullion, investors can buy and sell silver exposure through their regular brokerage accounts.

ETFs also allow silver to be easily integrated into diversified portfolios alongside equities, bonds, and other assets. By lowering barriers to entry and improving liquidity, financial products have transformed silver from a specialist asset into one that can be accessed, traded, and managed as easily as a stock.

#5 Macro Conditions Continue to Favour Precious Metals

Silver’s recent performance has been shaped not only by supportive macro conditions, such as expectations of lower real interest rates, currency volatility, and geopolitical uncertainty but also by a persistent imbalance between supply and demand.

According to industry data, the global silver market has been in deficit for multiple consecutive years. In 2024, total demand reached about 1.16 billion ounces, while supply lagged, producing a deficit of roughly 150 million ounces.2

Projections for 2025 point to another large shortfall, in the range of 117 - 149 million ounces, reflecting strong industrial use and investment demand alongside constrained mine output.2

Supply remains structurally tight because around 70% of silver production is a by-product of mining copper, lead, and zinc.10 This means higher silver prices do not automatically trigger higher silver supply unless production of those base metals also rises. As a result, supply is relatively inelastic, making prices more sensitive to demand shocks.

Physical market tightness has become increasingly visible. Declining inventories in major trading hubs and periodic stress in the London spot market has made premiums widen as the available metal becomes harder to source.11 This tightness has been amplified by policy and trade dynamics.

Silver’s inclusion on the U.S. critical minerals list has supported prices by underscoring its strategic importance. At the same time, concerns that silver could face new tariffs prompted a wave of metal being shipped to the U.S. earlier this year.11 These flows drained availability elsewhere and contributed to tight liquidity in the London spot market.

Together, persistent structural deficits, low supply elasticity, and shifting trade and policy dynamics have reinforced the supply-side squeeze. When this tight supply meets rising industrial demand and strong investor interest, silver becomes increasingly sensitive to both macroeconomic shifts and physical market constraints.

How to Play It

The Themes Silver Miners ETF (AGMI) seeks to track the STOXX Global Silver Miners Index (STXSILVV), which identifies companies that derive their revenues from silver mining.

AGMI seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the STXSILVV Index.

Conclusion

Silver’s relevance today is being shaped by forces that reach far beyond traditional precious-metal cycles. Its growing role in clean energy, electrification, and digital infrastructure is changing how the market values it, while persistent supply constraints are adding structural tension beneath prices. What once moved mainly on macro fear is now increasingly influenced by how the real economy is being rebuilt.

For investors, this changes the framing. Silver is no longer just a hedge for uncertain times, nor simply a cyclical industrial input. It has become a material tied to long-term transformation, with demand anchored in technology and energy systems that are still expanding. Exposure to silver now means participating in how global growth is evolving, while retaining the defensive qualities that have defined it for centuries.

For more information about the fund, including fees/expenses, holdings, standardized performance, risks and more, please visit https://themesetfs.com/etfs/agmi.

Footnotes:

1Interactive Brokers, Platinum Up 130%, Silver Up 150% in 2025’s Historic Rally, as of January 7, 2026

2The Silver Institute, World Silver Survey, as of April 2025

3World Gold Council, Gold Demand Trends: Q3 2025, as of October 30, 2025

4CME Group, Four Major Drivers of the Gold- Silver Price Ratio, of June 23, 2025

5Morgan Stanley, Gold vs Silver: 4 Key Differences You Should Know, as of 2025

6The Silver Institute, Silver, The Next Generation Metal, as of December 2025

7Discovery Alert, Fed QE Triggers Gold Silver Rally in 2025, as of December 12, 2025

8The role of precious metals in portfolio diversification during the Covid19 pandemic: A wavelet-based quantile approach, as of December 28, 2021

9Bloomberg, Here’s What to Watch for Silver’s Next Move After Wild Ride Past $80, as December 30, 2025

10SFA Oxford, Silver, Critical Minerals and The Energy Transition

11Reuters, Perfect storm of factors propels silver to record high above $65/oz, as of December 17, 2025

*Specific investments described herein do not represent all investment decisions made by Themes ETFs. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

Article by Ayesha Shetty

Author is a contractor of Leverage Shares LLC, a U.S. affiliate of Themes Management Company LLC. Leverage Shares LLC provides certain services to Themes under an intercompany services agreement.