Copper is quietly becoming one of the most important metals of the modern economy.

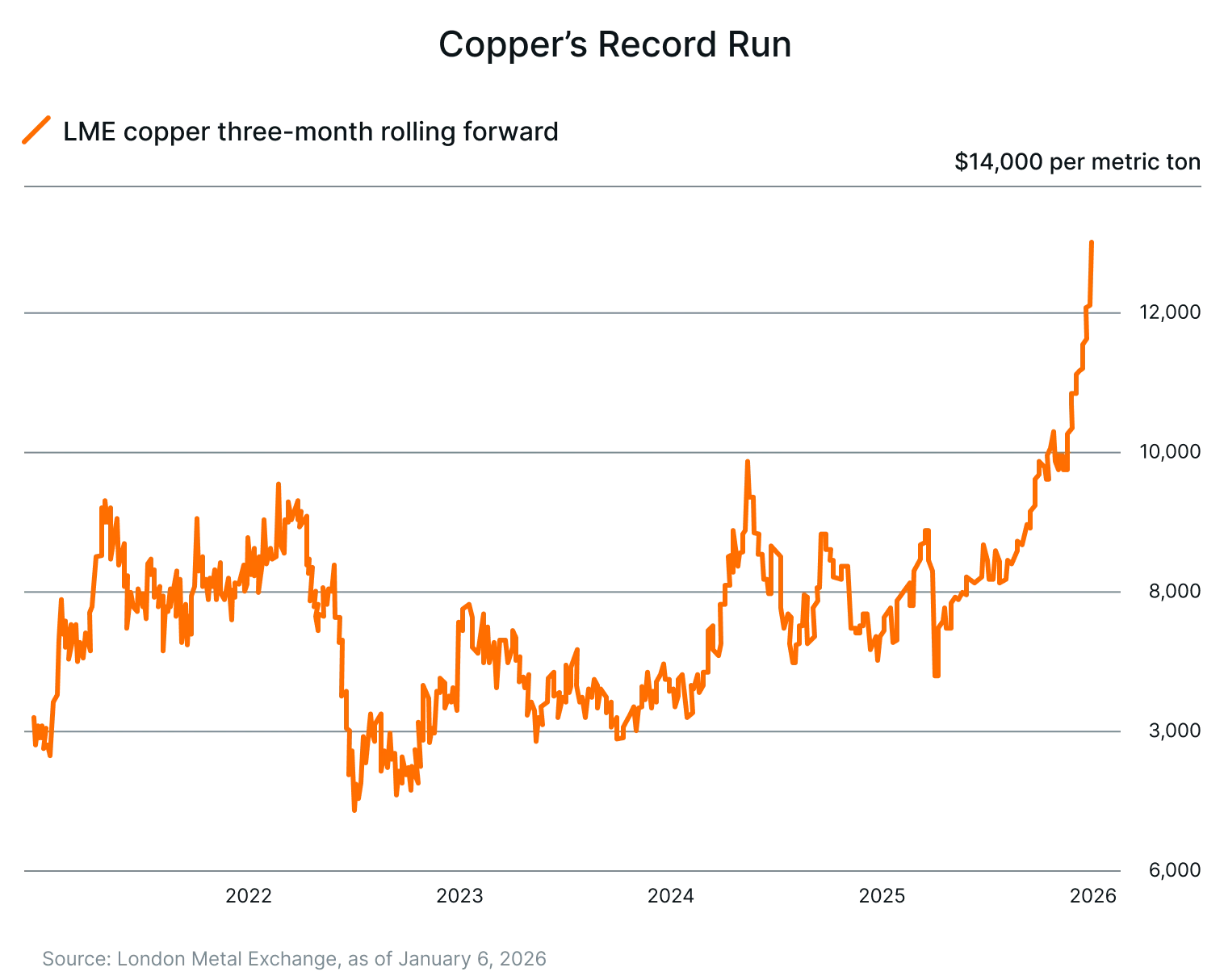

Long regarded as a cyclical industrial input, the metal has recently broken through record levels above US$14,000 per metric ton, a move that reflects far more than a short-term price spike¹. It underscores how central copper has become to the systems that power growth today.

From electrified transport and resilient power grids to data centers and defense infrastructure, copper sits at the foundation of the global economy’s physical expansion. Demand is increasingly driven by long-duration capital investment rather than transient economic cycles, while supply remains constrained by geology, long development timelines, and rising complexity.

For investors, this creates a compelling case to look beyond copper prices alone and toward companies positioned to benefit from this shift.

We believe the Themes Copper Miners ETF (COPA) is built to capture this opportunity.

By attempting to provide diversified exposure to companies engaged in copper mining, exploration, refining, and royalties, COPA may allow investors to participate in the long-term structural trends shaping the global copper market through a single, liquid investment vehicle.

Key Takeaways

Copper has evolved into a strategic real asset, underpinned by electrification, digital infrastructure, and capital-intensive investment cycles, making it relevant across both growth-led and policy-driven market environments.

Structural demand is continuing to grow alongside electrification, AI-driven infrastructure, and grid expansion, while supply growth remains constrained by long lead times, declining ore grades, and concentrated production.

#1 Electrification Is Driving Greater Use of Copper

Copper sits at the core of electrification. Every system that generates, stores, transmits, or consumes electricity depends heavily on copper because of its unmatched combination of conductivity, durability, and recyclability.

As the global economy shifts toward electric mobility, renewable energy, and digital infrastructure, copper demand is being structurally re-rated.

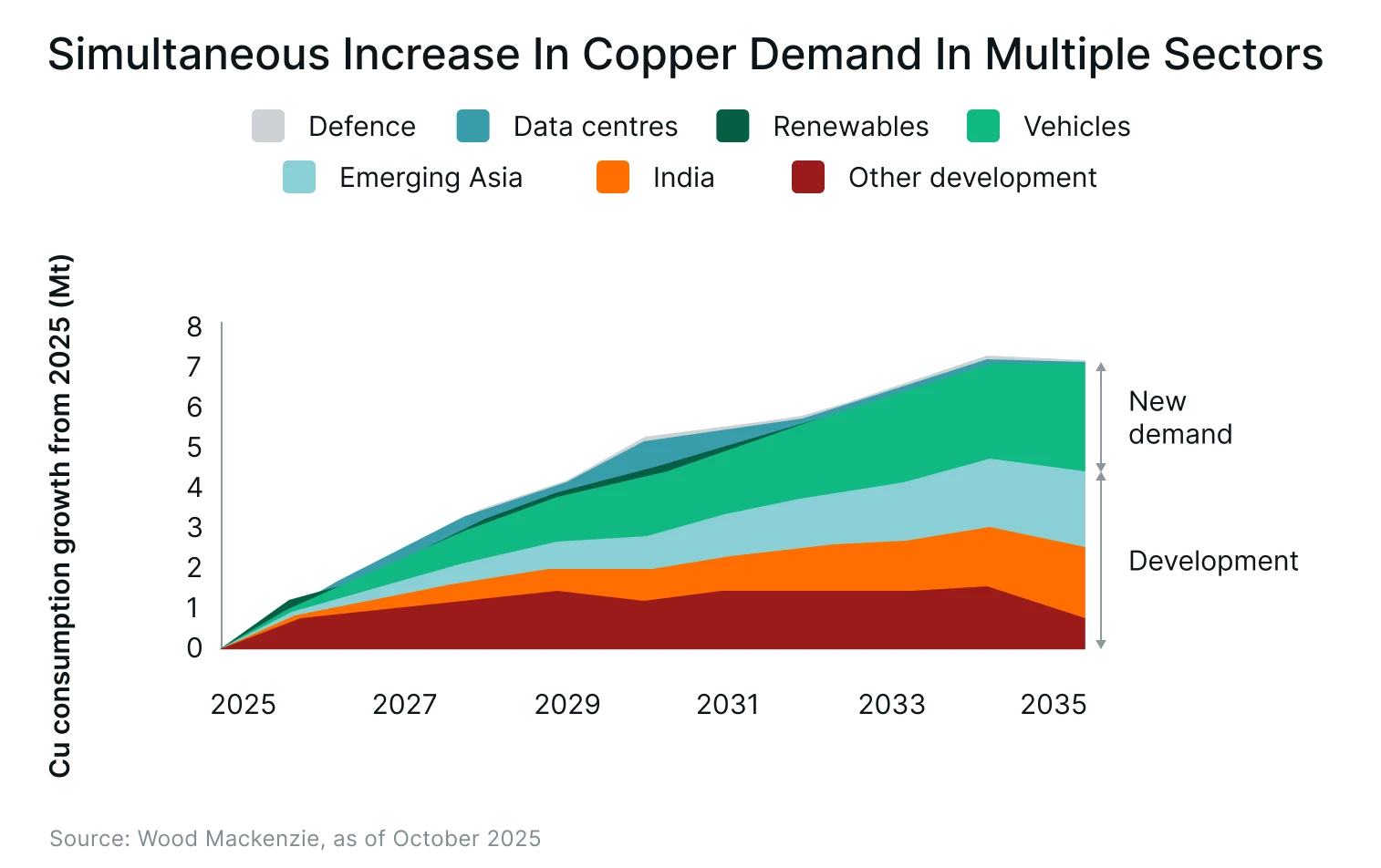

According to S&P Global Energy and Market Intelligence, global copper demand is projected to reach about 42 million metric tons by 2040, up from roughly 28 million tons today, implying nearly 50% growth driven largely by electrification across power grids, electric vehicles, renewable energy, data centres, and defence systems. Energy-transition uses alone (electric vehicles, renewable generation, grid expansion, and battery storage) are expected to add more than 7 million tons of incremental copper demand by 2040.2

Electric vehicles are a particularly powerful driver. EVs require more than three times as much copper as internal combustion vehicles because of their motors, batteries, inverters, wiring harnesses, and charging infrastructure.3 With global EV penetration expected to roughly double from about 22% in 2025 to around 44% by 2035 under base-case scenarios, we believe, copper demand from transport alone is set to grow materially.4

Power grids are another major vector. Renewable energy is more copper-intensive than fossil-fuel systems because it requires dense transmission and distribution networks to connect dispersed wind and solar capacity. Around 2 million tons per year of additional copper supply will be required over the next decade just to support renewable power expansion and grid upgrades.4

As electrification expands simultaneously across transport, energy, buildings, and industry, copper is becoming less of a cyclical metal and more of a foundational economic input. This suggests copper demand may become more closely tied to long-term growth trends, rather than reliant on short-term industrial cycles.

#2 Data Centres and Artificial Intelligence Are Creating a New Demand Layer

An increasingly important driver of copper demand is the rapid expansion of digital infrastructure, particularly data centres and artificial intelligence. AI systems require vast amounts of computing power, which in turn necessitate dense and highly reliable electrical infrastructure - power cables, transformers, cooling systems, servers, and backup power - all of which are copper-intensive.

Estimates suggest that AI-driven data centres will consume an additional 2,200 terawatt-hours of electricity by 2035, lifting copper demand for grid and power infrastructure tied to data centres alone to around 1.1 million tons per year by 2030.4 We believe this demand is structurally resilient.

Copper typically represents less than 0.5% of total data-centre project costs, meaning developers are largely insensitive to copper prices.4 As a result, demand tends to be relatively inelastic and can rise sharply when capacity build-outs accelerate.

The intensity of copper use is also increasing. AI-focused data centres can require up to four times as much copper as traditional facilities because of higher power density, more complex cooling systems, and greater redundancy requirements.3 As hyperscale operators race to expand capacity for cloud computing, large language models, and enterprise AI, copper demand is becoming increasingly linked to digital transformation rather than conventional construction cycles.

S&P Global projects that copper demand from AI and data centres will triple by 2040, as installed data-centre capacity rises to around 550 gigawatts, more than five times 2022 levels.2 Alongside defence systems and electrification, digital infrastructure is now one of the fastest-growing sources of copper demand.

For investors, this may represent a structurally new demand layer, one driven by technology investment rather than commodity pricing or traditional economic cycles, reinforcing copper’s role as a core input into the digital economy.

#3 Why Copper Supply Is Struggling to Keep Pace

While copper demand is accelerating across electrification, artificial intelligence, and defence systems, supply is increasingly unable to keep pace.

Global copper supply is expected to fall nearly 10 million metric tons short of demand by 2040, equivalent to roughly 24% of projected demand, even after recycled copper supply more than doubles to around 10 million metric tons.2

Over the same period, total demand is projected to rise by about 50%, reaching approximately 42 million metric tons, driven by expanding power grids, electric vehicles, data centres, renewable energy infrastructure, and defence applications.2

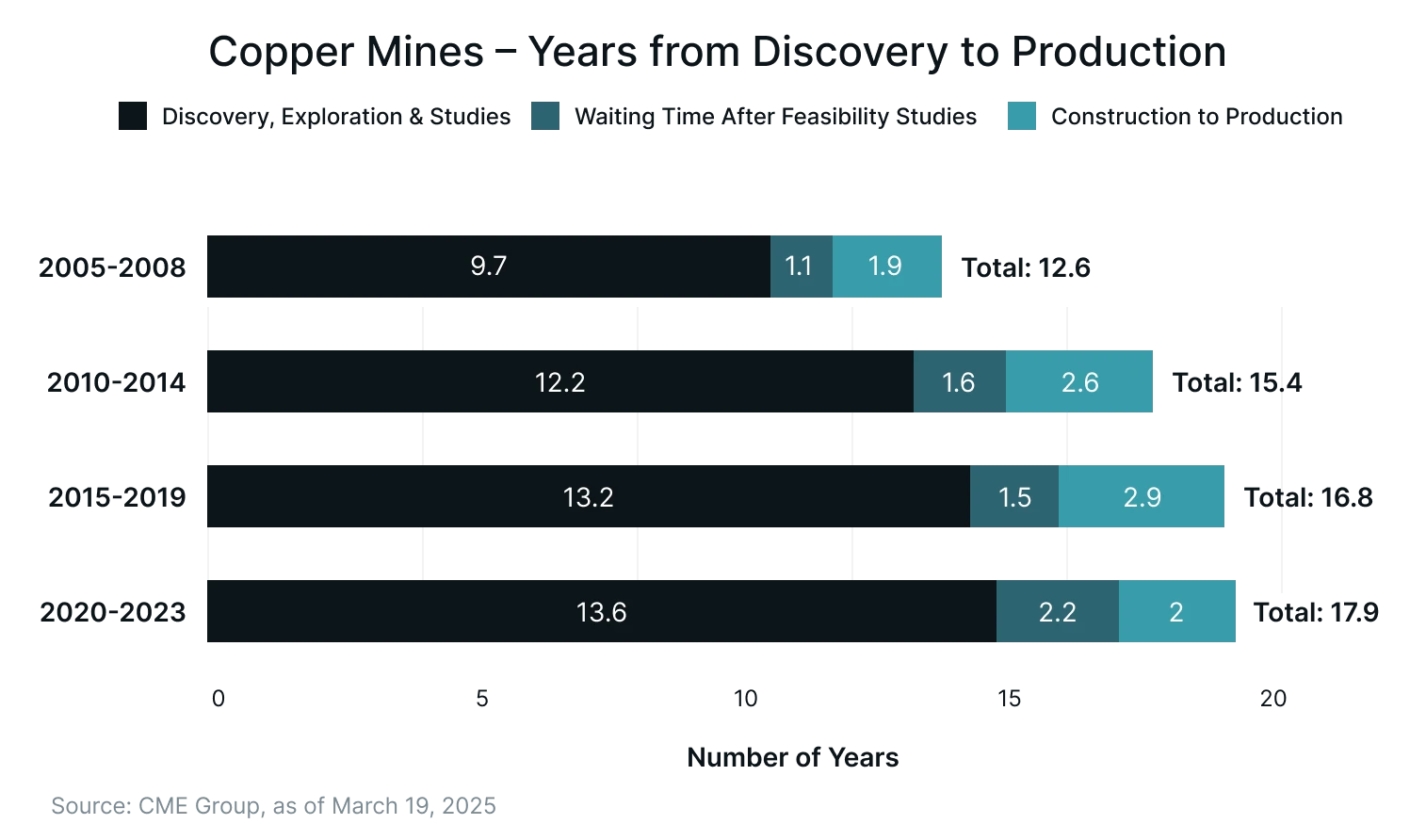

The scale of this imbalance reflects deep-rooted supply constraints. New copper projects are exceptionally slow to develop, with the average timeline from discovery to first production estimated at around 17 years.2

Geological challenges are compounding the problem as well. Copper ore grades have been declining steadily, meaning significantly more material must be mined and processed to produce the same amount of metal.3 At the same time, discovery rates have slowed sharply despite record exploration spending, eroding both the quality and quantity of new deposits and pushing up the cost base of future supply.

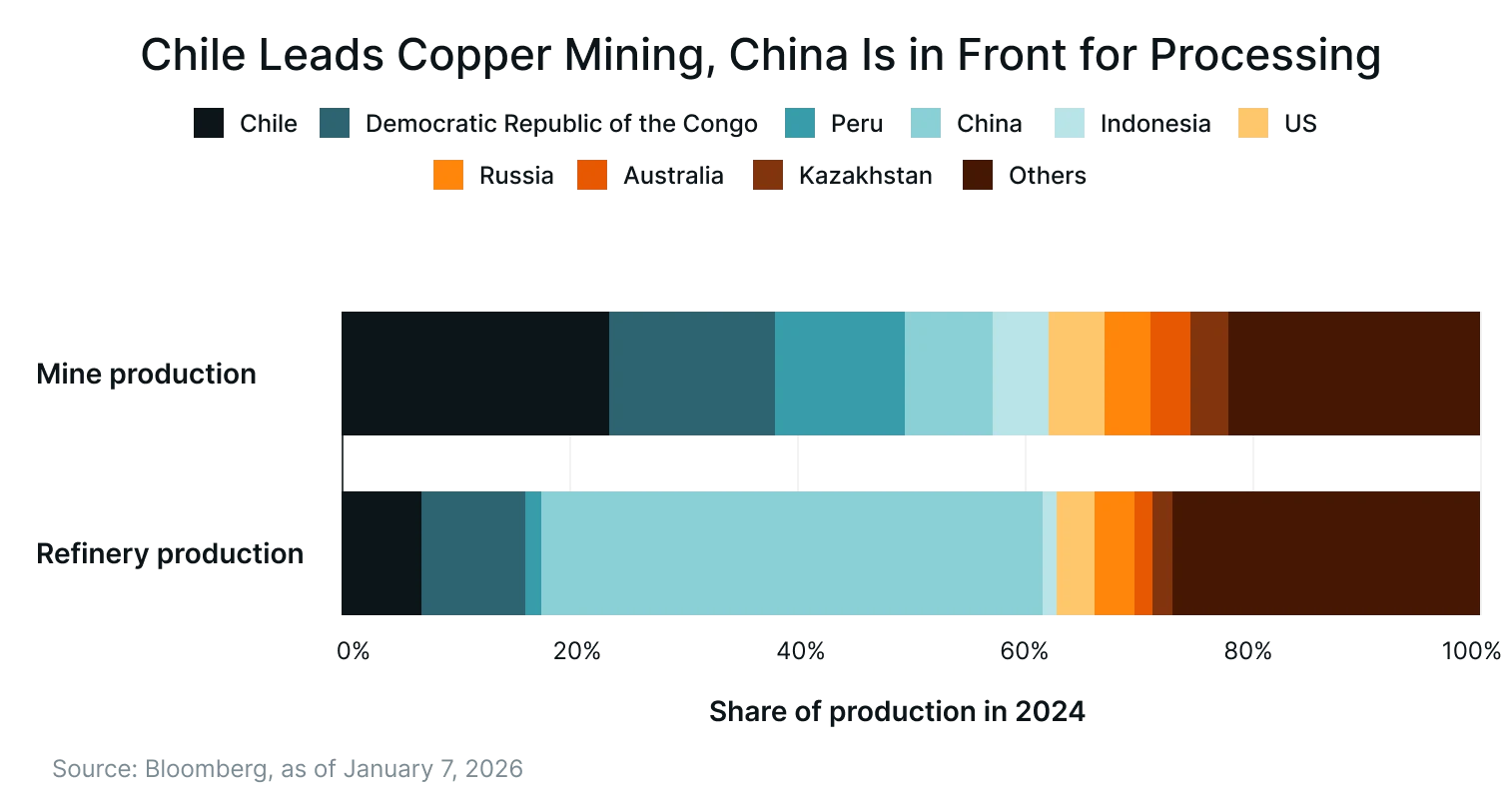

Supply concentration adds further fragility. Roughly half of global mined copper comes from just three countries - Chile, Peru, and the Democratic Republic of Congo, while China controls more than 40% of global refined copper production and about two-thirds of copper concentrate imports.3

This concentration heightens exposure to political instability, trade disputes, labour disruptions, and policy intervention, increasing the probability of supply shocks.

Meeting future demand would require an additional 10 million metric tons of primary copper supply by 2040, beyond gains from recycling. However, without a substantial increase in investment, global primary copper production could reach only around 22 million metric tons by 2040, roughly 1 million tons below current levels.2

For investors, these dynamics may point to a structurally tight market where supply responds slowly and imbalances are resolved primarily through price, reinforcing copper’s role as a strategically scarce asset in the global economy.

#4 Financial Access and Market Dynamics Have Improved

In addition to traditional futures and mining equities, investors now have access to copper-linked exchange-traded products (ETPs), mining-focused ETFs, and thematic commodity funds that track copper prices, miners, and broader base-metals baskets.

These products simplify participation in copper’s long-term story without the logistical, margin, or counterparty risks associated with futures trading.

Broad commodity ETF flows highlight rising investor interest in metals.

Data cited by Sprott Asset Management show that US-listed copper exchange-traded funds have recorded approximately US$ 1.2 billion in net inflows so far this year, already more than double the US$ 426 million seen over the entirety of 2025.5

This sharp acceleration in flows suggests that investors are increasingly using these vehicles not only for tactical exposure but also as part of longer-term allocations linked to evolving demand and supply dynamics.

This improved access, alongside copper’s changing demand and supply backdrop, offers an additional avenue for those seeking exposure to themes such as electrification, energy transition, and infrastructure investment.

#5 Copper’s Role in Portfolio Diversification Amid Macro Uncertainty

Copper may provide diversification benefits within a multi-asset portfolio, especially in the current macro environment marked by policy uncertainty, supply-chain fragility, and geopolitical risks.

In contrast to equities and bonds, copper’s performance is generally shaped more by physical market factors such as inventories, trade flows, and supply developments than by earnings growth or interest-rate expectations.

Recent market behaviour illustrates this clearly. Fears that the US could impose tariffs on refined copper products have led to stockpiling in the US, draining inventories elsewhere and tightening global availability.

Combined with mine disruptions stretching from Chile to Indonesia, these factors have pushed copper prices to new record highs above US$ 13,000 per metric ton on the London Metal Exchange, underscoring how copper can reprice rapidly in response to policy and supply shocks that are largely orthogonal to equity and bond markets.3

From a portfolio construction perspective, copper has historically exhibited low to moderate correlation with equities, typically in the 0.2–0.4 range over long periods,6 and near-zero or negative correlation with government bonds, particularly during inflationary or supply-driven episodes.7 This may support copper’s relevance during periods when traditional stock–bond diversification is less reliable, as has been observed in recent years.

In an environment where macro risks are increasingly shaped by trade policy, geopolitics, and physical constraints rather than purely monetary factors, copper can provide exposure to real-asset dynamics and may contribute to portfolio diversification.

How to Play It

The Themes Copper Miners ETF (COPA) seeks to track the BITA Global Copper Mining Select Index (BGCMSI), which identifies companies that derive their revenues from copper mining, explorations, refining, and royalties.

COPA seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the BGCMSI Index.

Conclusion

Copper is entering a phase where its importance is defined less by economic cycles and more by necessity. As economies invest in electrified transport, resilient power grids, and digital infrastructure, copper is becoming an essential input rather than a discretionary one.

At the same time, the difficulty of bringing new supply online means the market is operating with far less slack than in previous cycles, increasing sensitivity to both sustained investment and unexpected disruptions.

For investors, this reshapes copper’s role within a long-term strategy. Exposure today reflects participation in the physical build-out of the modern economy, backed by durable demand drivers and structurally tight supply.

With improving access through dedicated investment vehicles and potential diversification benefits in an uncertain macro landscape, we believe copper is no longer just a cyclical trade - it is a strategic asset positioned at the center of the next phase of global economic transformation.

For more information about the fund, including fees/expenses, holdings, standardized performance, risks and more, please visit https://themesetfs.com/etfs/copa.

Footnotes:

*Diversification does not eliminate risk. Investors cannot directly invest in an index.

1Reuters, Copper Lurches to Record High Above US$14,000 As Speculators Pile In, as of January 29, 2025

2S&P Global, Copper Supply Gap to Widen 24% by 2040 as Electrification Accelerates, as of January 8, 2026

3Bloomberg, The World Needs a Lot More Copper. But Will There Be Enough Supply, as of January 7, 2026

4Wood Mackenzie, High Wire Act: Is Soaring Copper Demand an Obstacle to Future Growth, as of October 2025

5Financial Times, Copper leads scorching metals rally amid global uncertainty, as of January 29, 2026

6CME Group, Copper: Major Factors That Offer Two Opposing Price Scenarios, as of March 19, 2025

7Erasmus School Of Economics, The Role of Commodities in Traditional Stock and Bond Portfolios: A Comparative Study, as of June 24, 2024

Article by Ayesha Shetty

Author is a contractor of Leverage Shares LLC, a U.S. affiliate of Themes Management Company LLC. Leverage Shares LLC provides certain services to Themes under an intercompany services agreement.