From Euphoria to Repricing

When Donald Trump returned to the White House on January 20, 2025, markets believed they understood the playbook. Investors anticipated deregulation, tax relief, and a reflationary impulse: a revival of the post-2016 “Trump bump” that once propelled US equities higher while tariff threats were largely dismissed as negotiating tools.

Instead, Trump’s first year back in office has rewritten that script entirely.

Rather than a straightforward pro-business reset, markets have been forced to grapple with a presidency defined by institutional disruption, aggressive trade policy, and a governing style that has expanded executive power at a pace investors struggled to digest. Federal agencies were hollowed out, funding was frozen, global trade relationships were upended, and trade policy moved from rhetorical threat to structural reality. The result has been a market regime characterised by persistent volatility, sharp sectoral divergence, and a fundamental reassessment of risk.

From the “Trump Bump” to Policy Reality

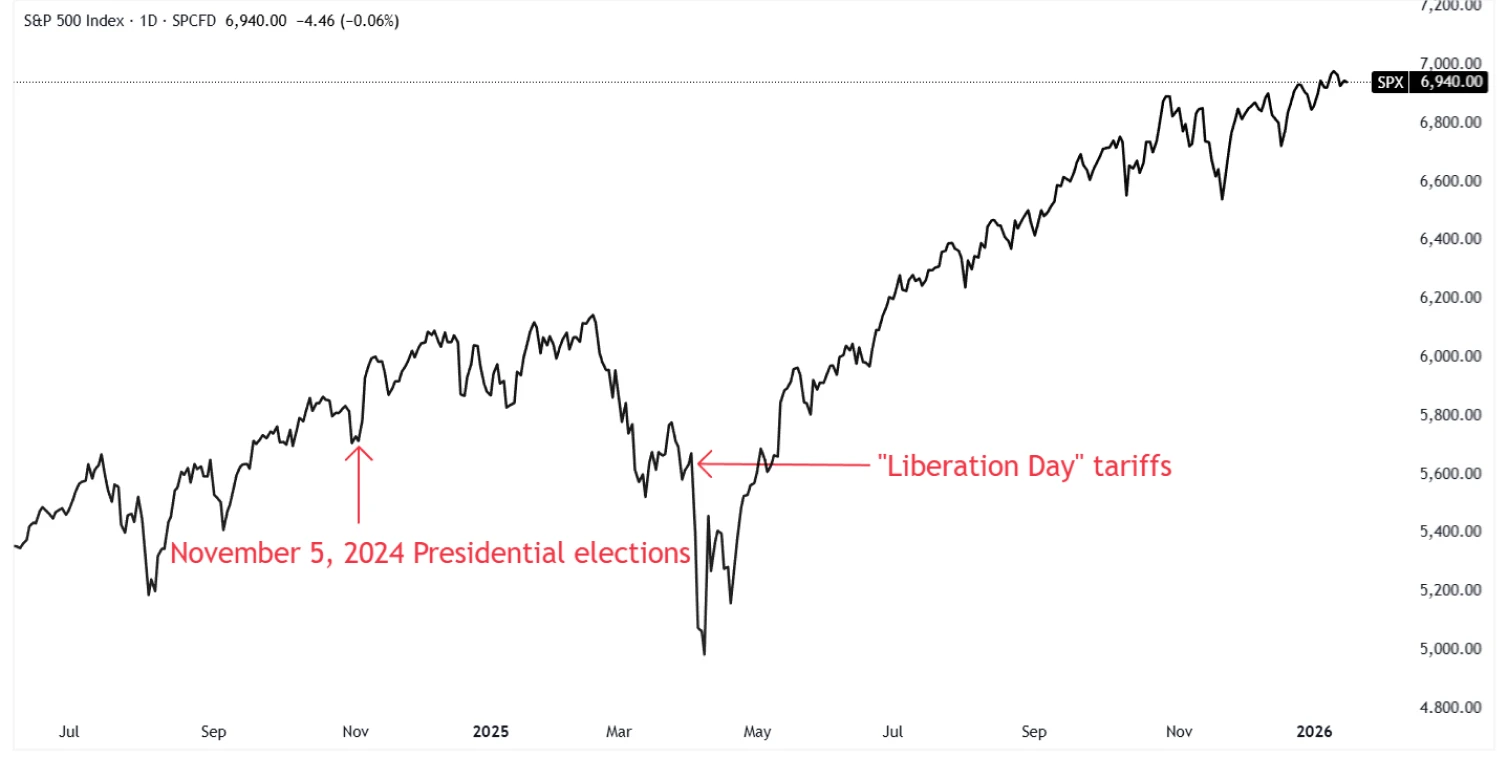

The initial reaction followed a familiar arc. Trump’s re-election in late 2024 sparked a relief rally as equities climbed on hopes that deregulation and tax cuts would once again outweigh trade risks. The S&P 500 rose roughly 6% from inauguration through February, reflecting confidence that tariffs would ultimately prove symbolic rather than substantive.

That assumption unravelled quickly. As 2025 progressed and tariffs moved decisively from talk to implementation, markets were forced to reprice not only higher input costs but a regime of sustained policy uncertainty. By April, the S&P 500 had erased all post-election gains and fallen more than 20% from its February peak, a sharp reminder of how quickly sentiment can turn when policy credibility replaces speculation.

Although equities bottomed on the 8th of April and staged a recovery, the character of the market had changed. The S&P 500 still finished 2025 up 17%, but leadership narrowed, volatility rose, and asset prices became increasingly sensitive to geopolitics, trade headlines, and macro signals rather than earnings momentum alone. What began as exuberance evolved into recalibration, a market still hopeful for pro-growth outcomes, but far less willing to ignore near-term economic costs.

Source: TradingView. S&P 500 daily price chart, as of 20 January, 2026

Tariffs: No Longer Tactical

A defining realisation of Trump’s first year back in office is that tariffs can no longer be treated as a cyclical bargaining tool. Even if individual country levels are renegotiated or softened, their persistence has embedded them into the structural fabric of the financial markets.

For investors, this has profound implications. Tariffs now directly affect long-term valuation through higher costs, weaker demand, elevated risk premia, and compressed multiples, particularly for globally integrated businesses. They also alter supply chains, capital allocation decisions, and competitiveness in ways that cannot be captured through one-off model adjustments.

Markets increasingly reward pricing power, geographic flexibility, and resilience over efficiency, while companies reliant on frictionless global trade face structurally higher uncertainty. In this environment, ignoring tariffs risks systematic overvaluation rather than short-term forecasting error.

Protectionism’s Unexpected Casualties

Ironically, some of the biggest losers from the 2025 tariff regime have been sectors many expected to benefit. Industrials, autos, consumer staples, and globally exposed manufacturers have struggled as tariffs raised input costs, invited retaliation, and weakened global demand.

Markets have also interpreted the tariff shock less as inflationary and more as a demand drag. Bond markets pricing in faster rate cuts reflect concerns that growth, not prices, will absorb the impact. That backdrop is particularly hostile for cyclical sectors dependent on capital expenditure, trade flows, and business confidence.

Protectionism, in practice, has proven far less protective than advertised, especially for companies built on scale, efficiency, and cross-border integration.

Winners in an Unsettled Market

Market leadership during Trump’s first year back has been selective and often counterintuitive. Defense stands out as a clear beneficiary, supported by heightened geopolitical tensions, pressure on NATO allies to boost military spending, and a more confrontational US foreign policy that has strengthened long-term earnings visibility for contractors.

Financials, particularly large US banks, have also fared well. Expectations of looser regulation combined with resilient earnings helped support valuations despite macro volatility.

Perhaps the most striking beneficiary has been gold. Trump’s chaotic second term has driven a powerful surge in demand for safe havens, supported by a weaker US dollar, sticky inflation, and heightened geopolitical risk. Gold prices have risen roughly 70% since his return, with gold miners delivering even more amplified gains.

Outside the US, European equities have quietly emerged as relative winners. Capital rotation away from US policy risk, attractive valuations, and increased fiscal spending on defense and infrastructure have driven outperformance versus US indices.

By contrast, several widely touted “Trump trades” have disappointed. Energy stocks have struggled amid supply concerns, while crypto assets, despite dramatic rallies, have delivered volatility rather than consistency. The lesson has been clear: markets reward earnings visibility and policy alignment, not slogans.

Policy Uncertainty as a Structural Headwind

Beyond tariffs themselves, uncertainty has become one of the most underappreciated macro drags of this cycle. Markets are not just pricing policy outcomes, but the unpredictability surrounding their scope, duration, and legal durability. That uncertainty has lifted equity risk premia, widened credit spreads, and increased volatility around every major policy announcement.

For corporates, the impact is tangible. Capital expenditure decisions increasingly prioritise resilience over efficiency, leading to delayed investment, duplicated supply chains, and higher long-term costs. Over time, this behaviour weighs on productivity and potential growth, making policy uncertainty economically restrictive even before the full effects of tariffs are realised.

Looking Ahead: A More Fragile Equilibrium

As markets look toward 2026 and beyond, the dominant risk is not a single shock but a prolonged period of macro tension. Tariff-driven cost pressures colliding with slowing global growth place central banks in a narrow corridor, complicating policy responses and increasing sensitivity to data surprises.

Perhaps the biggest market mispricing remains duration. Many investors continue to treat Trump’s trade policies as loud but temporary. This time, the evidence suggests something more enduring: a strategic use of trade policy to change supply chains and exert geopolitical leverage.

Until markets fully price that reality, sectors reliant on global efficiency remain vulnerable, while those aligned with domestic insulation, pricing power, and policy priorities are likely to command a lasting premium.

In Trump’s first year back in office, the S&P 500 has not collapsed, but it has been fundamentally repriced. And that, more than any headline rally or sell-off, may prove to be the most consequential change of all.

Author is a contractor of Leverage Shares LLC, a U.S. affiliate of Themes Management Company LLC. Leverage Shares LLC provides certain services to Themes under an intercompany services agreement.