Article by Edward Sheldon

High Cash Flow Stocks Rally Amid AI Volatility

February 10, 2026 | Research Insights

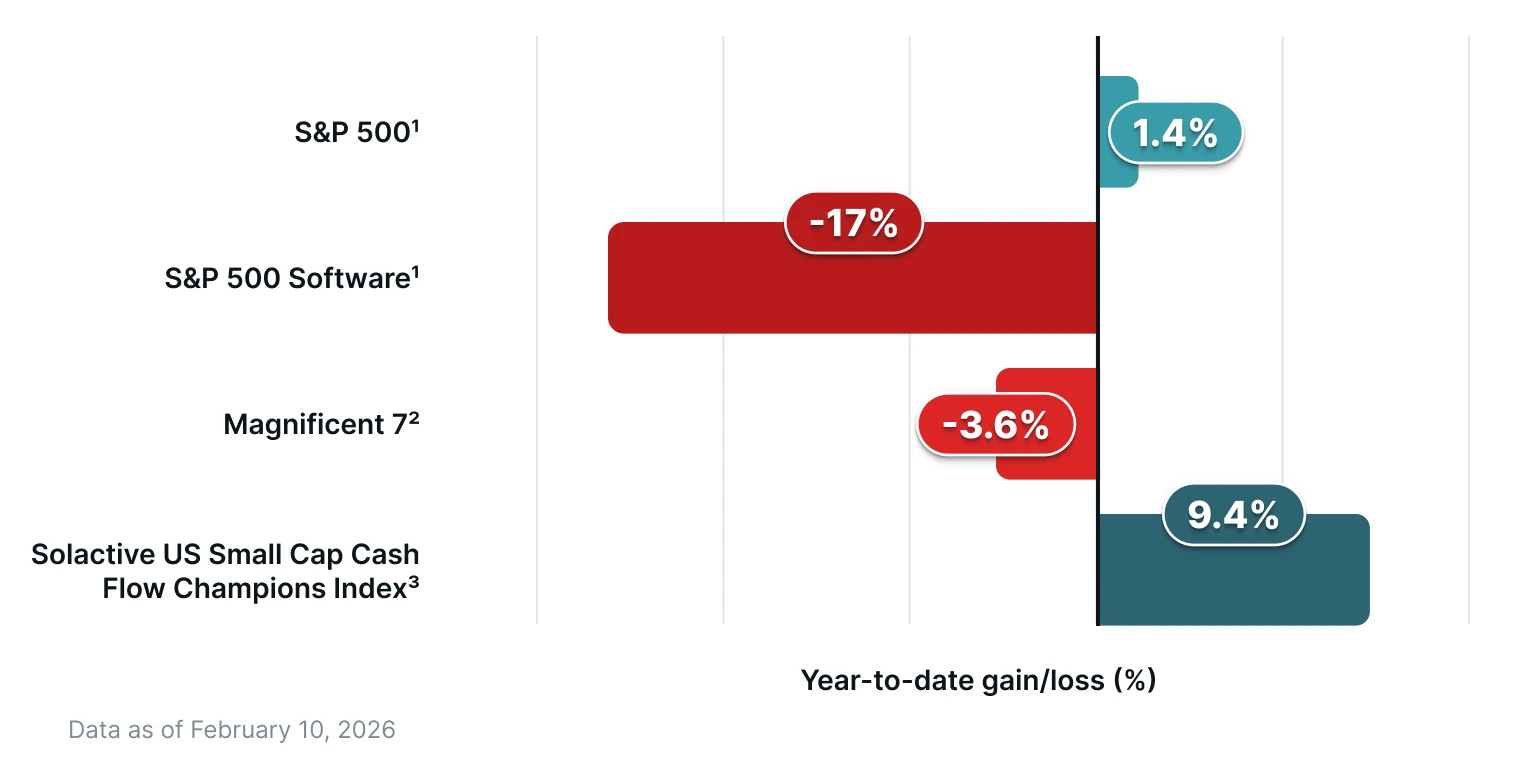

In recent weeks, several areas of the stock market have come under pressure. Software names like Salesforce and Adobe have plummeted amid concerns over AI disruption while mega-cap tech stocks like Amazon and Microsoft have lost ground as investors have grown wary of their massive AI infrastructure capex budgets.

Against this tumultuous backdrop, high cash flow stocks have served as a very effective hedge. Small-cap stocks with strong cash flows, in particular, have generated significant outperformance.

Why Cash Flow is Suddenly in Focus

There are several reasons high cash flow stocks are outperforming right now. One is concern in relation to mega-cap tech capital expenditures. In the past, these companies were generally viewed as ‘asset-light’ cash flow machines. However, recently, these businesses have become capital intensive entities. This year, the hyperscalers are set to spend over $600 billion4 on AI infrastructure meaning that free cash flow will be significantly reduced. Making matters worse, there is no guarantee that this spending will actually pay off and generate an adequate return on investment. Amid this material increase in spending, investors are rotating into other areas of the market where free cash flow is robust such as Energy, Consumer Staples, and Materials. Year to date, these have been the three best-performing5 sectors.

Uncertainty in relation to AI disruption is also no doubt boosting high cash flow stocks. This year, investors have grown increasingly concerned that AI applications from the likes of Anthropic and OpenAI are going to disrupt the business models of enterprise software companies such as Salesforce, ServiceNow, and Snowflake. As a result, they have been shifting money out of these types of companies into businesses that offer more long-term security in terms of cash flow. The focus has been on resilient companies that are potentially immune to AI and capable of generating reliable cash flows well into the future.

Value in Small Caps

With the market at high levels, there is also a search for value at present. As a result, investors are focusing heavily on metrics such as free cash flow yield. This valuation metric is often seen as superior to other valuation metrics such as the price-to-earnings (P/E) ratio and EV/EBITDA as it’s harder to manipulate. Ultimately, it tells you exactly how much cash a business generates relative to its market value.

The search for value is a key driver behind the sharp rally in small-cap high cash flow stocks in 2026. At the start of the year, the valuation gap between the S&P 500 index and the Russell 2000 was substantial. Note that for the first time in years, small-cap earnings are projected to grow significantly faster than large-cap earnings. Forecasts for 2026 show the Russell 2000 delivering 19%6 year-over-year earnings growth versus 14%7 for the S&P 500.

A Return to Fundamentals

Whether it's the resilience of the Energy sector or the untapped value in small caps, the message is clear: in a landscape of technological uncertainty, actual cash in hand is the ultimate hedge. As the initial "AI at any cost" euphoria wears off, investors are returning to fundamentals. Looking ahead, prioritizing high free cash flow could be an astute strategy. In an era where speculative growth is being put to the test, companies that can prove their worth through tangible cash flows are likely to remain in demand.

Footnotes:

1Google Finance, as of February 10, 2026

2Roundhill Investments, as of February 10, 2026

3Solactive, as of February 10, 2026

4Reuters, Big Tech's $600 billion spending plans exacerbate investors' AI headache, as of February 6, 2026

5SSGA.com, Sector tracker, as of February 9, 2026

6Aberdeen Investments, US small caps: A tale of two halves, as of December 5, 2026

7Advantage Factsheet, Earnings Insight, as of February 6, 2026

Author is a contractor of Leverage Shares LLC, a U.S. affiliate of Themes Management Company LLC. Leverage Shares LLC provides certain services to Themes under an intercompany services agreement.