How Smaller Companies Can Help to Diversify an Investment Portfolio

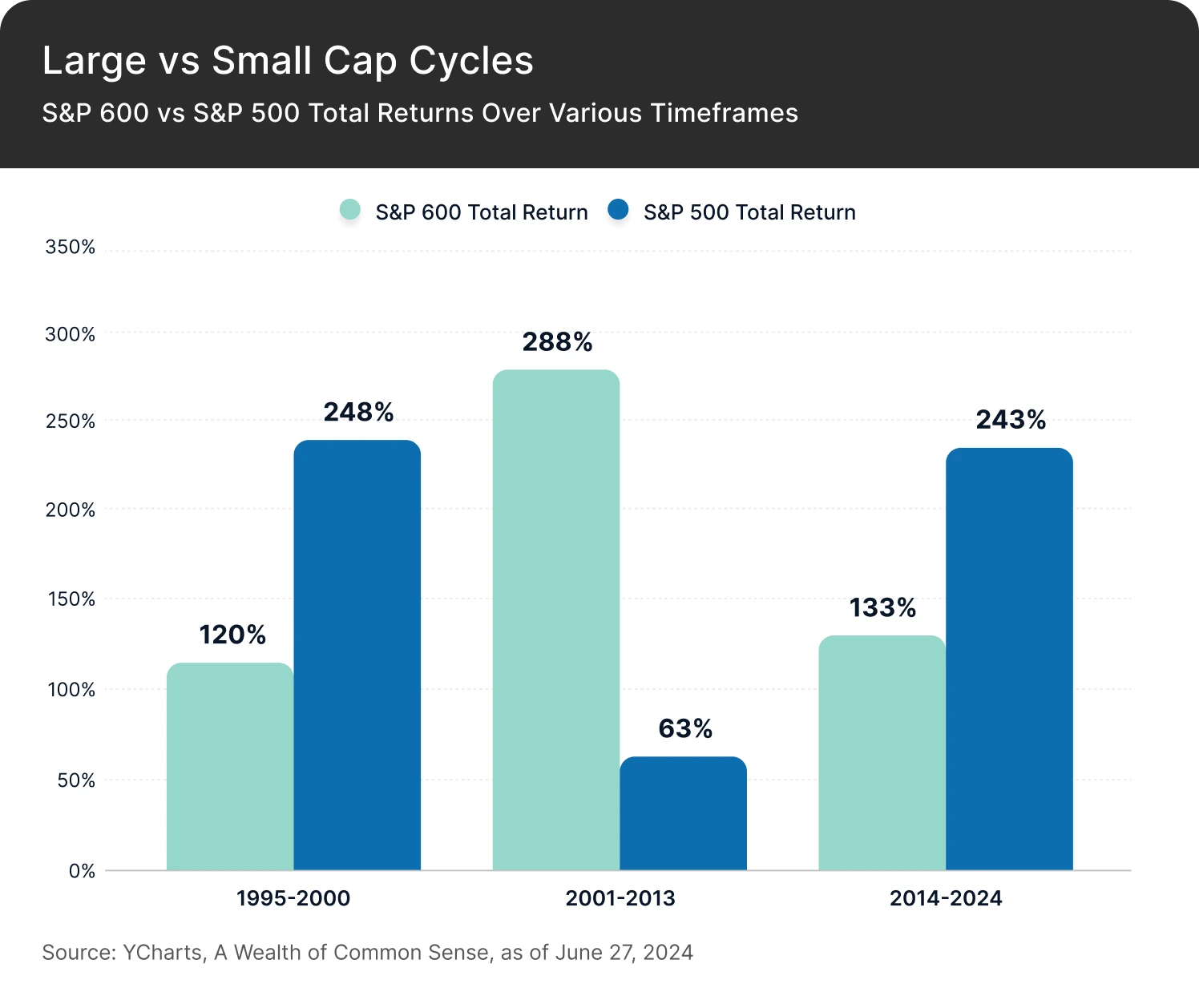

Small-cap stocks often have a relatively low correlation to large-cap stocks. One reason for this is that smaller companies tend to be more economically sensitive than larger businesses. Given that small caps and large caps don’t move in sync, small caps can offer diversification benefits, potentially helping investors build more balanced portfolios. With exposure to small-cap stocks, investors may be able to enhance their returns during certain phases of the economic cycle.

Why Cash Flow is Important When Investing in Smaller Companies

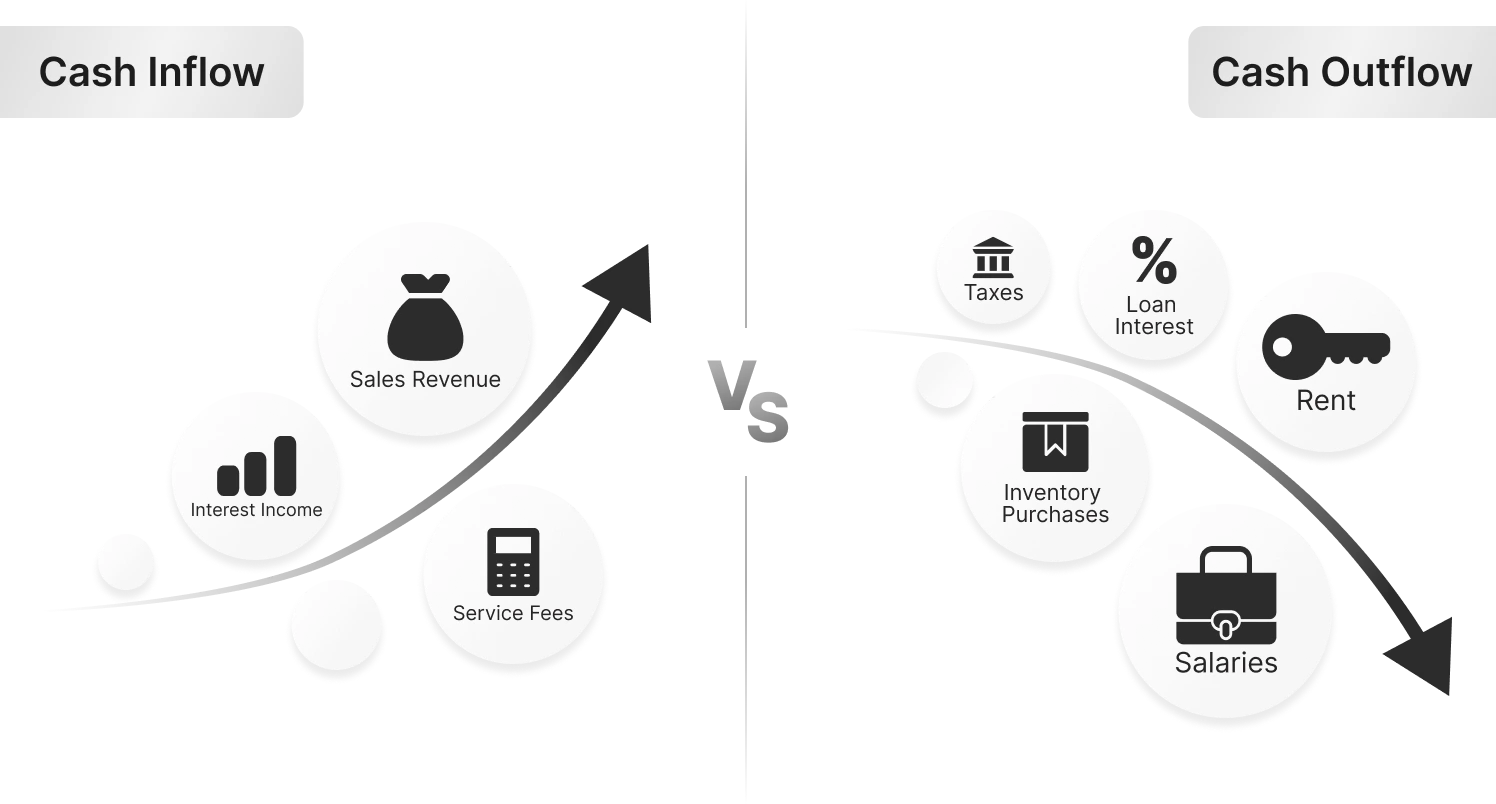

Cash flow is the money that flows in and out of a business over a specific period. And it’s an important metric when investing in smaller companies. If a company has significant positive cash flow, it is likely to have the ability to pay off its debts, invest for long-term growth, and weather economic downturns. By contrast, if a company has negative cash flow, it may struggle to meet its financial obligations and end up getting into financial trouble.

How is Cash Flow Calculated?

Cash flow is typically calculated using a cash flow statement, which is a statement designed to show how a company’s activities have affected its cash and cash equivalents. On a cash flow statement, there are three main categories of cash flow activities:

Operating Activities – These relate to the core operations of the business (e.g. cash inflows from sales or cash outflows from wages).

Investing Activities – These relate to the purchase and sale of long-term assets, such as property, plant, and equipment.

Financing Activities – Inflows here could be from the issuance of stocks or bonds, while outflows could be from repaying loans or paying dividends.

Net cash flow for the period is calculated by adding up all the cash inflows from operating, investing, and financing activities, and then subtracting all the cash outflows from these same activities.

The Themes US Small Cap Cash Flow Champions ETF

Those seeking exposure to smaller US companies with strong cash flows may wish to check out the Themes US Small Cap Cash Flow Champions ETF (SMCF).This aims to track the Solactive US Small Cap Cash Flow Champions Index (SOLSUCCT). In terms of how this index is created, a universe of US small-cap stocks is screened to identify companies that have remained cash flow positive for at least four years. These cash flow positive companies are then ranked according to their estimated cash flow for the next year. Finally, the top 75 companies are selected for the index.