A Look into Luxury

As their name implies, luxury goods are broadly defined as goods that are perceived to be of superior quality or value relative to comparable substitutes. As such, luxury goods often command significantly higher prices. The motivations underpinning the acquisition of luxury goods are many, ranging from expressions of affluence to affection.

Companies have built vast portfolios of luxury brands that cater to this demand, encompassing everything from cars and yachts to jewelry and watches. Historically, luxury brands tended to target a relatively narrow segment of customers. However, luxury brands have since shifted their sales strategies to cater to a broader base of customers, which has not only increased their revenues but also improved their resilience in the face of recessionary environments.

Post-Pandemic Pop

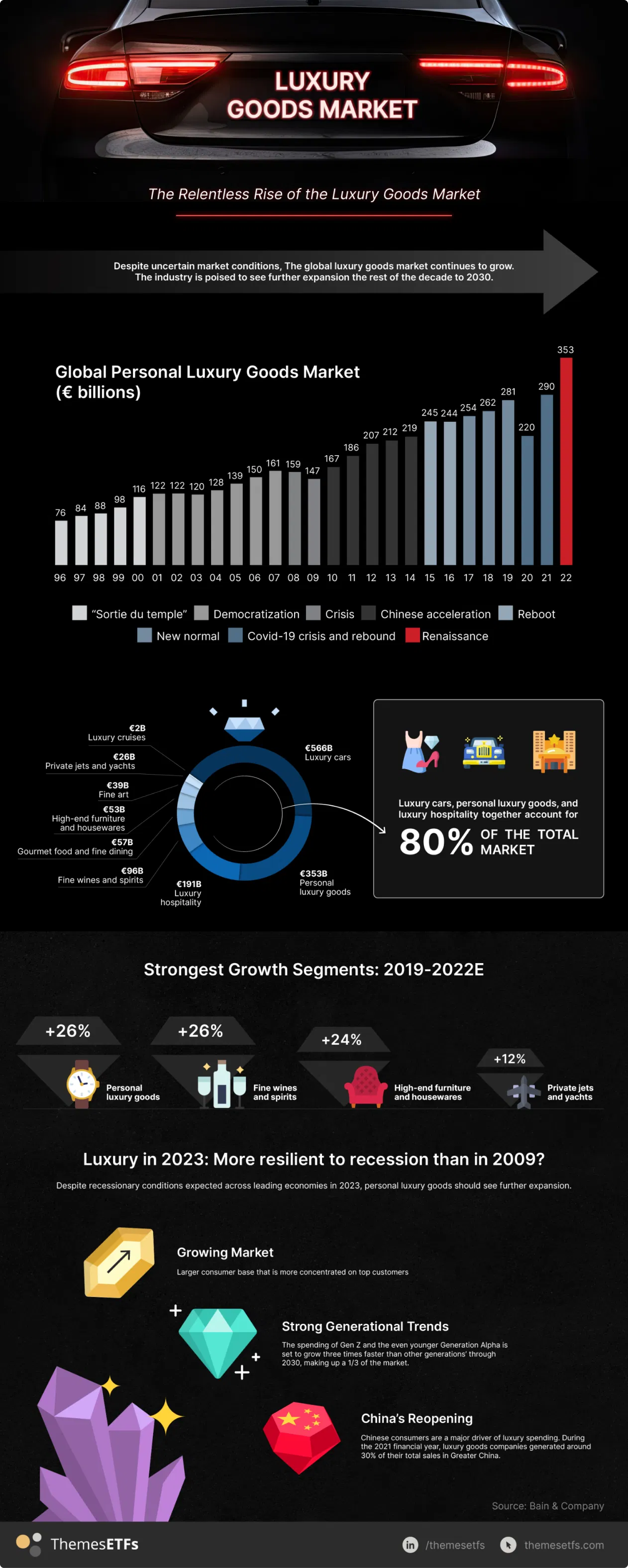

In the wake of the Covid-19 pandemic, spending on personal luxury goods contracted along with the rest of the global economy. However, the industry rapidly recovered, returning to record levels and a new all-time high of €353 billion in 2022.1 The strength and speed of this rebound showcased both the improved resilience of the luxury goods market in the face of recessionary circumstances, as well as the growing demand for luxury goods.

The global personal luxury goods market is projected to grow to €530 billion-€570 billion by 2030, representing a growth rate of over 140% relative to pre-pandemic levels according to economic estimates and consultancy forecasts.1

Stratifying Sales Segments

As of 2022, the aggregate value of the global luxury market has surpassed €1.38 trillion.1

The market is led by luxury cars at €566 billion which accounts for 40.9% of the total, followed by personal luxury goods at €353 billion (25.5%), and luxury hospitality at €191 billion (13.8%). Together, these segments comprise over 80% of the total market.

1Source: Bain & Company, Renaissance in Uncertainty as of 31 December 2023

Our European Luxury ETF (FINE) seeks to track the Solactive European Luxury Index (SOLELUXN), which identifies 25 European luxury companies that generate their revenues from either:

Luxury Accessories

Premium Clothing

Luxury Beauty Products

Cars & Yachts

Upscale Hospitality

FINE seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the SOLELUXN Index.