December 15, 2024

Uranium Sector Rises in Conviction with that of AI

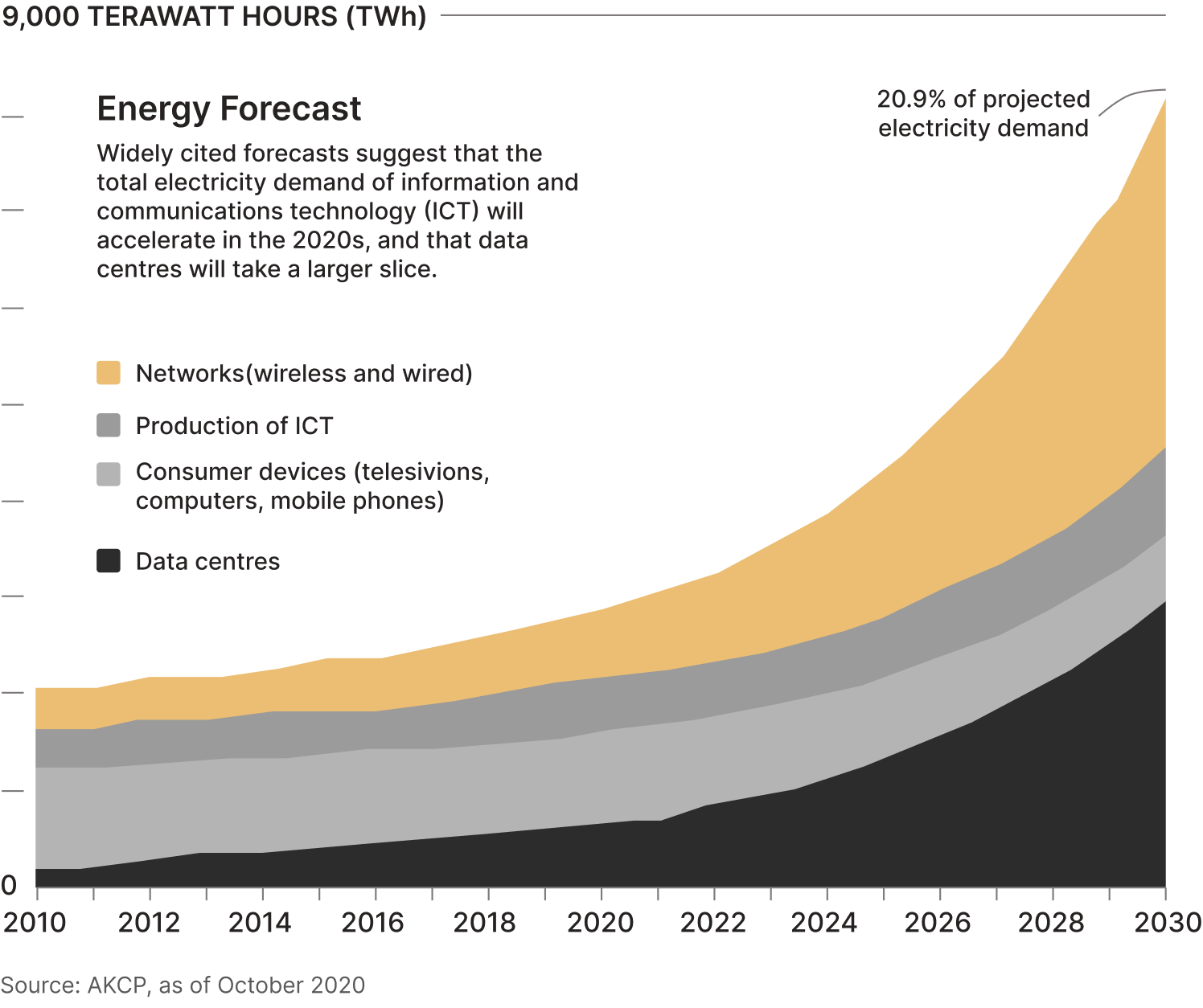

Rising utilization of streaming platforms, social media applications and sundry apps around the world continue to be transformative for the fortunes of data centers, which face steadily rising demands that the sector races to fulfil. By the end of this decade, it is estimated that over 20% of the nearly 8,000 terawatt hours (TWh) of total energy requirement worldwide would from data centres – nearly equalling that of the networks that make the internet available1.

With 5G rollouts currently in place all over the world – especially in Emerging Markets (EM) economies – the need for greater energy availability for effective data centre operations in the wake of increasing penetration of high-speed internet, streaming services, et al, becomes ever more strident.

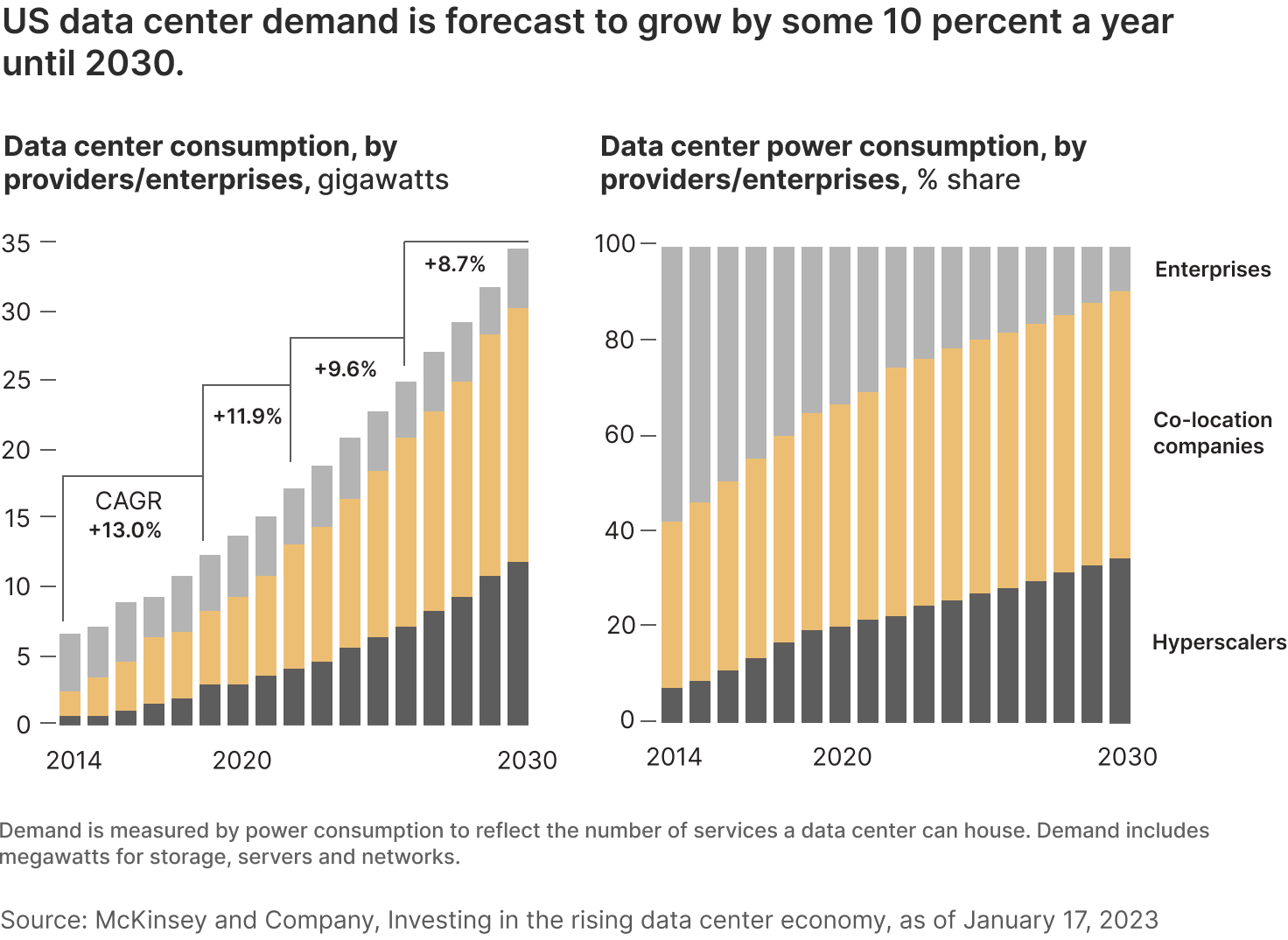

In the United States alone, data centres’ power consumption is expected to grow by 10% year-on-year all the way till the end of the decade2.

While the likes of Amazon Web Services and Google Cloud do offer stiff competition to the likes of co-location companies – which typically rent out network capacity, power and server-related infrastructure to enterprises both large and small – is expected to remain resilient. The data centre space is an area of stiff competition, with private equity transactions rising year-on-year.

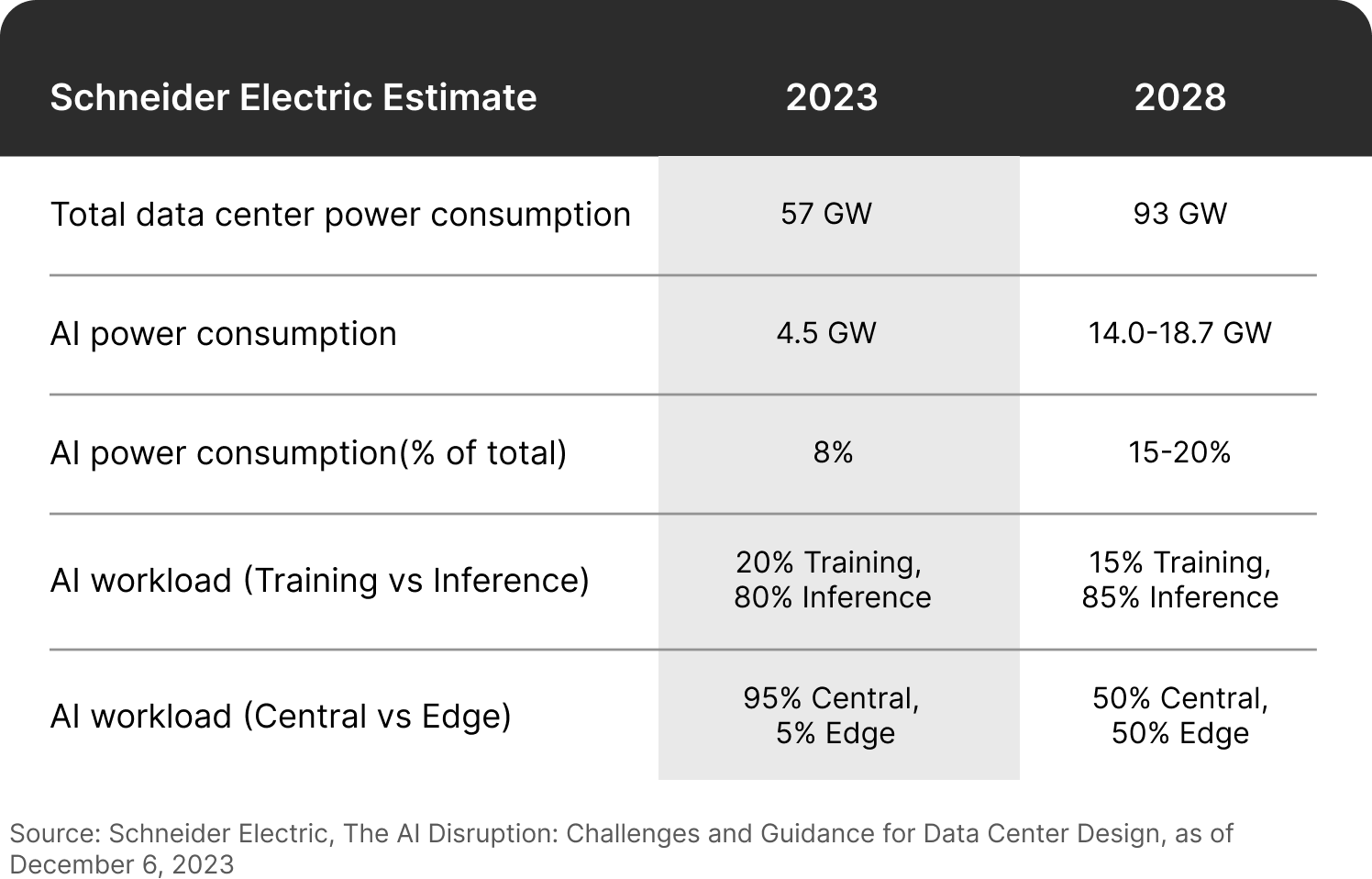

Within data centres, AI-driven workloads are expected to drive an increasing amount of workload and require greater provision of power: global power solutions provider Schneider Electric estimates that AI will be responsible for up to a fifth of total data centre power consumption by 20283.

Interestingly, AI-driven power consumption is expected to grow at a Compounded Annual Growth Rate (CAGR) of 25-33%3, a rate that is 2-3 times that of overall data centre power demand. Given the leading edge that AI-driven processes have established in the Western Hemisphere, it can be expected that efficient power supply would be required to drive this here more so than elsewhere.

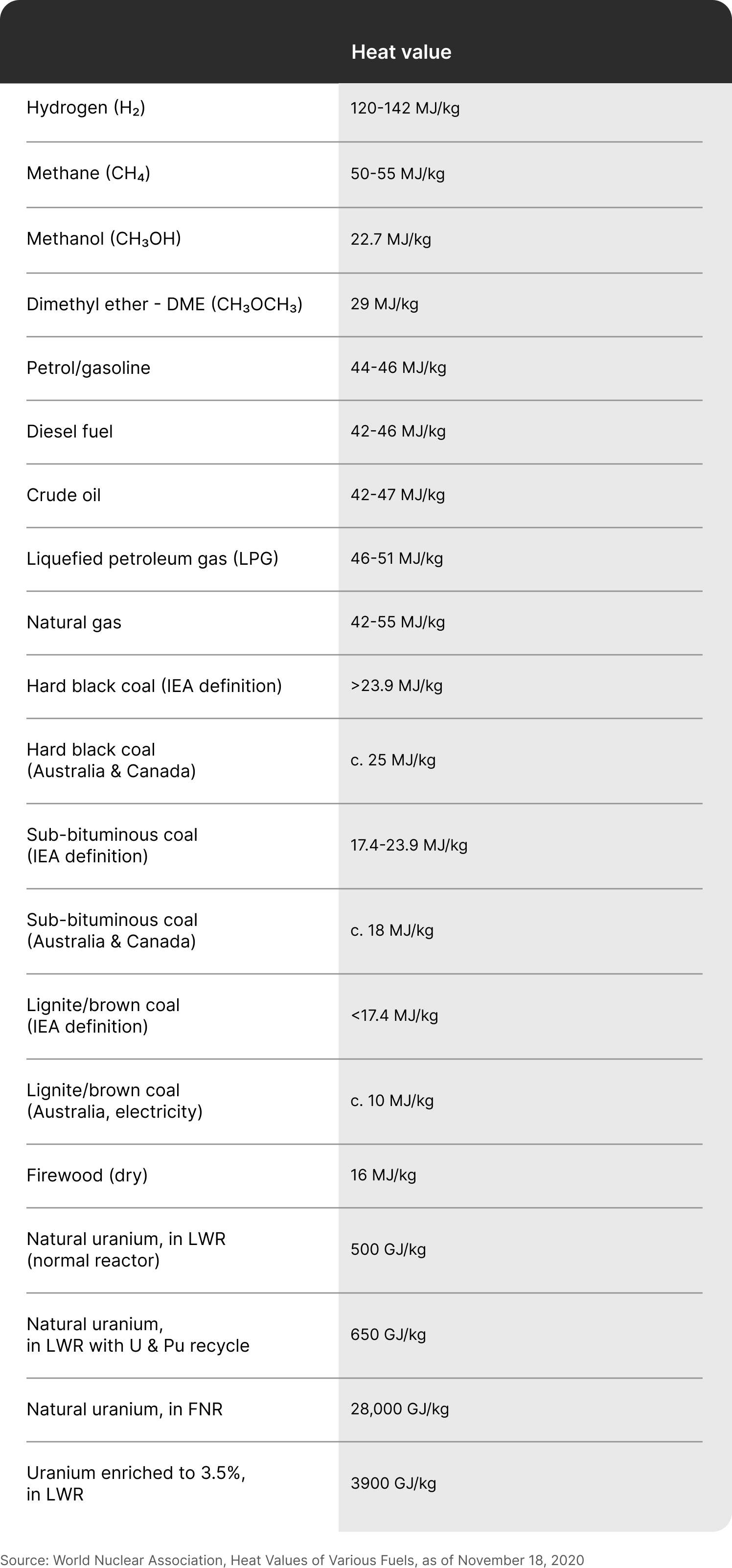

Of all sources of electricity generation, nuclear power generation techniques are by far the most efficient, with average estimates measured in Gigajoules per kilogram as opposed to all other fuel sources, which run in the Megajoules per kilogram range4:

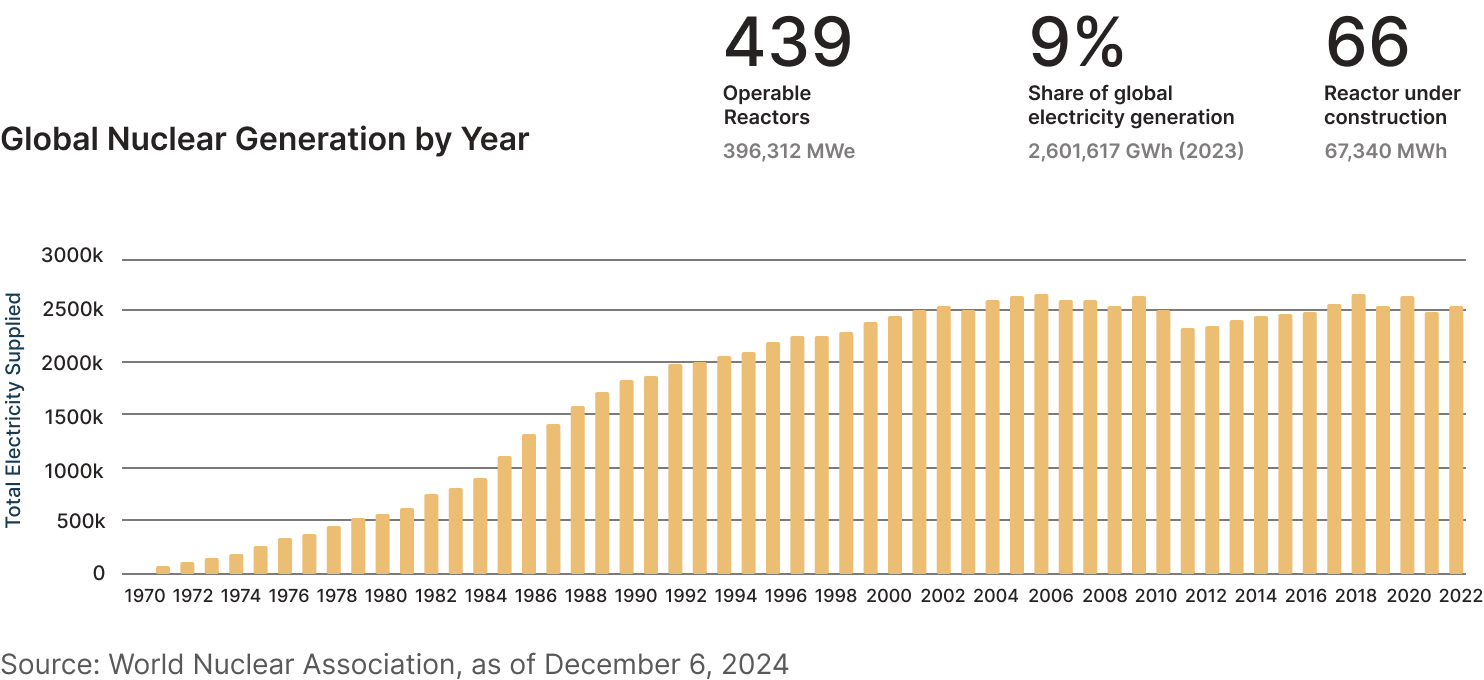

However, as of 2023, the total share of nuclear reactors in total power generation the world over has fallen from 15% as of the end of the Cold War to a little under 9%.

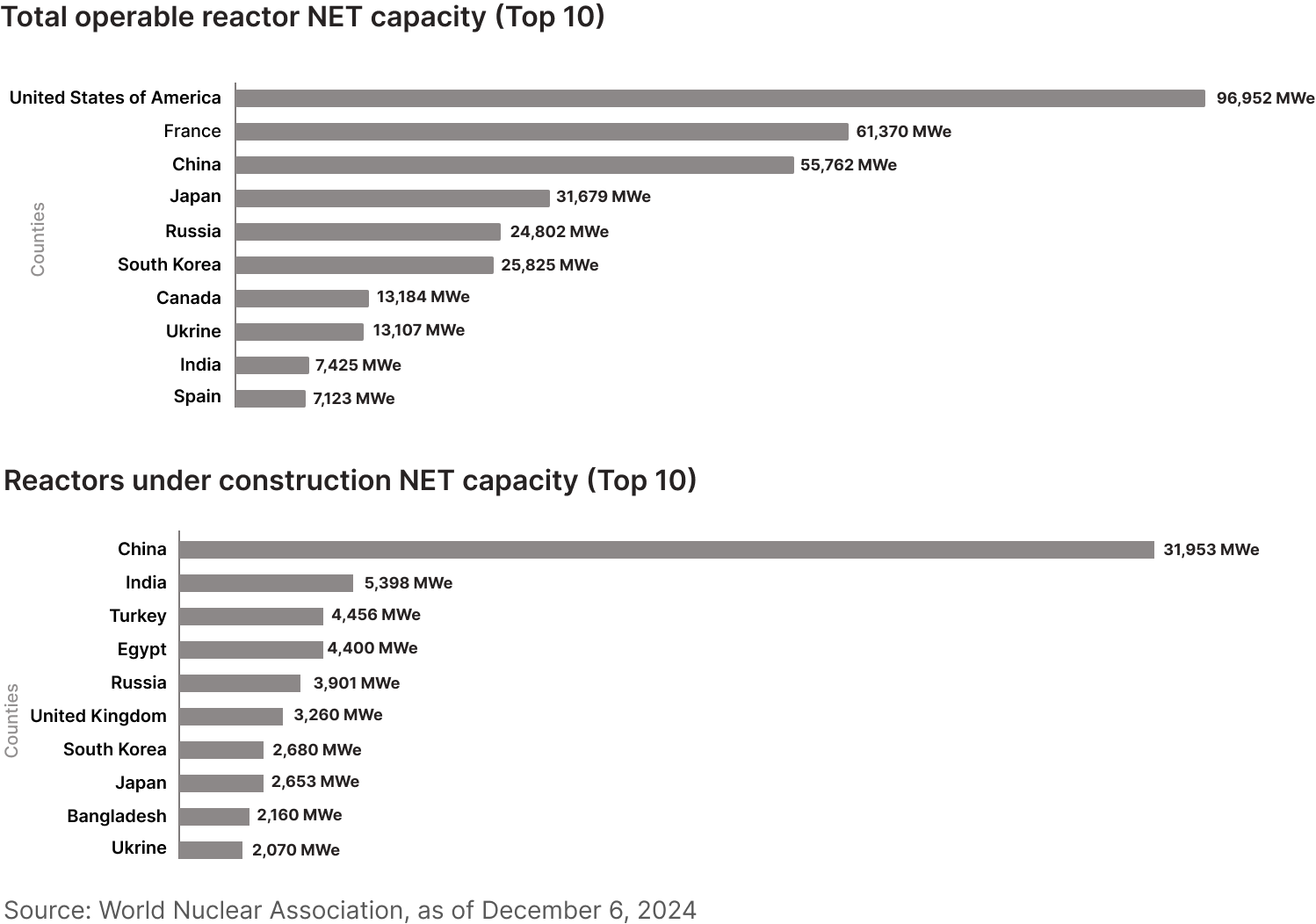

The overall efficiency of nuclear power isn’t entirely lost on EM countries: while the United States outstrips nearly every other country by a wide margin in presently available reactor capacity, EM countries such as China, India, Turkey and Egypt are actively working on augmenting their nuclear power capabilities.

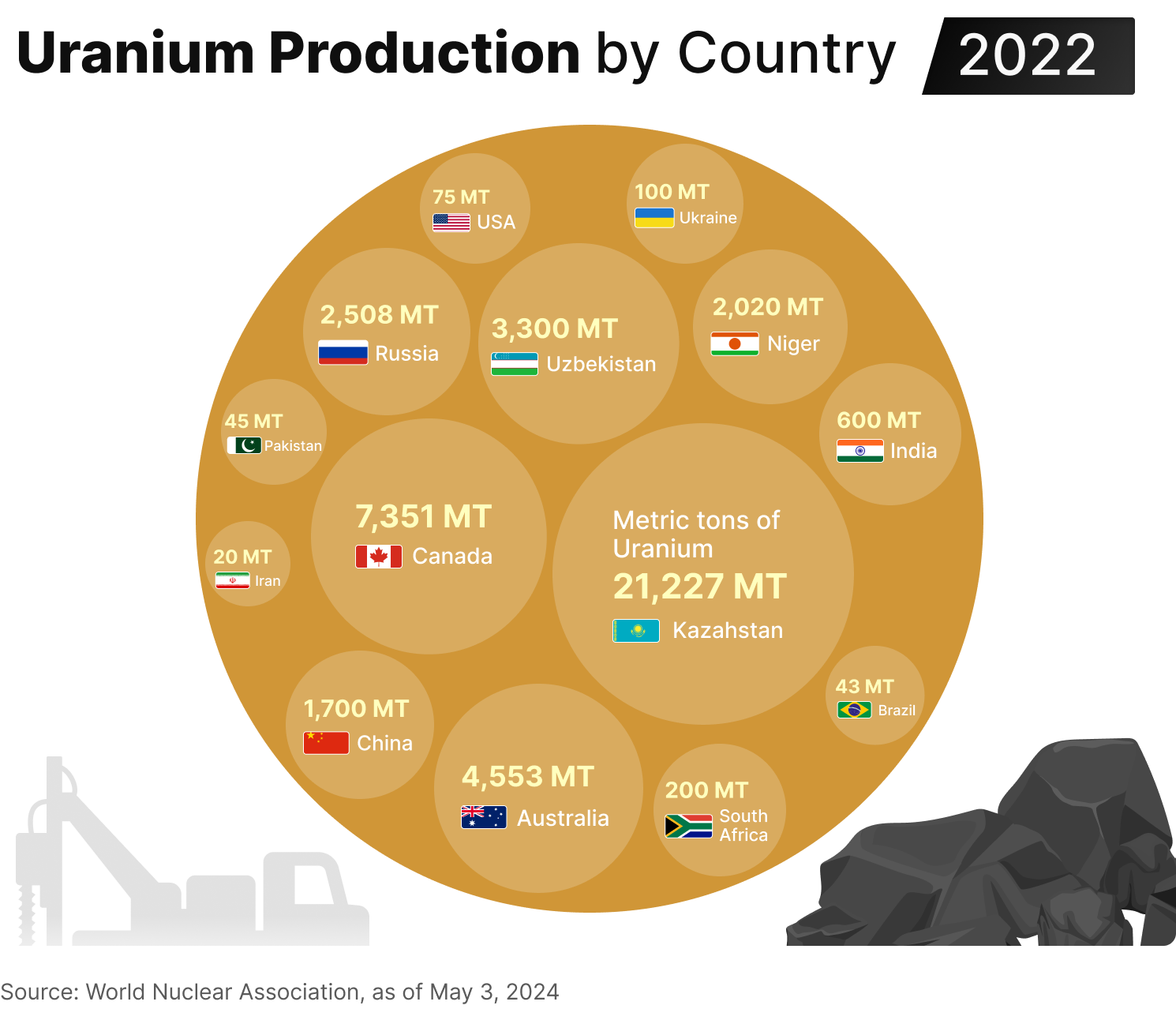

Globally, the supply of uranium is predominantly dependent on post-Soviet countries while North America’s share in total uranium supply has seen a gradual decline5.

The driving factor behind capacity installation is fuel availability which, in turn, is influenced by geopolitics. Geopolitics also has an effect on reactor design decisions. For example, while most countries focus on building Pressurized Water Reactors (PWRs), India focuses on the building of Pressurized Heavy Water Reactors (PHWRs) using largely home-grown technology. PHWRs produce more energy per kilogram of mined uranium than other designs, but also produce a much larger amount of used fuel per unit output6. Plus, PHWRs don’t need to shut down for refuelling, ensuring nearly-continuous operation. India also has access to captive uranium mines, thereby potentially enabling a steady supply of fuel for its reactors.

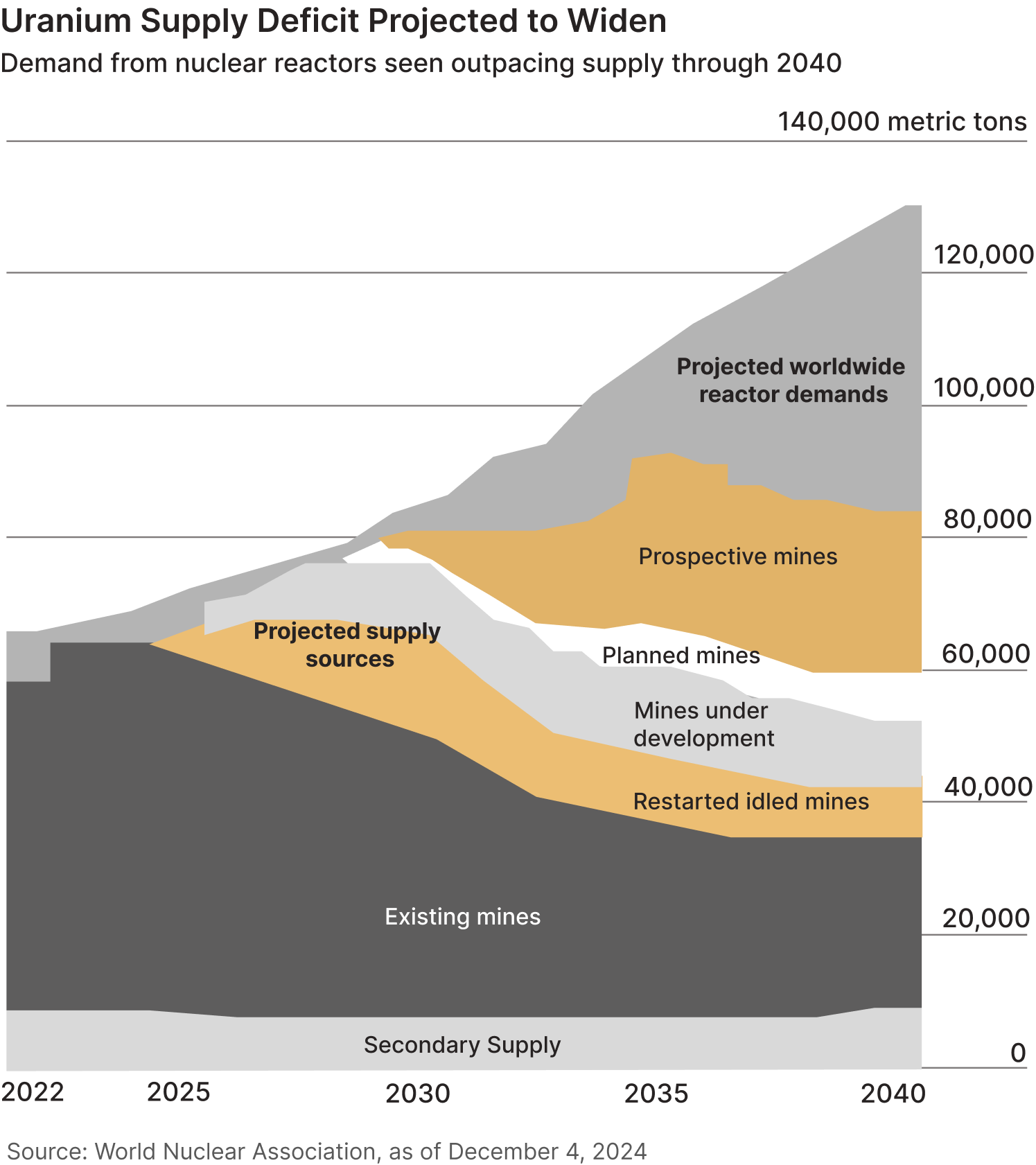

So persistent is overall nuclear material demand that the already-existing gap between demand and production is expected to widen, with nuclear market research and analysis firm UxC estimating a cumulative shortfall of well over half a million metric tons by the end of 2040.

Given the energy efficiency of nuclear power generation and improving technologies in nuclear safety, the use case for nuclear power generation systems is increasingly strong. With new buildouts of reactors all over the world comes a growing demand for uranium, which is now driving up the spot price of uranium ore. A not-insignificant component of this growing demand for energy is the rising number of data centers with AI-driven workload management systems.

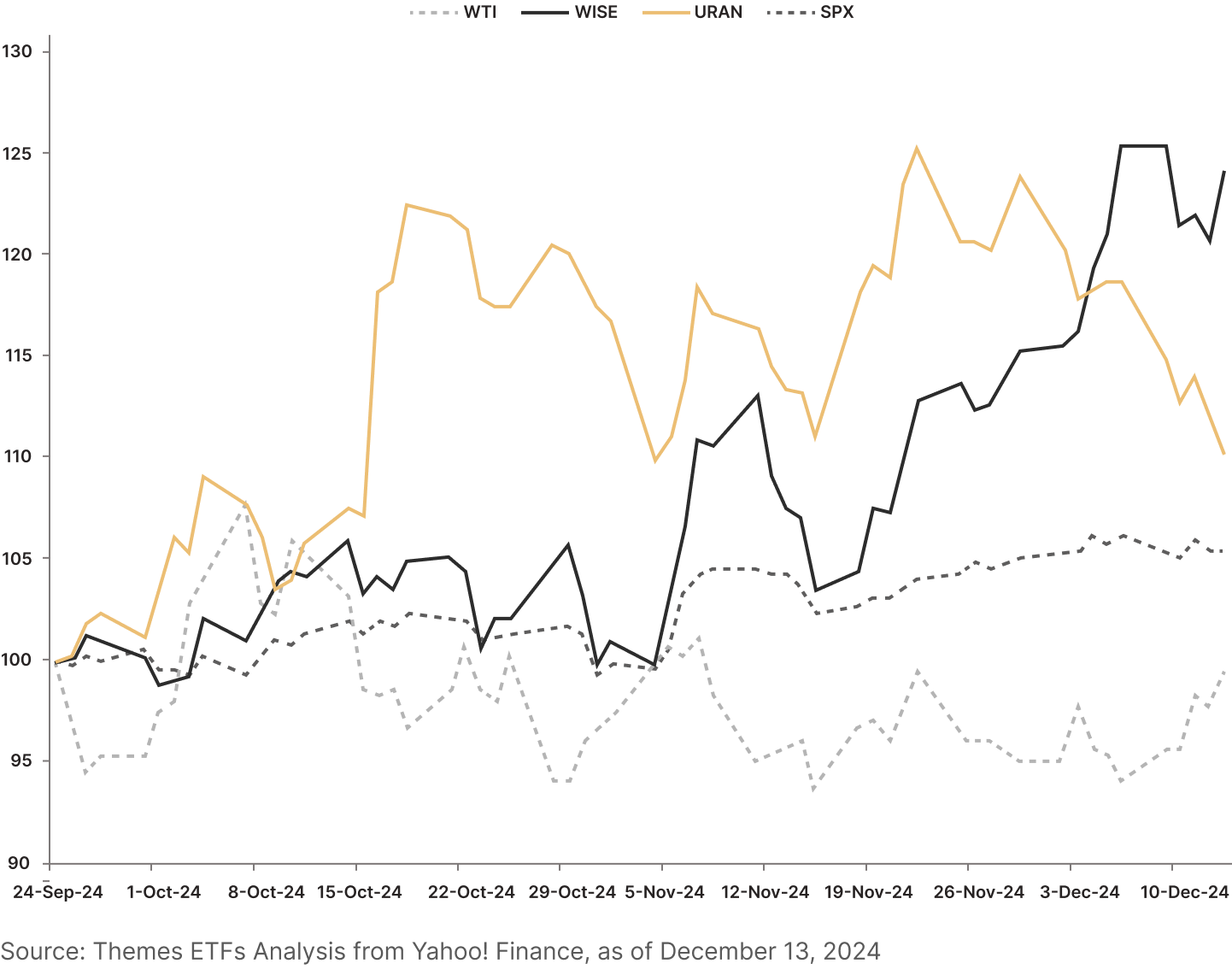

Thus, it is entirely within the realm of likelihood to assert that the nuclear energy sector will be better aligned with the semiconductor companies and other AI-relevant stocks. As it turns out, correlations between the nuclear energy sector – as represented by the Themes Uranium & Nuclear ETF (URAN) – and the AI-relevant sector – as represented by the Themes Generative Artificial Intelligence ETF (WISE) has been very strong in recent months7.

Overall, the uranium-relevant sector has seen some signs of a cool-off in recent times as expectations ride high on the notion that President Trump’s administration would work towards ending its standoff against Russia in the Russo-Ukrainian conflict, thereby freeing up supply of uranium ore and other materials from Russia to the United States. However, the fact remains that uranium is in short supply relative to the planned capacity of new buildouts all over the world. While President Trump’s campaign was replete with promises for revitalizing the nuclear energy sector, it remains to be seen if the new administration will ease global supply bottlenecks via the authorization of renewed mining efforts within the United States, export of technology and so forth.

Both URAN and its correlated cousin WISE show very strong outperformance versus the S&P 500 and investments in crude oil, which should open up new paradigms for professional investors to consider. An investment decision in URAN and WISE would be both correlated and diversified: while increasing energy demand creates a use case for increasing nuclear reactor buildout, the output of said reactors aren’t wholly restricted to AI-relevant work since it buttresses efficient energy supply to the wider economy as well. With both nuclear energy and semiconductors becoming increasingly fundamental to the modern economy, it could be argued that investing into these sectors are “no brainers”.

Footnotes:

1AKCP, Data Center Energy Use Rises – What’s Next for Efficiency?, as of October 2020

2McKinsey & Company, Investing in the rising data center economy, as of January 17, 2023

3Schneider Electric, The AI Disruption: Challenges and Guidance for Data Center Design, as of December 6, 2023

4World Nuclear Association, Heat Values of Various Fuels, as of November 18, 2020

5World Nuclear Association, as of May 3, 2020

6World Nuclear Association, Nuclear Power Reactors, as of December 4, 2020

7Nikkei Asia, AI investment boom extends to nuclear power generation and uranium, as of May 4, 2020